Welcome to PrintableAlphabet.net, your go-to source for all points associated with How Do You Calculate Bad Debts In this extensive guide, we'll look into the intricacies of How Do You Calculate Bad Debts, supplying beneficial understandings, engaging tasks, and printable worksheets to boost your learning experience.

Understanding How Do You Calculate Bad Debts

In this area, we'll check out the basic principles of How Do You Calculate Bad Debts. Whether you're an instructor, moms and dad, or student, acquiring a strong understanding of How Do You Calculate Bad Debts is crucial for effective language procurement. Expect insights, suggestions, and real-world applications to make How Do You Calculate Bad Debts come to life.

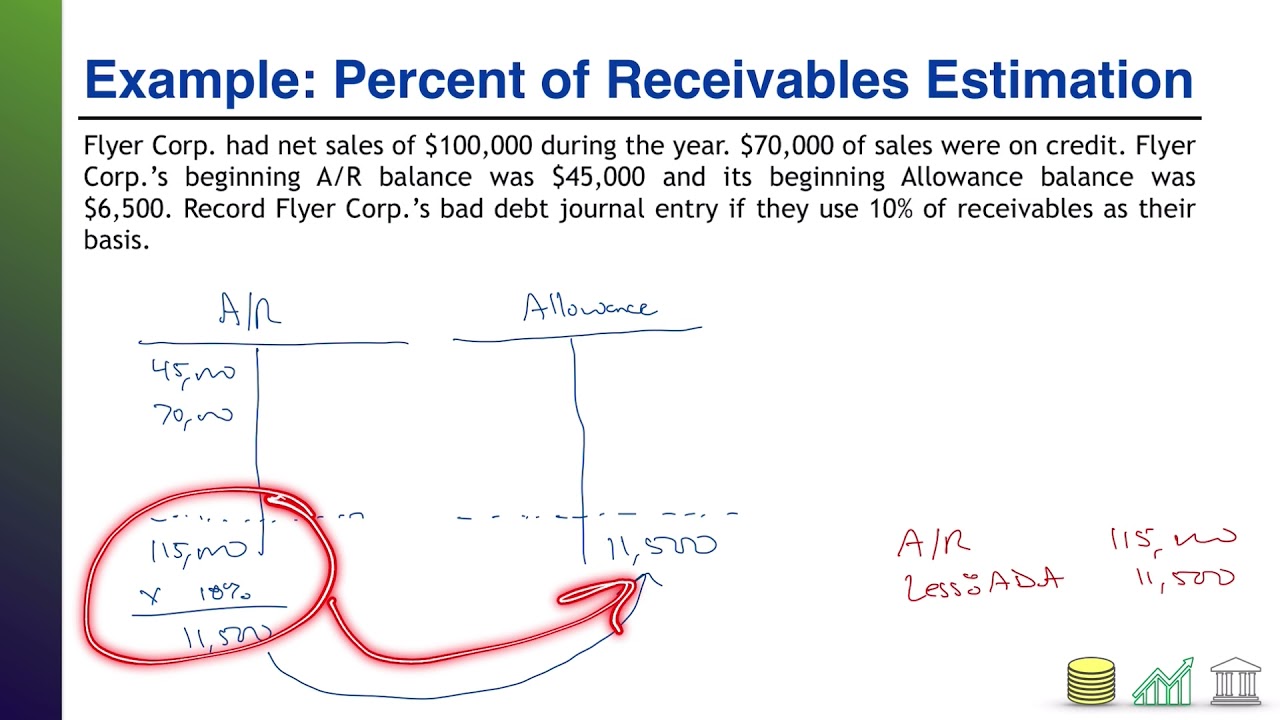

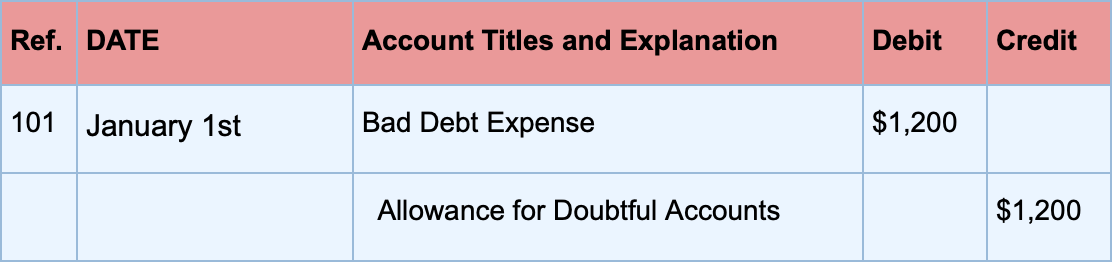

Estimating Bad Debts Percent Of Receivables YouTube

How Do You Calculate Bad Debts

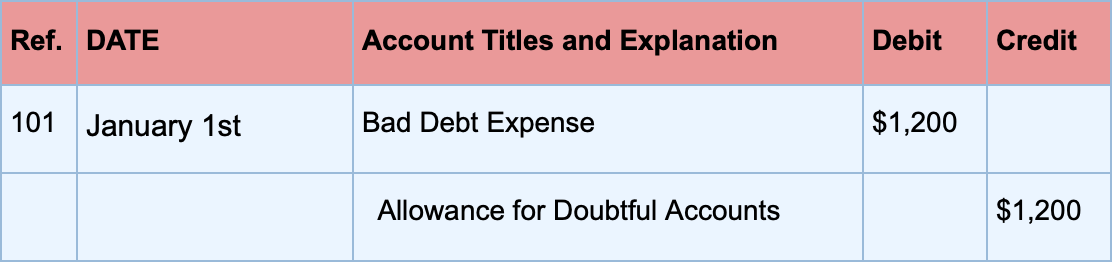

The bad debt expense records a company s outstanding accounts receivable that will not be paid by customers This accounting entry allows a company to write off accounts receivable that are uncollectible Learn how to

Discover the importance of understanding How Do You Calculate Bad Debts in the context of language growth. We'll review just how proficiency in How Do You Calculate Bad Debts lays the structure for improved reading, creating, and general language skills. Check out the wider effect of How Do You Calculate Bad Debts on effective interaction.

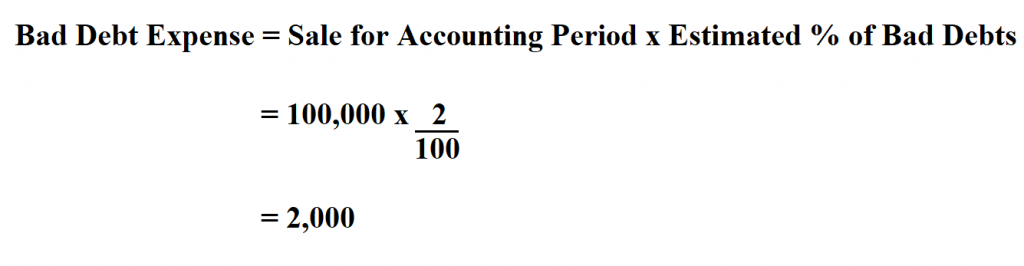

How To Calculate Bad Debt Expense

How To Calculate Bad Debt Expense

In this article we ll define a bad debt expense explain how to identify them go over the formula to calculate bad debt expenses with examples cover the methods of estimating your business bad debt and

Knowing does not have to be plain. In this area, locate a selection of engaging tasks customized to How Do You Calculate Bad Debts students of every ages. From interactive video games to imaginative exercises, these activities are created to make How Do You Calculate Bad Debts both fun and instructional.

Here s How To Calculate Bad Debt Expense FORMULA EXPLAINED

Here s How To Calculate Bad Debt Expense FORMULA EXPLAINED

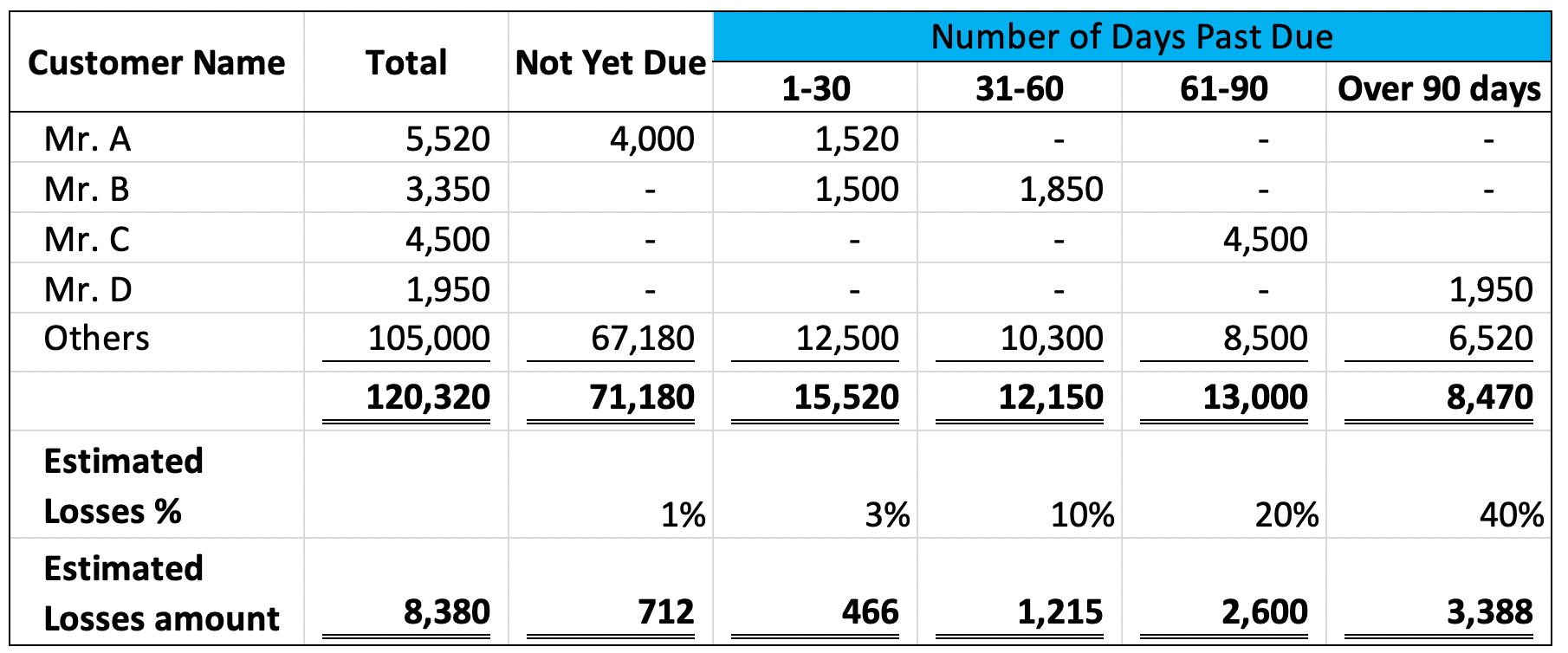

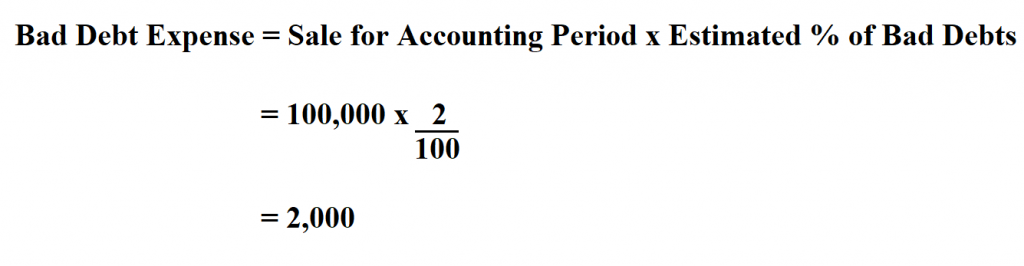

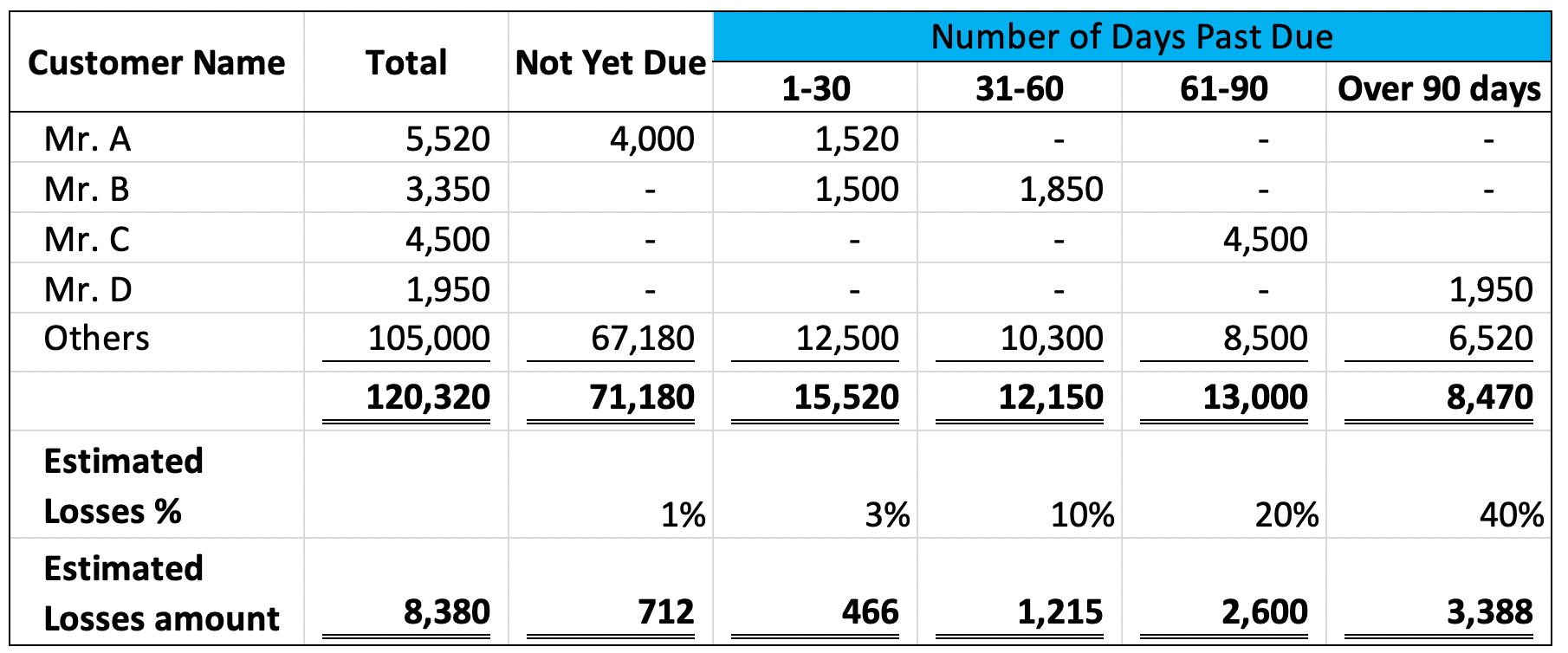

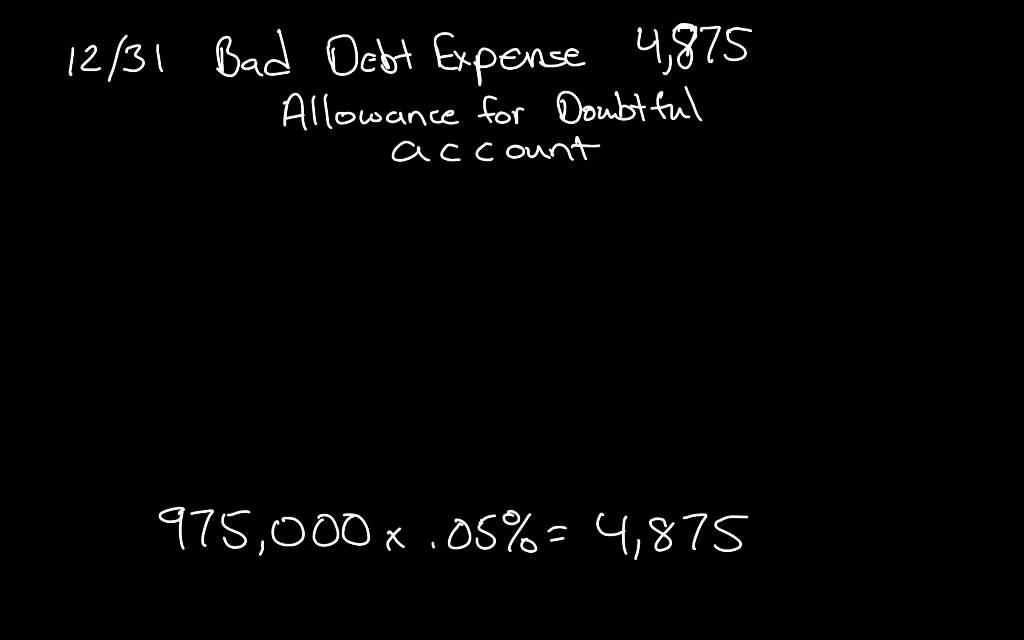

There are two main ways to estimate an allowance for bad debts the percentage sales method and the accounts receivable aging method

Access our particularly curated collection of printable worksheets focused on How Do You Calculate Bad Debts These worksheets satisfy numerous ability degrees, making sure a tailored knowing experience. Download and install, print, and appreciate hands-on activities that reinforce How Do You Calculate Bad Debts skills in an efficient and satisfying way.

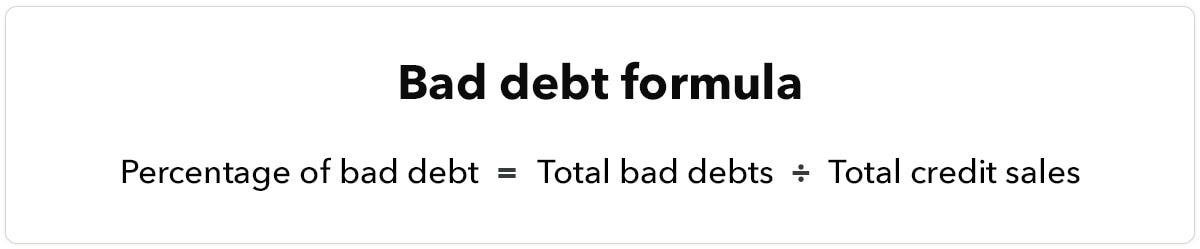

Bad Debt Expense Formula How To Calculate Examples

Bad Debt Expense Formula How To Calculate Examples

Calculate Bad Debt Expense Overview Bad debt expense is the loss that incurs from the uncollectible accounts in which the company made the sale on credit but the customers didn t

Whether you're an educator seeking effective strategies or a student seeking self-guided techniques, this area uses functional suggestions for mastering How Do You Calculate Bad Debts. Benefit from the experience and understandings of teachers that specialize in How Do You Calculate Bad Debts education and learning.

Get in touch with like-minded people that share an interest for How Do You Calculate Bad Debts. Our neighborhood is a room for instructors, moms and dads, and learners to exchange ideas, inquire, and commemorate successes in the journey of grasping the alphabet. Join the discussion and be a part of our growing neighborhood.

Here are the How Do You Calculate Bad Debts

https://quickbooks.intuit.com › payme…

The bad debt expense records a company s outstanding accounts receivable that will not be paid by customers This accounting entry allows a company to write off accounts receivable that are uncollectible Learn how to

https://www.freshbooks.com › hub › acc…

In this article we ll define a bad debt expense explain how to identify them go over the formula to calculate bad debt expenses with examples cover the methods of estimating your business bad debt and

The bad debt expense records a company s outstanding accounts receivable that will not be paid by customers This accounting entry allows a company to write off accounts receivable that are uncollectible Learn how to

In this article we ll define a bad debt expense explain how to identify them go over the formula to calculate bad debt expenses with examples cover the methods of estimating your business bad debt and

Calculate Bad Debt Expense Methods Examples Accountinguide My XXX Hot

How To Calculate And Record The Bad Debt Expense QuickBooks

Calculating Bad Debt Expense And Allowance For Doubtful Accounts YouTube

What Is A Bad Debt Expense Ultimate Guide With Examples

How To Calculate Bad Debt Expense Percent Of Sales Method YouTube

Bad Debts Recovered Journal Entry

Bad Debts Recovered Journal Entry

What Is The Provision For Doubtful Debts And Bad Debts