Welcome to PrintableAlphabet.net, your best resource for all things associated with Intangible Assets What Can Be Capitalised In this comprehensive overview, we'll delve into the details of Intangible Assets What Can Be Capitalised, providing valuable insights, involving tasks, and printable worksheets to boost your knowing experience.

Comprehending Intangible Assets What Can Be Capitalised

In this area, we'll check out the fundamental ideas of Intangible Assets What Can Be Capitalised. Whether you're an instructor, parent, or student, obtaining a strong understanding of Intangible Assets What Can Be Capitalised is important for successful language purchase. Anticipate understandings, pointers, and real-world applications to make Intangible Assets What Can Be Capitalised come to life.

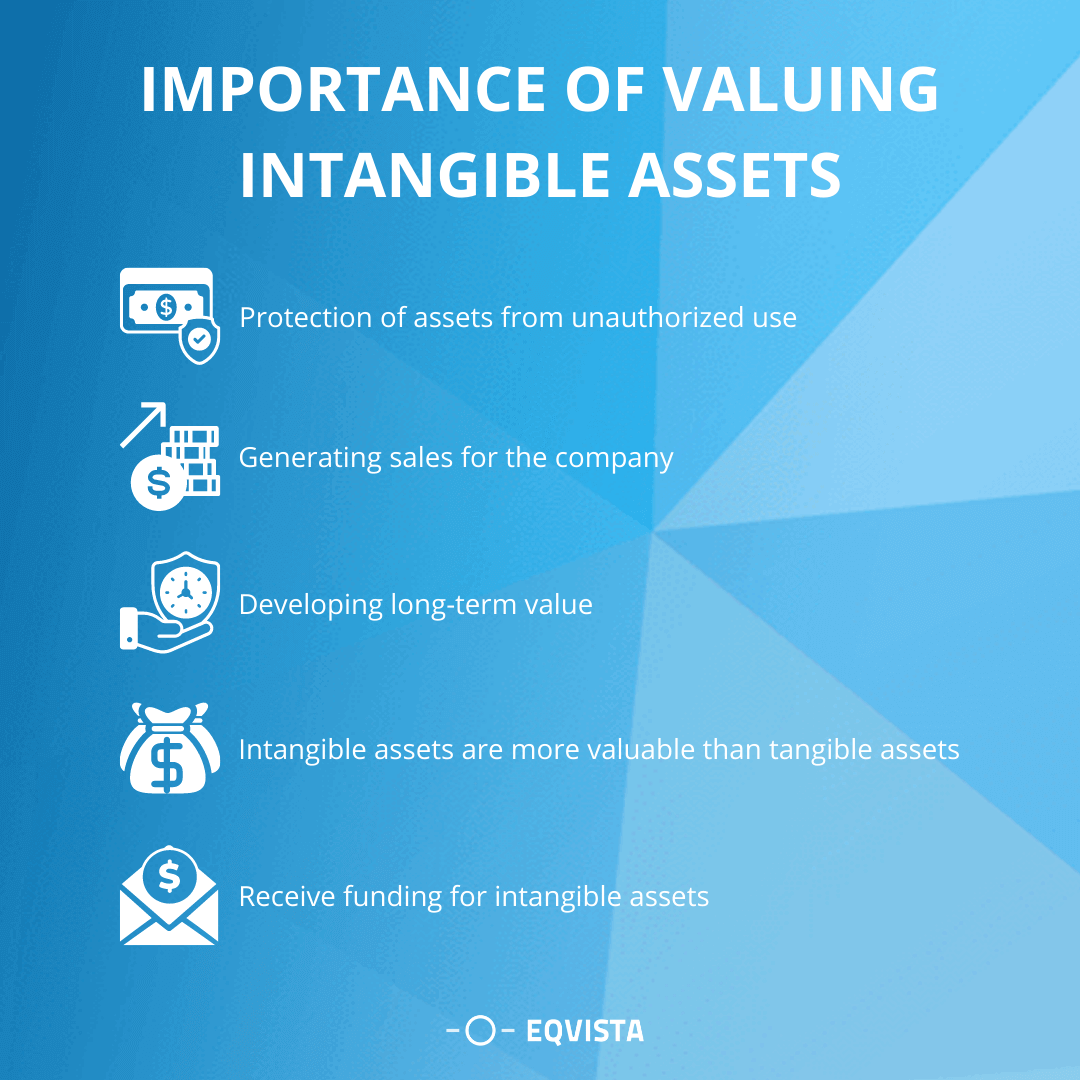

How To Do Intangible Asset Valuation In Hong Kong Eqvista

Intangible Assets What Can Be Capitalised

There is realistically one internally generated intangible asset that can be capitalised These are development costs where entities incur costs in order to develop new product lines or

Discover the relevance of mastering Intangible Assets What Can Be Capitalised in the context of language development. We'll talk about just how proficiency in Intangible Assets What Can Be Capitalised lays the foundation for enhanced reading, composing, and total language abilities. Explore the more comprehensive effect of Intangible Assets What Can Be Capitalised on efficient interaction.

Tangible Vs Intangible Assets Infographics Here Are The Top 4

Tangible Vs Intangible Assets Infographics Here Are The Top 4

If an internally generated intangible asset arises from the development phase of a project then directly attributable expenditure is capitalised from the date on which the entity can

Discovering doesn't need to be boring. In this area, locate a variety of appealing activities tailored to Intangible Assets What Can Be Capitalised students of all ages. From interactive video games to creative exercises, these activities are developed to make Intangible Assets What Can Be Capitalised both enjoyable and academic.

Amortization Of Intangible Assets Advantages And Disadvantages

Amortization Of Intangible Assets Advantages And Disadvantages

Intangible assets have a complex tax treatment As more businesses acquire these assets it s important to understand why they re complicated What Makes Intangibles

Gain access to our particularly curated collection of printable worksheets concentrated on Intangible Assets What Can Be Capitalised These worksheets satisfy various ability degrees, making certain a tailored discovering experience. Download and install, print, and take pleasure in hands-on tasks that strengthen Intangible Assets What Can Be Capitalised abilities in an effective and satisfying means.

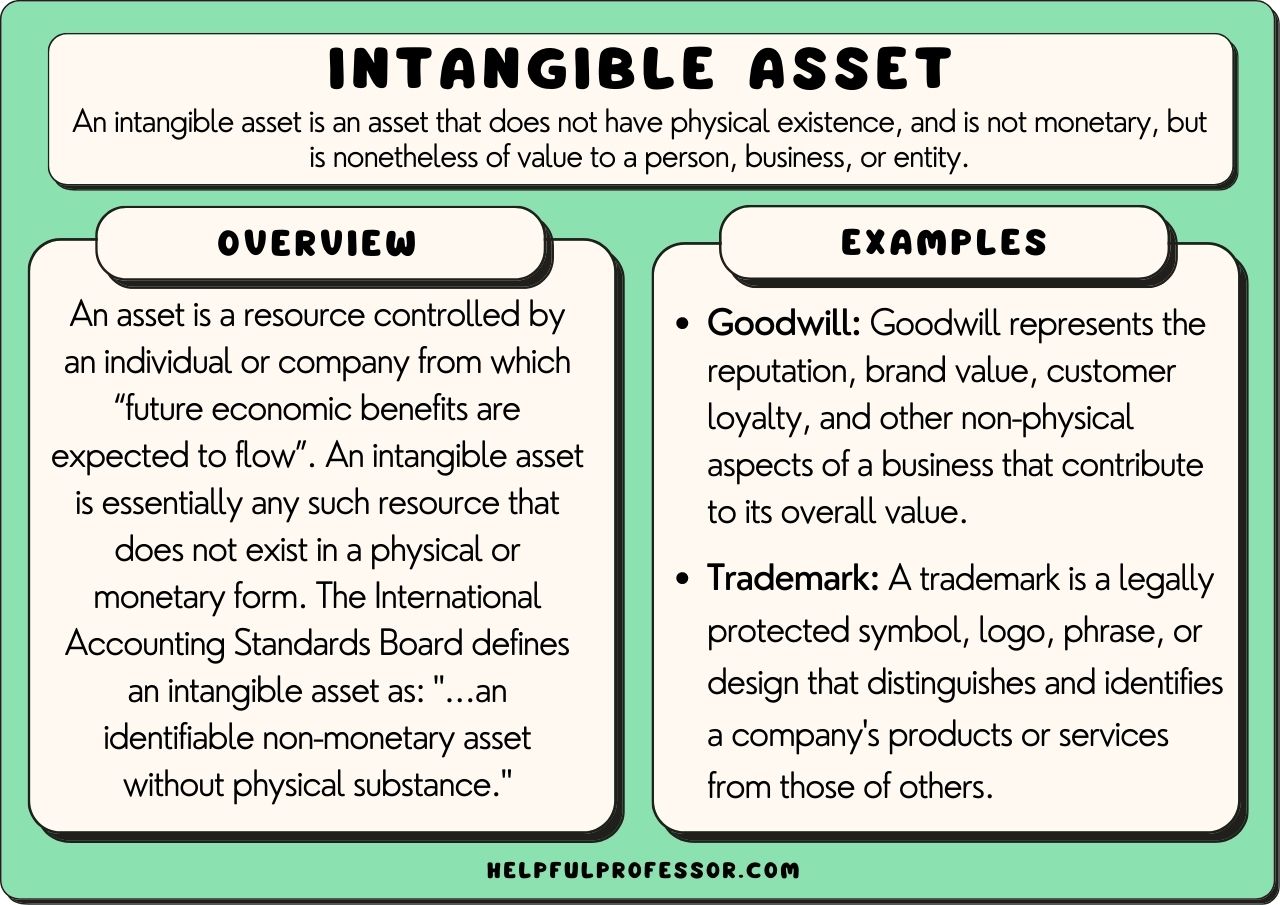

10 Intangible Asset Examples 2023

10 Intangible Asset Examples 2023

Standards Board 138 Intangible Assets when it comes to thinking about how to treat these internal costs This guidance basically says that these costs can be capitalised and held on

Whether you're a teacher searching for reliable strategies or a learner looking for self-guided strategies, this area provides functional pointers for understanding Intangible Assets What Can Be Capitalised. Take advantage of the experience and understandings of instructors who focus on Intangible Assets What Can Be Capitalised education.

Connect with like-minded people that share an interest for Intangible Assets What Can Be Capitalised. Our community is a space for teachers, moms and dads, and students to trade ideas, inquire, and commemorate successes in the journey of understanding the alphabet. Join the discussion and belong of our expanding neighborhood.

Download Intangible Assets What Can Be Capitalised

https://www.accaglobal.com › ... › intangible-assets.html

There is realistically one internally generated intangible asset that can be capitalised These are development costs where entities incur costs in order to develop new product lines or

https://assets.kpmg.com › content › dam › kpmg › mt › pdf …

If an internally generated intangible asset arises from the development phase of a project then directly attributable expenditure is capitalised from the date on which the entity can

There is realistically one internally generated intangible asset that can be capitalised These are development costs where entities incur costs in order to develop new product lines or

If an internally generated intangible asset arises from the development phase of a project then directly attributable expenditure is capitalised from the date on which the entity can

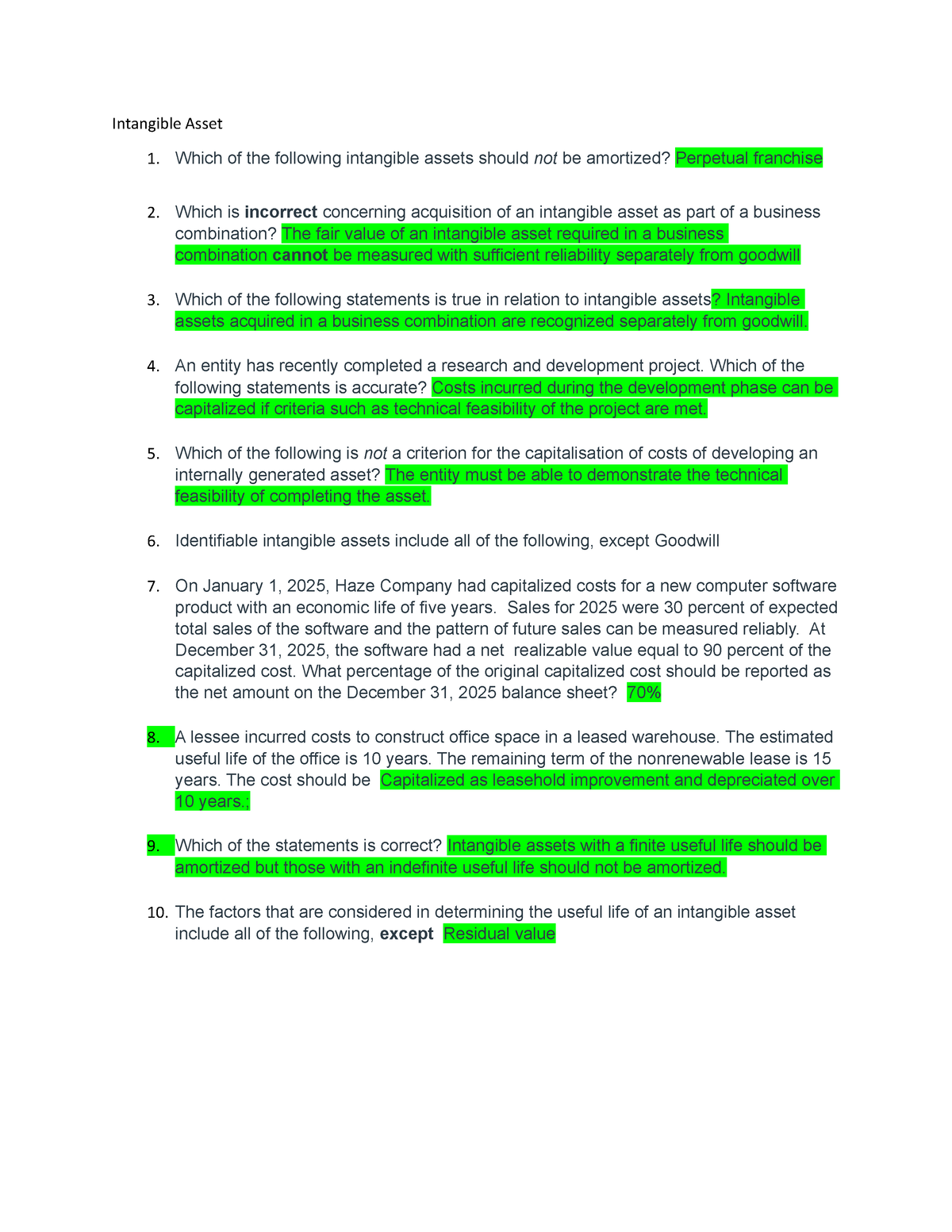

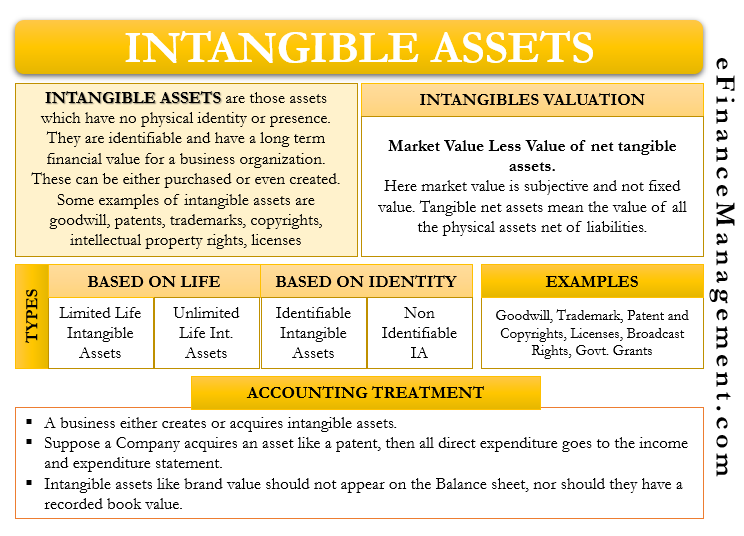

Intangible Asset Quiz Intangible Asset Which Of The Following

What Are Intangible Assets EverEdge Global

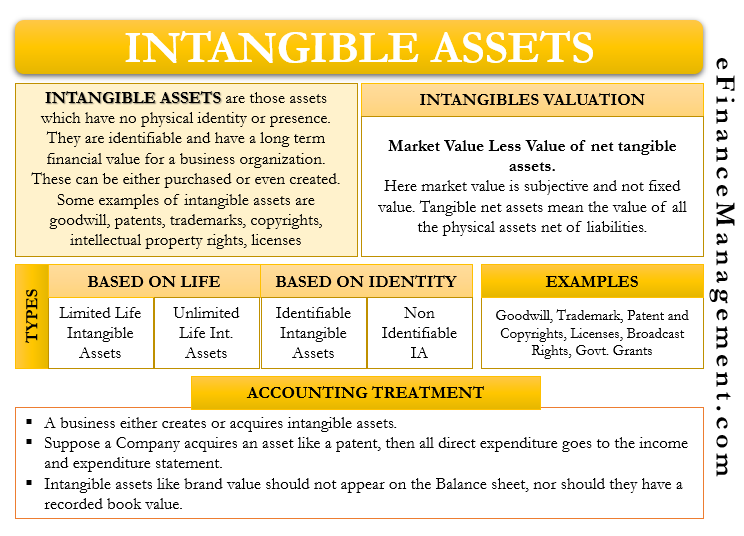

Intangible Assets Meaning Valuation Categories Example Accounting

Difference Between Tangible Assets And Intangible Assets Diferr

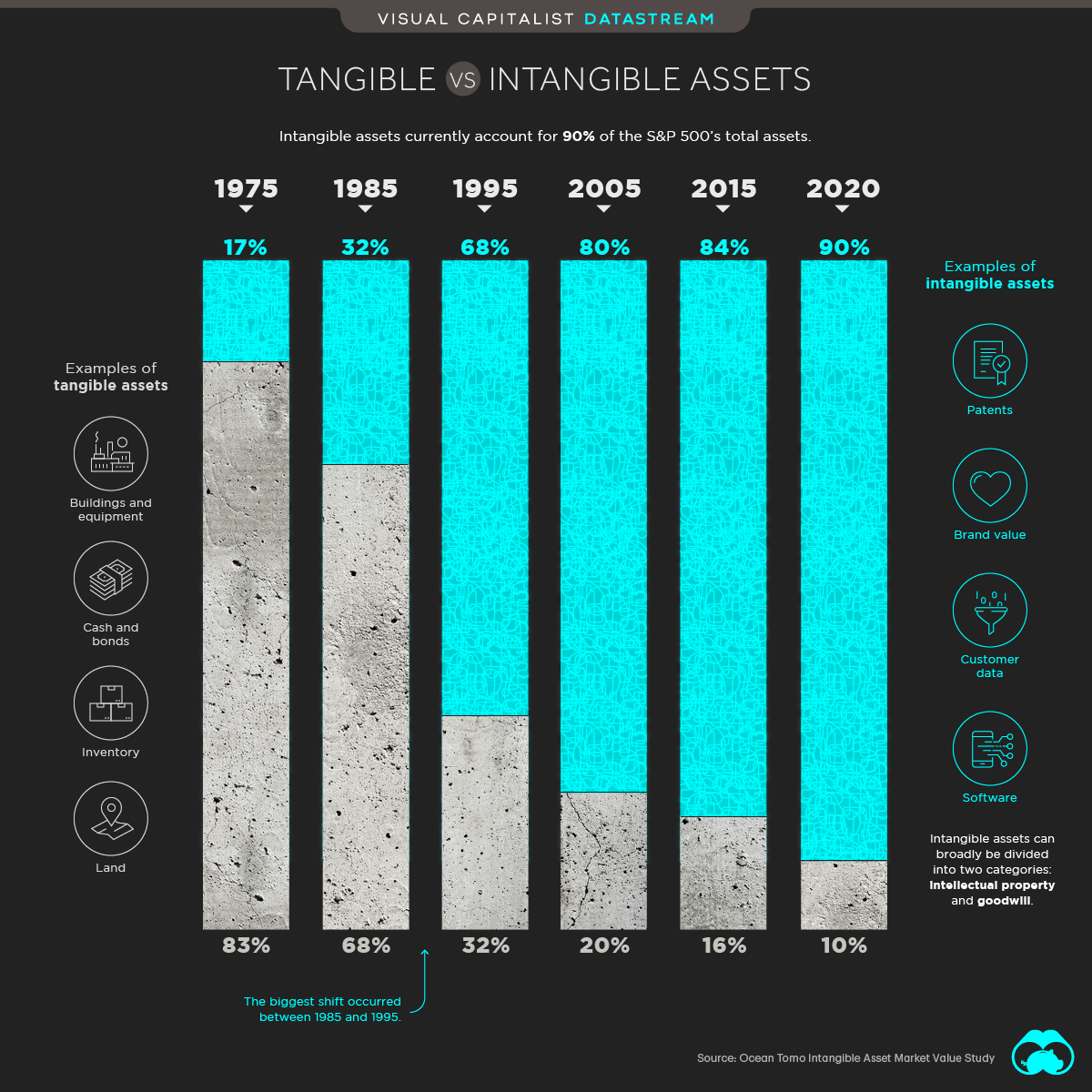

Jeff Desjardins Blog The Soaring Value Of Intangible Assets In The S

Intangible Assets Types Stock Illustration Illustration Of Chart

Intangible Assets Types Stock Illustration Illustration Of Chart

R D Costs How To Journalize And Record Expenses Thales Learning