Welcome to PrintableAlphabet.net, your go-to source for all points related to How Does Child Earned Income Credit Work In this thorough overview, we'll look into the complexities of How Does Child Earned Income Credit Work, supplying beneficial understandings, engaging activities, and printable worksheets to enhance your learning experience.

Understanding How Does Child Earned Income Credit Work

In this section, we'll discover the essential ideas of How Does Child Earned Income Credit Work. Whether you're an educator, moms and dad, or student, obtaining a strong understanding of How Does Child Earned Income Credit Work is essential for successful language purchase. Anticipate insights, suggestions, and real-world applications to make How Does Child Earned Income Credit Work come to life.

All You Need To Know About The Earned Income Credit AnchorAndHopeSF

How Does Child Earned Income Credit Work

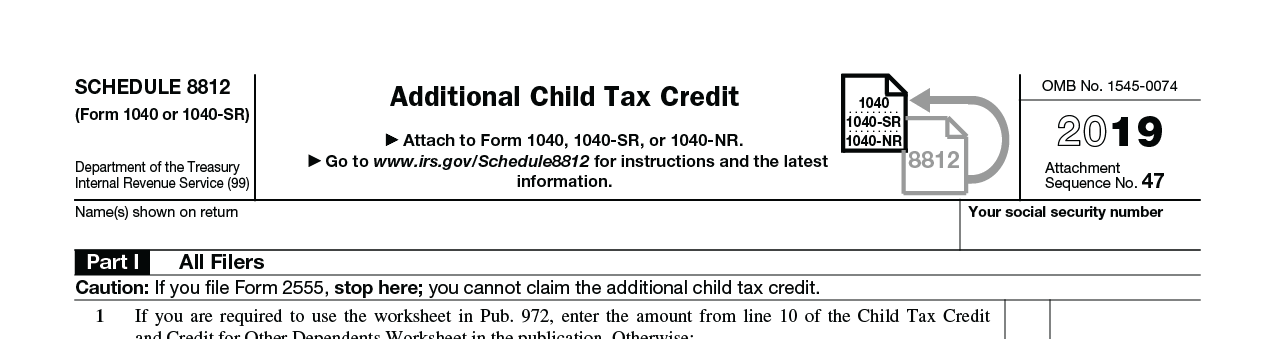

The Child Tax Credit is a 2 000 per child tax benefit claimed by filing Form 1040 and attaching Schedule 8812 to the return To qualify for the credit the taxpayer s dependent

Discover the relevance of understanding How Does Child Earned Income Credit Work in the context of language advancement. We'll review how effectiveness in How Does Child Earned Income Credit Work lays the structure for enhanced analysis, writing, and general language skills. Discover the more comprehensive effect of How Does Child Earned Income Credit Work on efficient interaction.

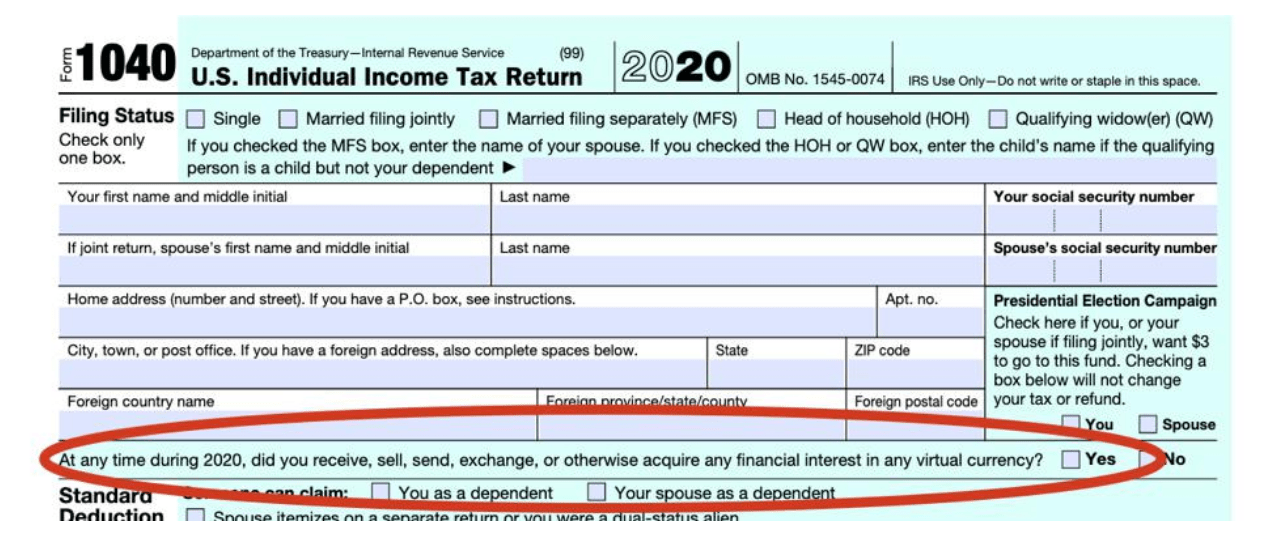

Irs Releases Form 1040 For 2020 Tax Year Free Download Nude Photo Gallery

Irs Releases Form 1040 For 2020 Tax Year Free Download Nude Photo Gallery

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a

Knowing does not need to be boring. In this section, discover a variety of engaging activities tailored to How Does Child Earned Income Credit Work students of all ages. From interactive games to innovative workouts, these activities are made to make How Does Child Earned Income Credit Work both fun and educational.

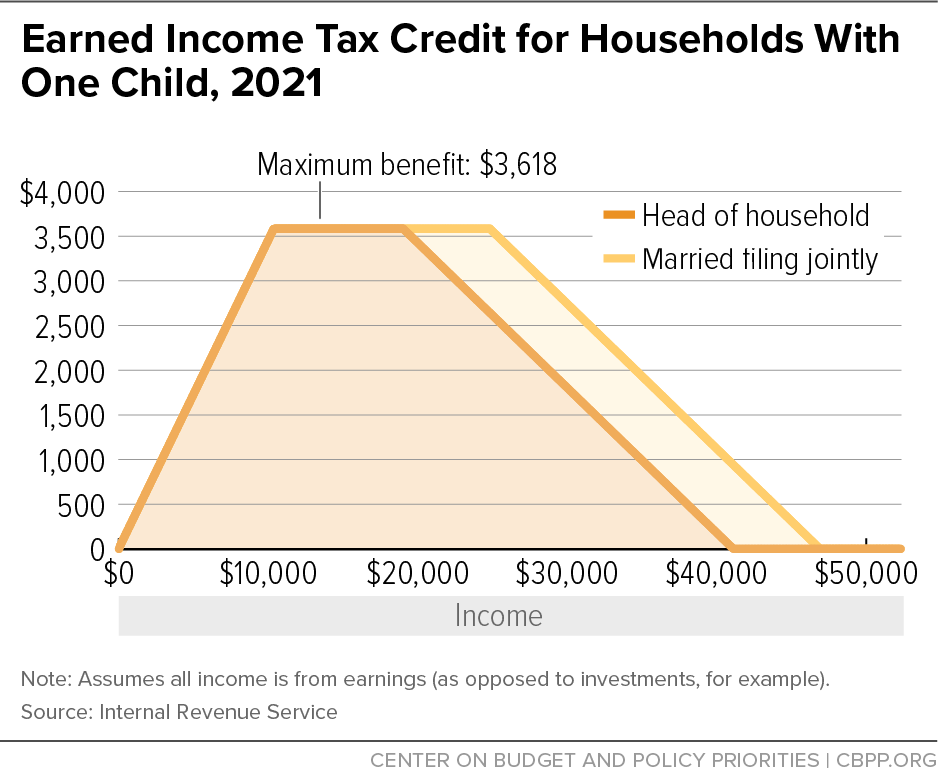

Earned Income Tax Credit For Households With One Child 2021 Center

Earned Income Tax Credit For Households With One Child 2021 Center

To Claim EITC With a Qualifying Child the Child Must Pass All of the Following Tests Relationship A son or daughter including an adopted child or child lawfully placed for

Gain access to our particularly curated collection of printable worksheets focused on How Does Child Earned Income Credit Work These worksheets accommodate different ability levels, guaranteeing a personalized learning experience. Download, print, and appreciate hands-on tasks that strengthen How Does Child Earned Income Credit Work skills in an effective and pleasurable method.

Earned Income Credit Calculator 2021 DannielleThalia

Earned Income Credit Calculator 2021 DannielleThalia

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the

Whether you're an educator looking for efficient strategies or a learner seeking self-guided approaches, this section provides useful suggestions for understanding How Does Child Earned Income Credit Work. Benefit from the experience and understandings of teachers who specialize in How Does Child Earned Income Credit Work education and learning.

Connect with like-minded people that share an enthusiasm for How Does Child Earned Income Credit Work. Our area is a space for teachers, moms and dads, and students to trade concepts, seek advice, and commemorate successes in the trip of grasping the alphabet. Join the conversation and be a part of our growing neighborhood.

Download More How Does Child Earned Income Credit Work

https://www.investopedia.com/.../c/chil…

The Child Tax Credit is a 2 000 per child tax benefit claimed by filing Form 1040 and attaching Schedule 8812 to the return To qualify for the credit the taxpayer s dependent

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a

The Child Tax Credit is a 2 000 per child tax benefit claimed by filing Form 1040 and attaching Schedule 8812 to the return To qualify for the credit the taxpayer s dependent

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a

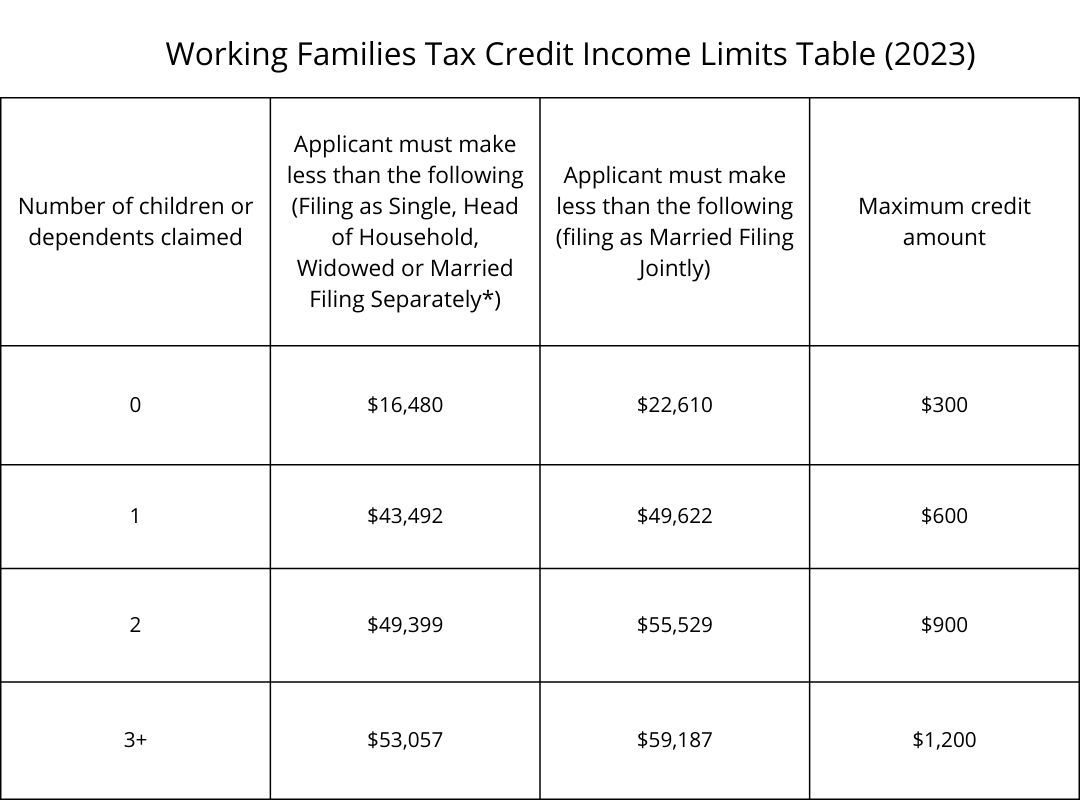

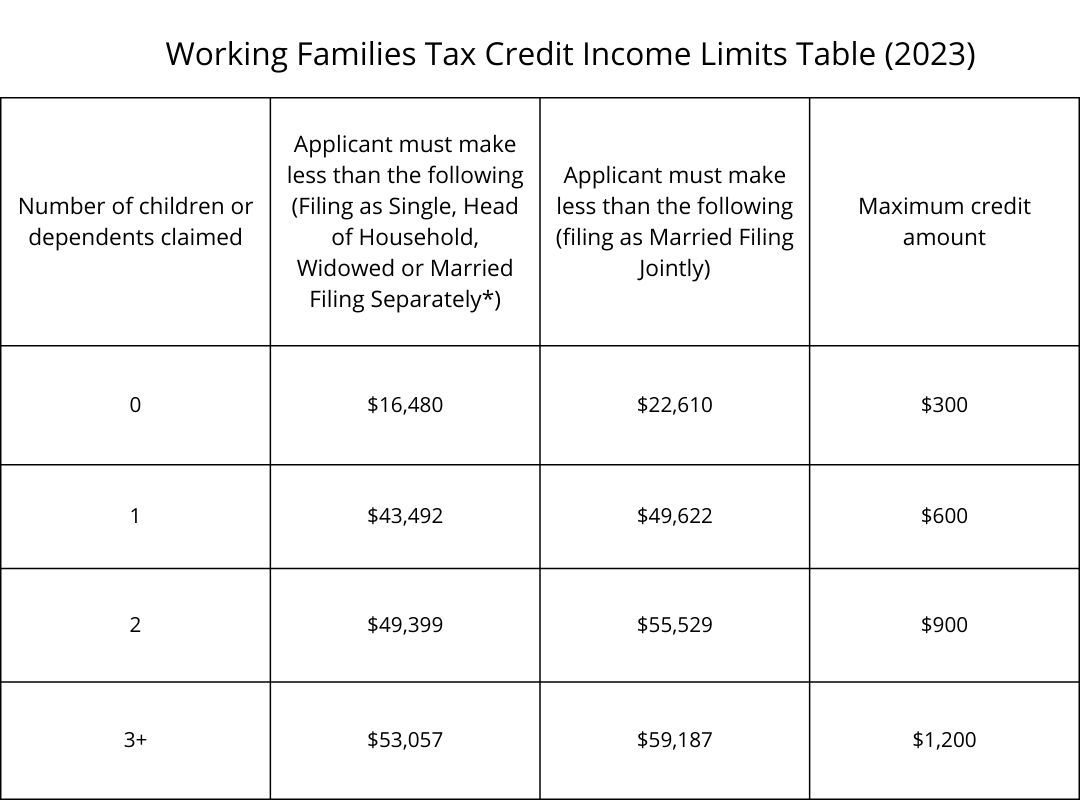

FAQ WA Tax Credit

Earned Income Tax Credit EITC Who Qualifies

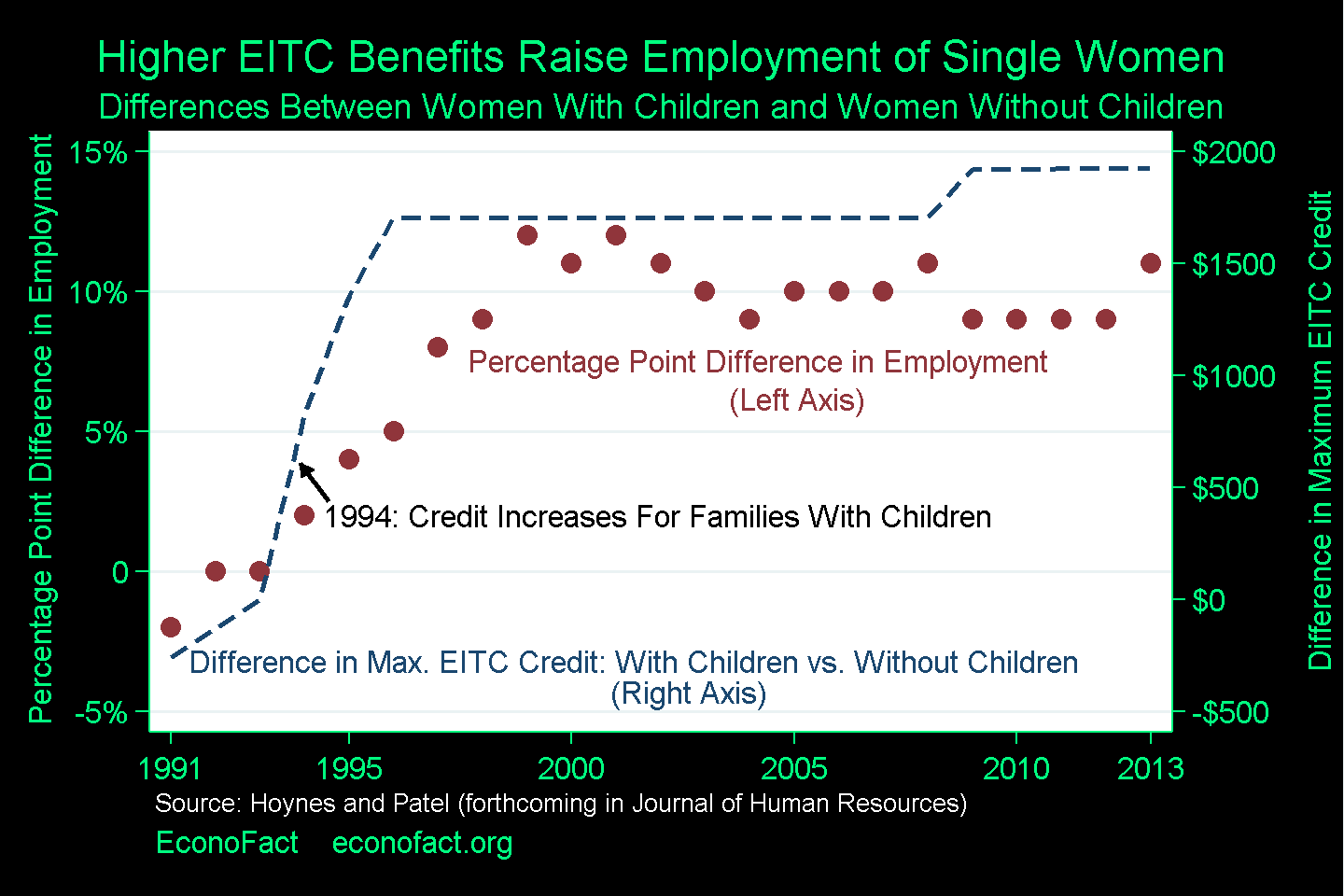

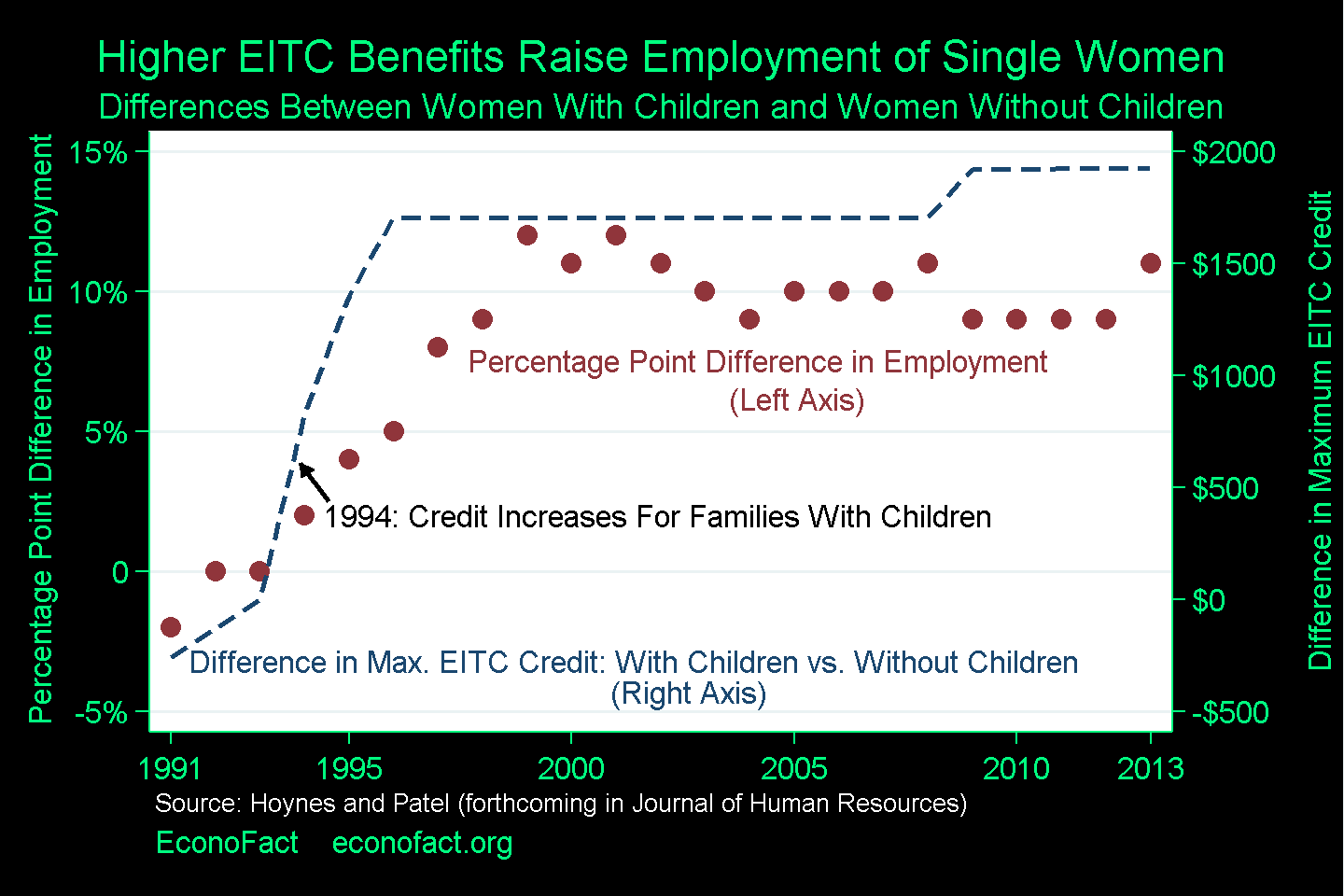

The Success Of The Earned Income Tax Credit Econofact

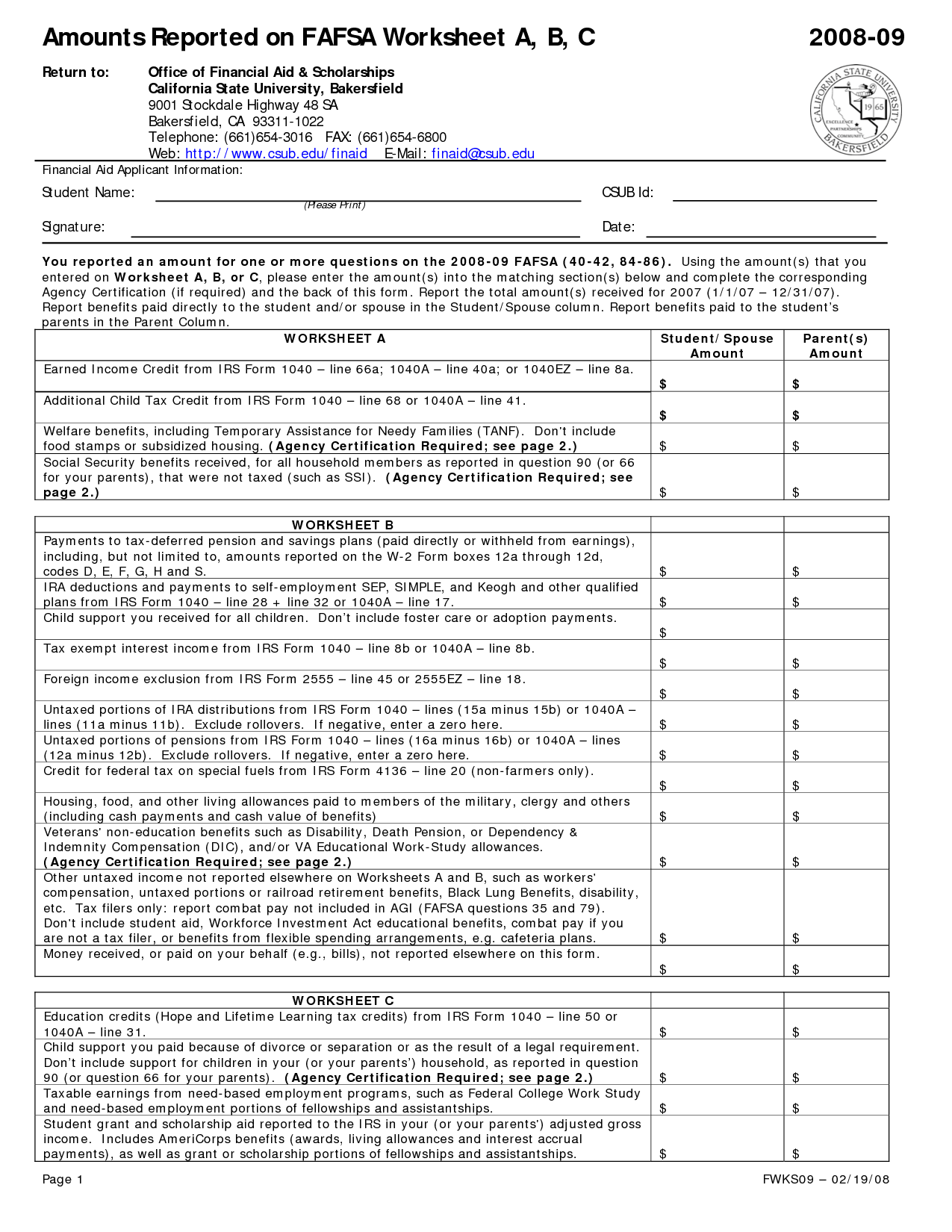

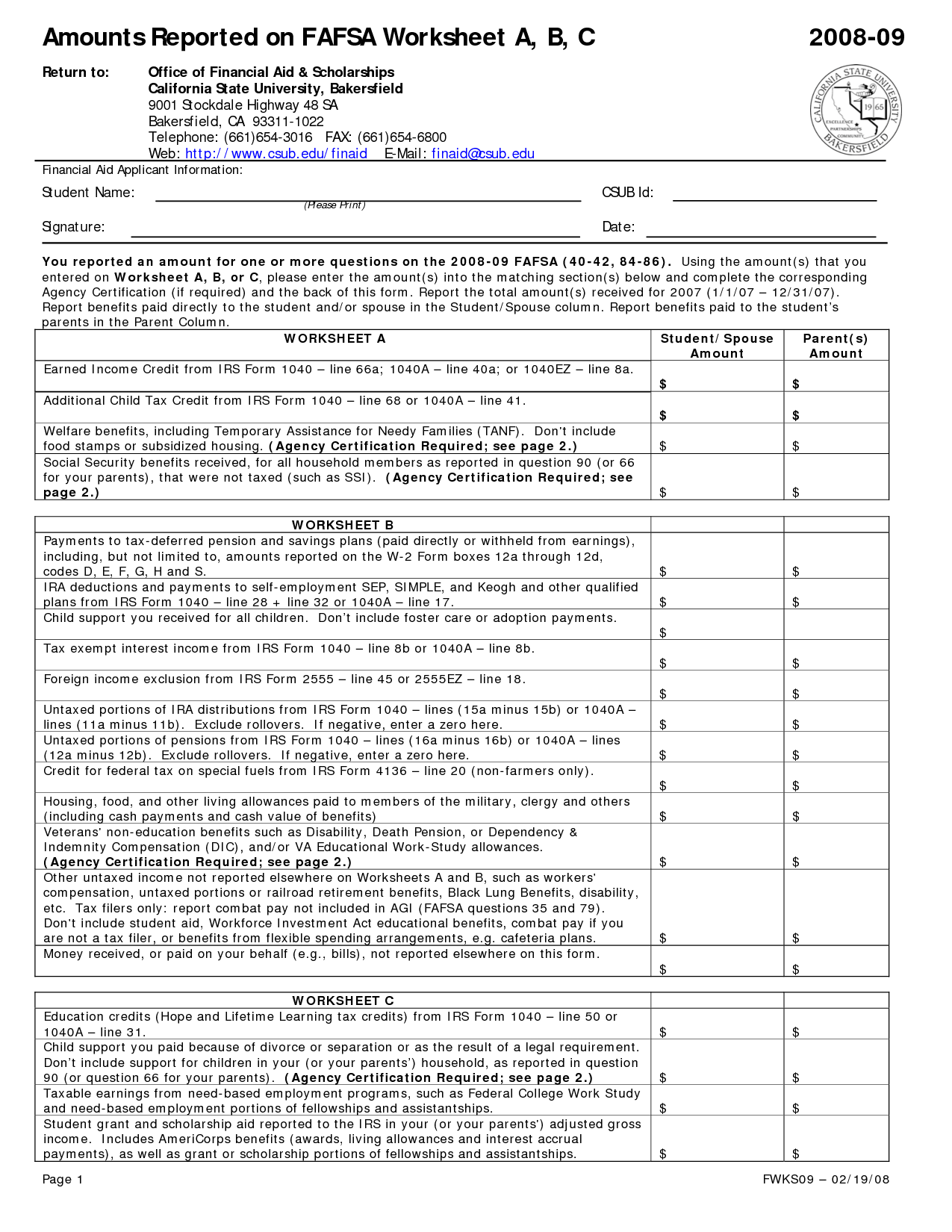

Income Calculation Worksheet 2022

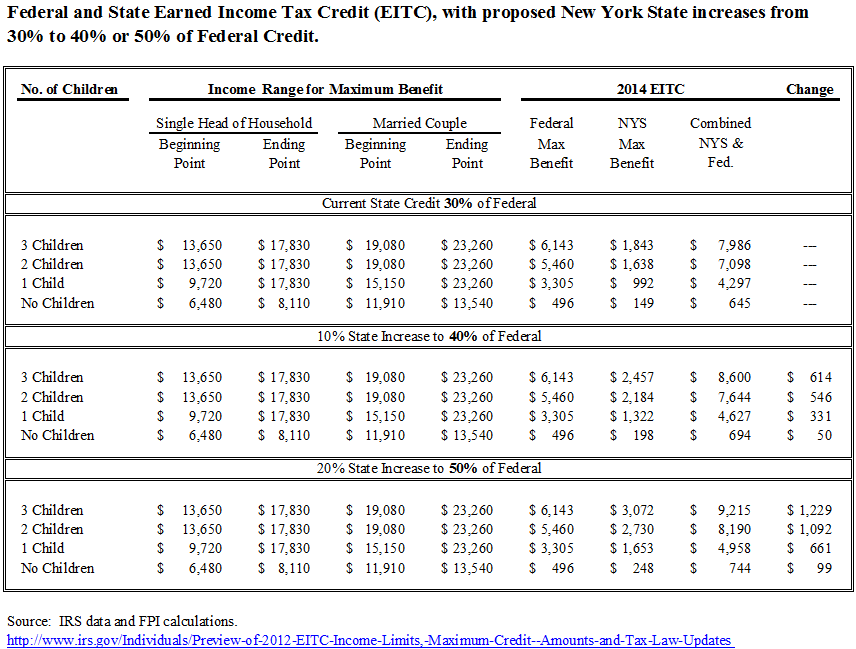

NYS Can Help Low income Working Families With Children By Increasing

Chart Book The Earned Income Tax Credit And Child Tax Credit Center

Chart Book The Earned Income Tax Credit And Child Tax Credit Center

What Is The Child Tax Credit And How Much Of It Is Refundable Brookings