Welcome to PrintableAlphabet.net, your best source for all things associated with Replacement Method Is A Method Of Depreciation In this detailed overview, we'll look into the intricacies of Replacement Method Is A Method Of Depreciation, supplying important understandings, involving activities, and printable worksheets to boost your understanding experience.

Understanding Replacement Method Is A Method Of Depreciation

In this section, we'll discover the basic ideas of Replacement Method Is A Method Of Depreciation. Whether you're an instructor, moms and dad, or learner, gaining a strong understanding of Replacement Method Is A Method Of Depreciation is essential for successful language acquisition. Anticipate insights, tips, and real-world applications to make Replacement Method Is A Method Of Depreciation revived.

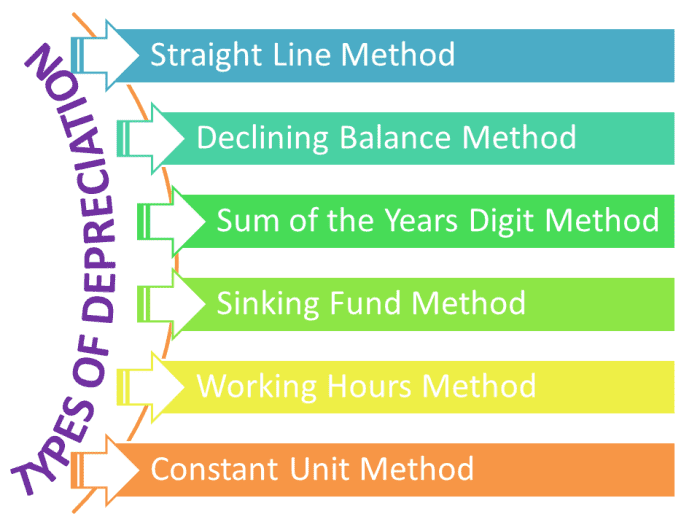

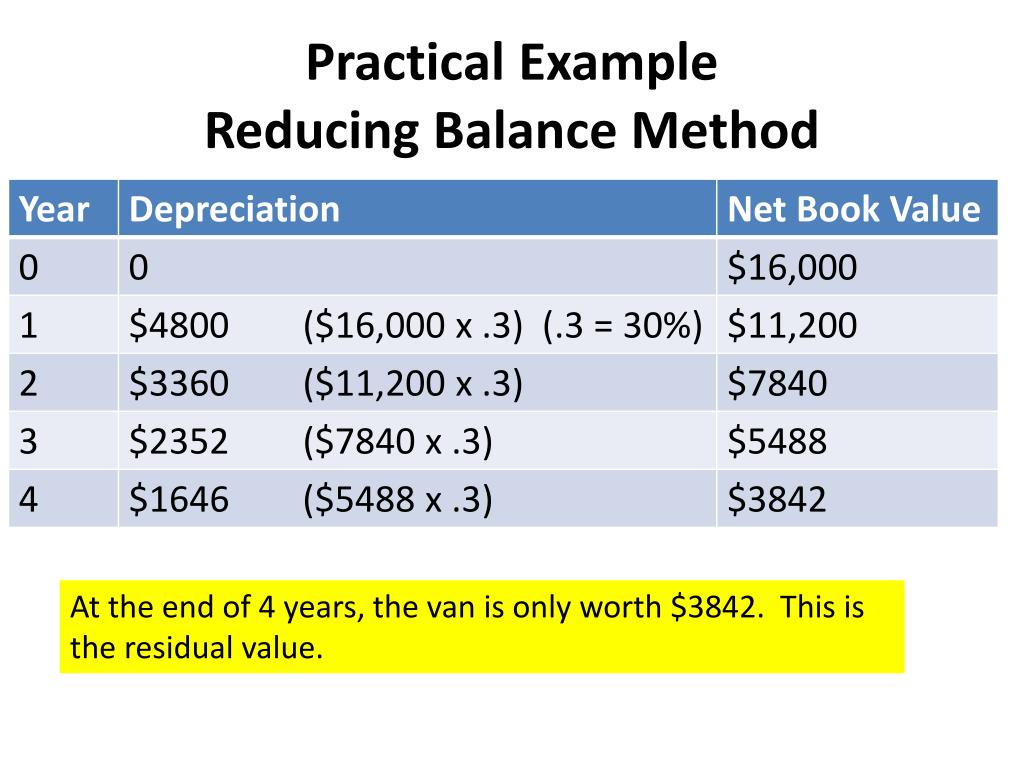

Methods Of Depreciation Formulas Problems And Solutions 2022

Replacement Method Is A Method Of Depreciation

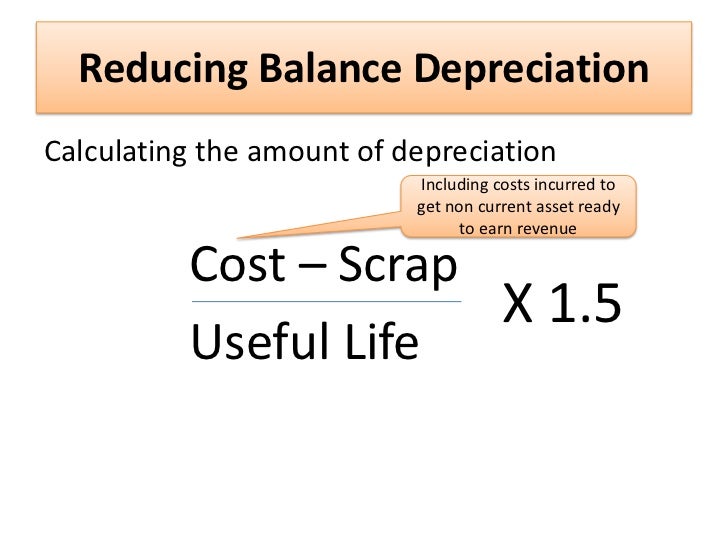

The replacement cost method is a valuation approach that estimates the cost to replace an asset with a new one of similar kind and quality adjusting for physical depreciation This method is

Discover the importance of mastering Replacement Method Is A Method Of Depreciation in the context of language development. We'll go over just how effectiveness in Replacement Method Is A Method Of Depreciation lays the foundation for improved analysis, creating, and general language abilities. Check out the more comprehensive effect of Replacement Method Is A Method Of Depreciation on efficient communication.

How To Calculate Depreciation To Date Haiper

How To Calculate Depreciation To Date Haiper

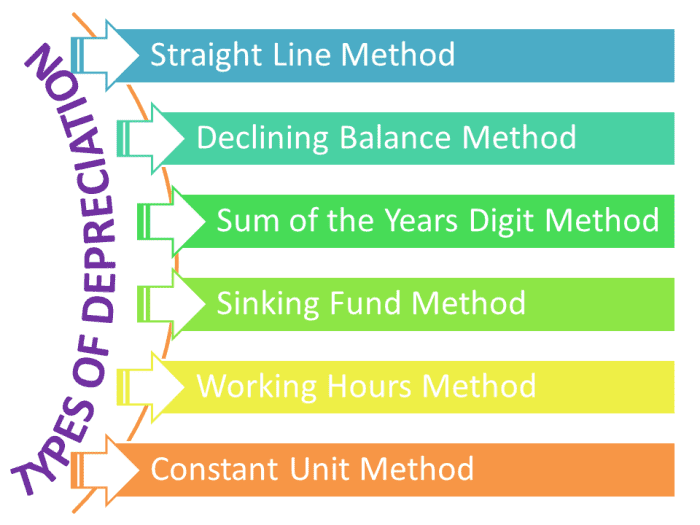

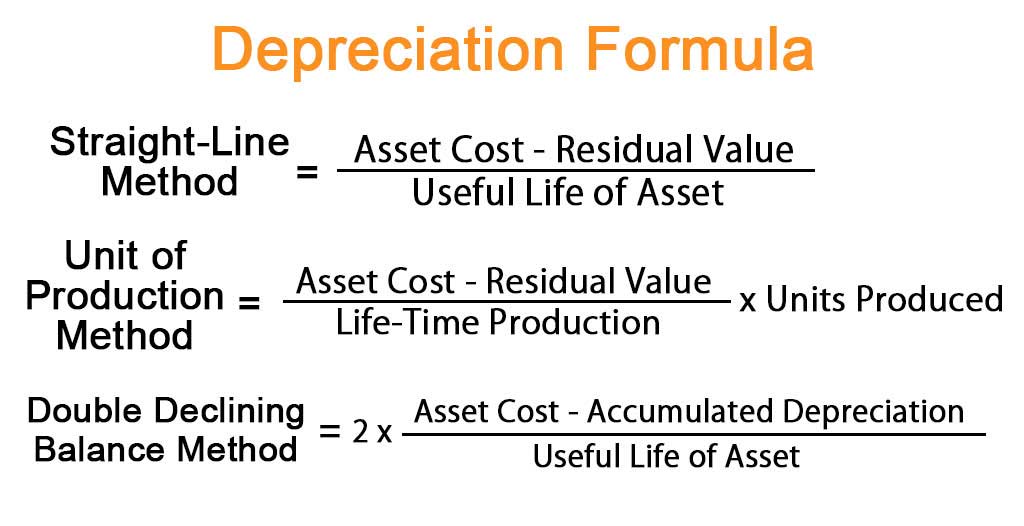

Depreciation is an accounting expense that reduces the value of long lived assets over their useful life Learn how depreciation is calculated what methods and assumptions are used and how it

Understanding does not need to be plain. In this area, find a selection of appealing activities customized to Replacement Method Is A Method Of Depreciation learners of any ages. From interactive games to imaginative workouts, these tasks are made to make Replacement Method Is A Method Of Depreciation both fun and instructional.

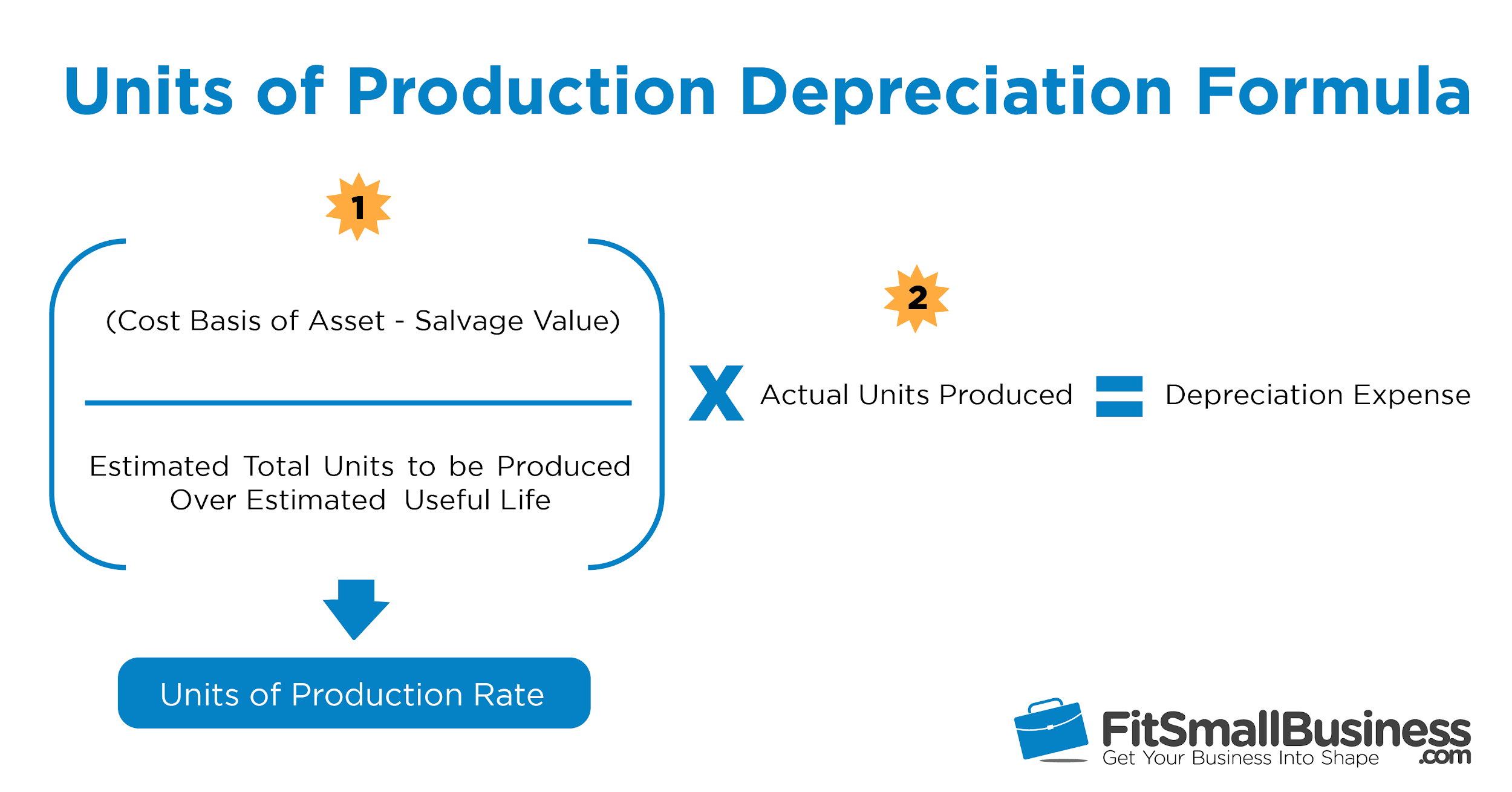

Units Of Production Depreciation How To Calculate Formula

Units Of Production Depreciation How To Calculate Formula

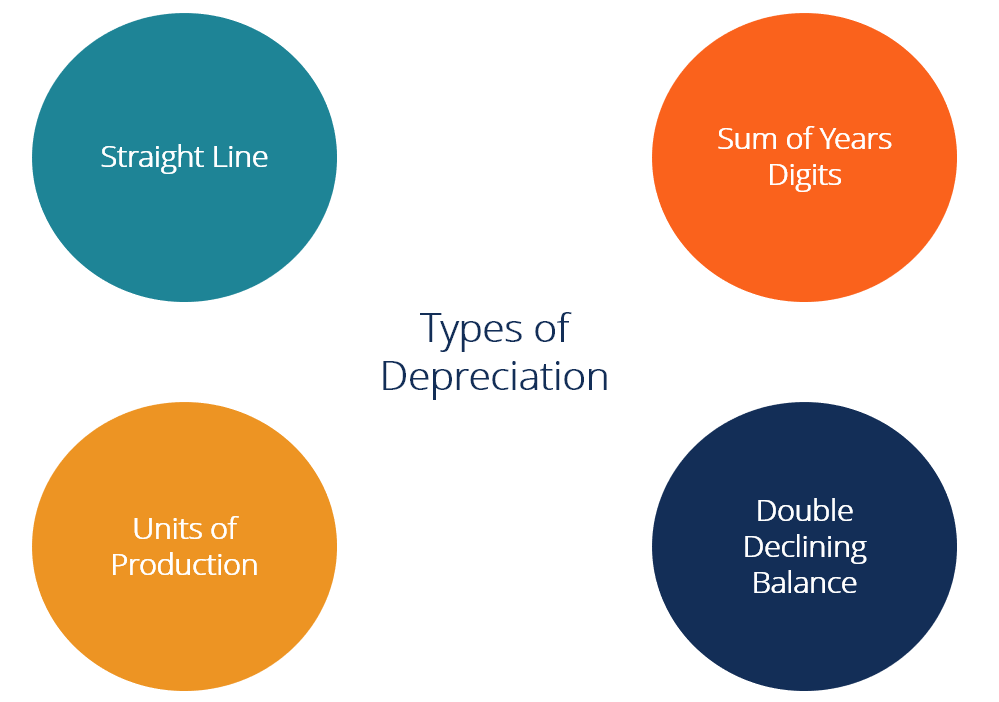

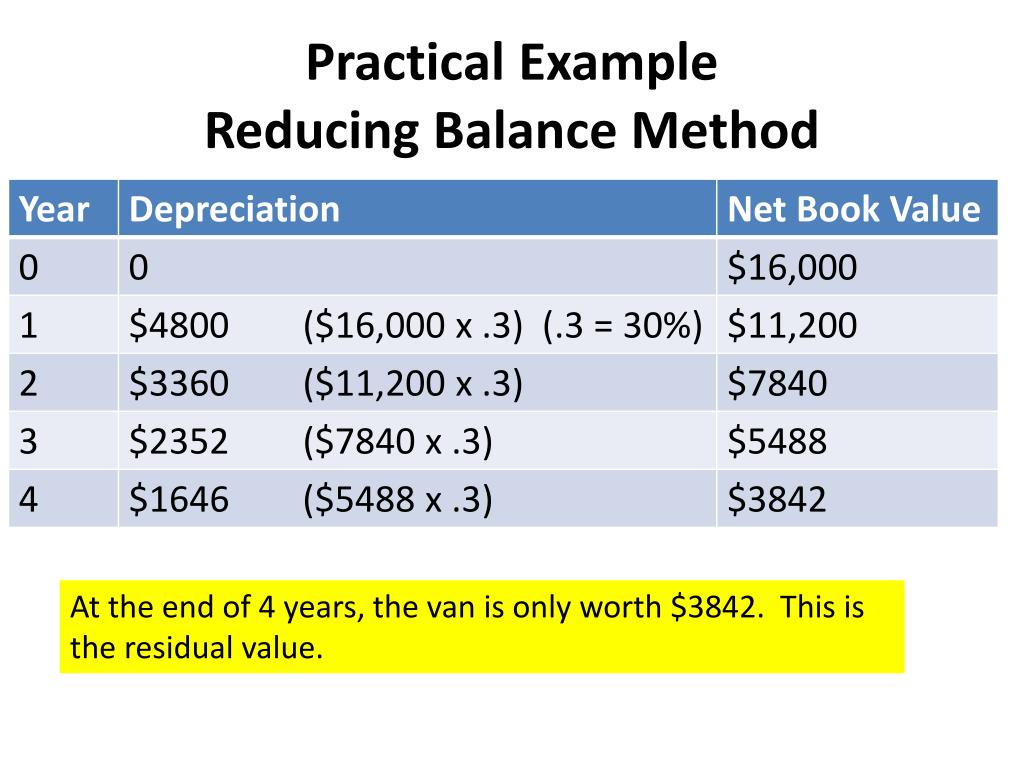

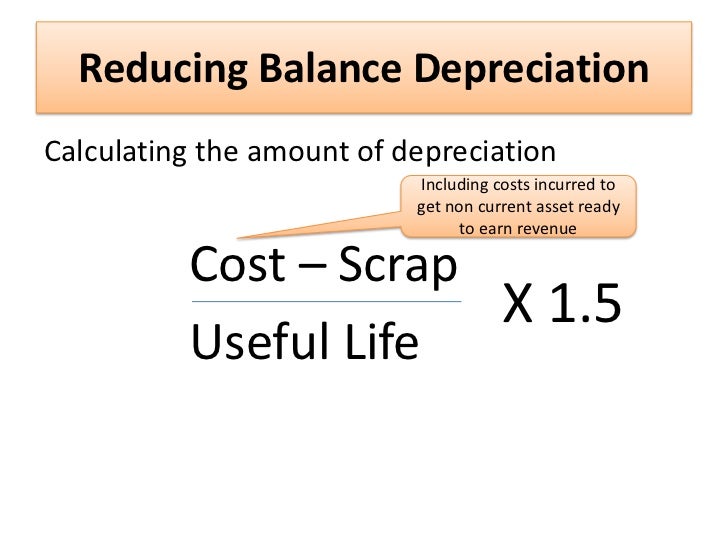

Learn how to calculate depreciation for different types of assets using four common methods straight line declining balance units of production and sum of years digits See formulas examples and tips for choosing the

Access our specially curated collection of printable worksheets focused on Replacement Method Is A Method Of Depreciation These worksheets deal with numerous skill degrees, ensuring a tailored discovering experience. Download and install, print, and take pleasure in hands-on activities that strengthen Replacement Method Is A Method Of Depreciation abilities in a reliable and enjoyable method.

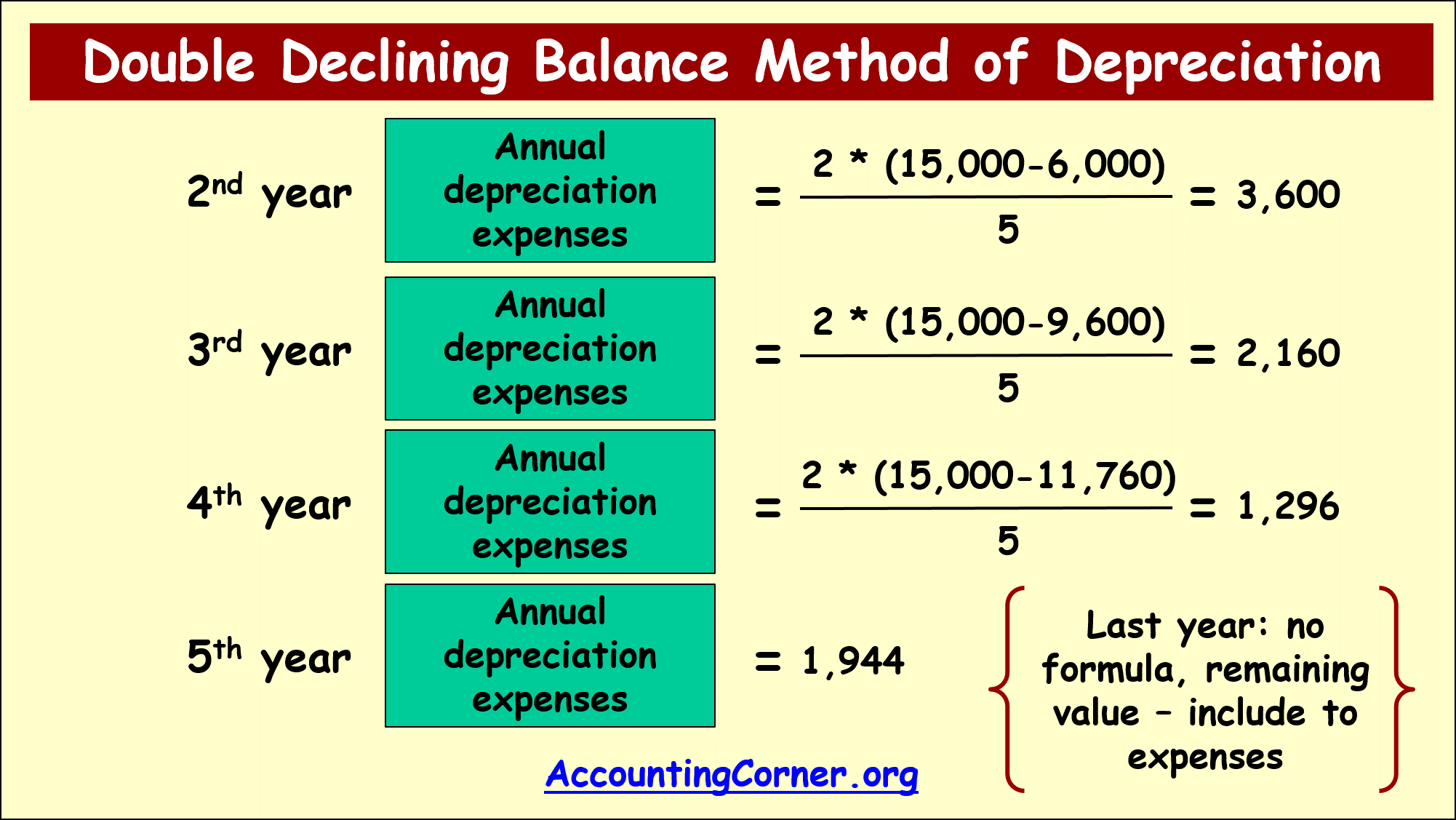

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

The choice of depreciation method affects a company s financial reports tax obligations and asset management strategies By understanding the nuances of each method companies

Whether you're a teacher looking for efficient methods or a student looking for self-guided methods, this area provides functional pointers for mastering Replacement Method Is A Method Of Depreciation. Gain from the experience and understandings of instructors that specialize in Replacement Method Is A Method Of Depreciation education and learning.

Get in touch with similar people that share an interest for Replacement Method Is A Method Of Depreciation. Our area is an area for instructors, parents, and students to trade ideas, inquire, and commemorate successes in the journey of grasping the alphabet. Sign up with the conversation and belong of our expanding community.

Get More Replacement Method Is A Method Of Depreciation

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

https://library.fiveable.me › key-terms › business...

The replacement cost method is a valuation approach that estimates the cost to replace an asset with a new one of similar kind and quality adjusting for physical depreciation This method is

https://www.investopedia.com › ... › de…

Depreciation is an accounting expense that reduces the value of long lived assets over their useful life Learn how depreciation is calculated what methods and assumptions are used and how it

The replacement cost method is a valuation approach that estimates the cost to replace an asset with a new one of similar kind and quality adjusting for physical depreciation This method is

Depreciation is an accounting expense that reduces the value of long lived assets over their useful life Learn how depreciation is calculated what methods and assumptions are used and how it

How To Calculate Depreciation By Reducing Balance Method Haiper

Yearly Depreciation Formula GryffyddNiami

Depreciation Straight Line Method Or Original Cost Method Lecture 2

How To Calculate Depreciation Using Reducing Balance Method Haiper

What Is Straight Line Depreciation Method PMP Exam YouTube

How To Choose Between Straight line Depreciation And Accelerated

How To Choose Between Straight line Depreciation And Accelerated

Methods Of Depreciation Formulas Problems And Solutions Owlcation