Welcome to PrintableAlphabet.net, your go-to resource for all points associated with Tax Payment Due Date For Qrmp In this detailed guide, we'll explore the complexities of Tax Payment Due Date For Qrmp, offering useful understandings, engaging activities, and printable worksheets to enhance your understanding experience.

Recognizing Tax Payment Due Date For Qrmp

In this section, we'll check out the essential principles of Tax Payment Due Date For Qrmp. Whether you're an educator, parent, or student, getting a solid understanding of Tax Payment Due Date For Qrmp is essential for effective language procurement. Expect insights, suggestions, and real-world applications to make Tax Payment Due Date For Qrmp revived.

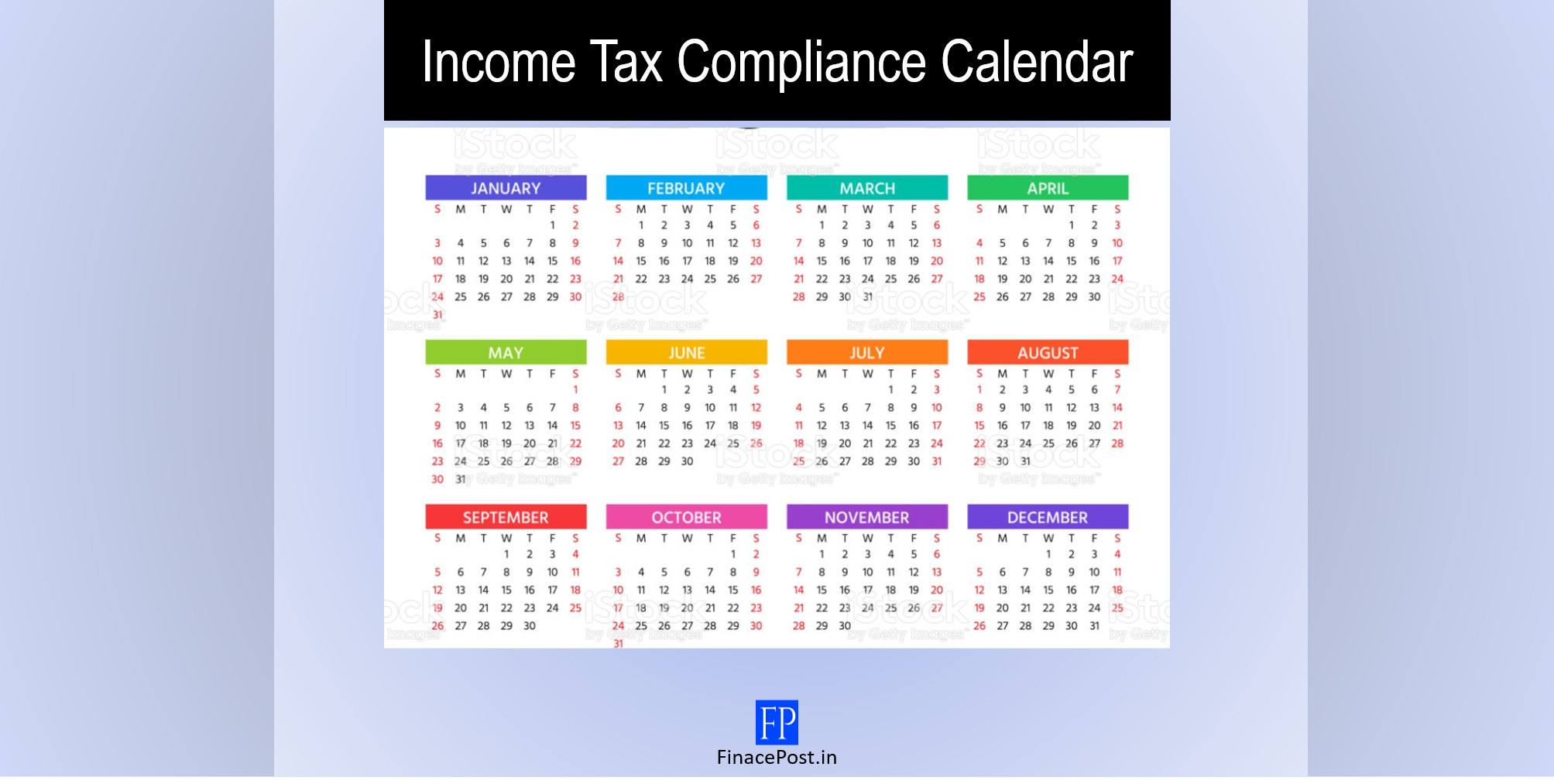

Advance Tax Payment Due Date For FY 2022 23 AY 2023 24

Tax Payment Due Date For Qrmp

Due Dates For Payments Under the QRMP Scheme All registered persons under the QRMP scheme should pay the tax due in each of the first two months of the quarter by the 25th of the next month

Discover the relevance of mastering Tax Payment Due Date For Qrmp in the context of language growth. We'll talk about just how proficiency in Tax Payment Due Date For Qrmp lays the structure for improved reading, creating, and total language skills. Check out the broader impact of Tax Payment Due Date For Qrmp on effective interaction.

Installment Of Advance Tax Payment Due Date For FY 2020 21 SAG Infotech

Installment Of Advance Tax Payment Due Date For FY 2020 21 SAG Infotech

If RTP has exercised the QRMP option he will have to file GSTR 3B on a quarterly basis The due date for the same is on or before the 22 nd or 24 th day of the

Understanding doesn't have to be boring. In this area, locate a selection of appealing activities customized to Tax Payment Due Date For Qrmp students of every ages. From interactive games to innovative workouts, these tasks are created to make Tax Payment Due Date For Qrmp both enjoyable and educational.

QRMP Scheme Last Due Date For GST Payment YouTube

QRMP Scheme Last Due Date For GST Payment YouTube

If tax due is paid within the first two months of the quarter by depositing an auto calculated fixed sum by the due date no interest will be levied on the taxpayer The interest

Gain access to our specifically curated collection of printable worksheets focused on Tax Payment Due Date For Qrmp These worksheets deal with different skill levels, making sure a personalized knowing experience. Download and install, print, and appreciate hands-on tasks that enhance Tax Payment Due Date For Qrmp skills in an effective and pleasurable way.

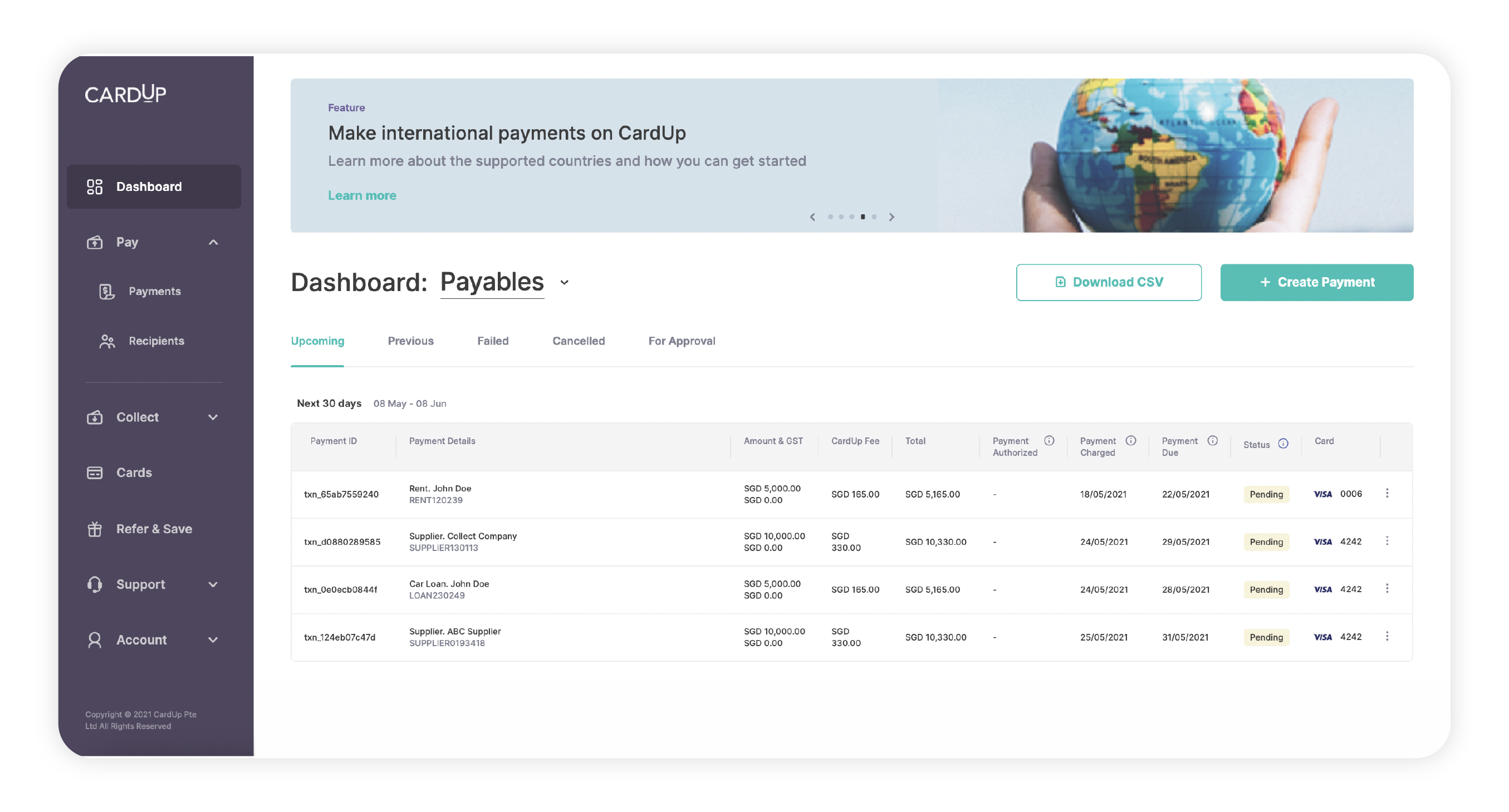

Where Can I Check On The Status Of My Payments CardUp Help Center

Where Can I Check On The Status Of My Payments CardUp Help Center

Self Assessment Method The actual tax due is to be paid through challan in Form GST PMT 06 by considering the tax liability on inward and outward supplies and the input tax

Whether you're an instructor trying to find effective techniques or a student looking for self-guided methods, this area supplies useful tips for understanding Tax Payment Due Date For Qrmp. Benefit from the experience and insights of instructors who specialize in Tax Payment Due Date For Qrmp education.

Get in touch with similar individuals who share a passion for Tax Payment Due Date For Qrmp. Our community is a space for educators, moms and dads, and students to trade ideas, inquire, and celebrate successes in the journey of mastering the alphabet. Sign up with the conversation and be a part of our expanding area.

Get More Tax Payment Due Date For Qrmp

https://cleartax.in/s/steps-tax-payment…

Due Dates For Payments Under the QRMP Scheme All registered persons under the QRMP scheme should pay the tax due in each of the first two months of the quarter by the 25th of the next month

https://taxguru.in/goods-and-service-tax/quarterly...

If RTP has exercised the QRMP option he will have to file GSTR 3B on a quarterly basis The due date for the same is on or before the 22 nd or 24 th day of the

Due Dates For Payments Under the QRMP Scheme All registered persons under the QRMP scheme should pay the tax due in each of the first two months of the quarter by the 25th of the next month

If RTP has exercised the QRMP option he will have to file GSTR 3B on a quarterly basis The due date for the same is on or before the 22 nd or 24 th day of the

Due Dates For GST Returns Types Of GST Returns Ebizfiling

Manual

Income Tax Compliance Calendar FinancePost

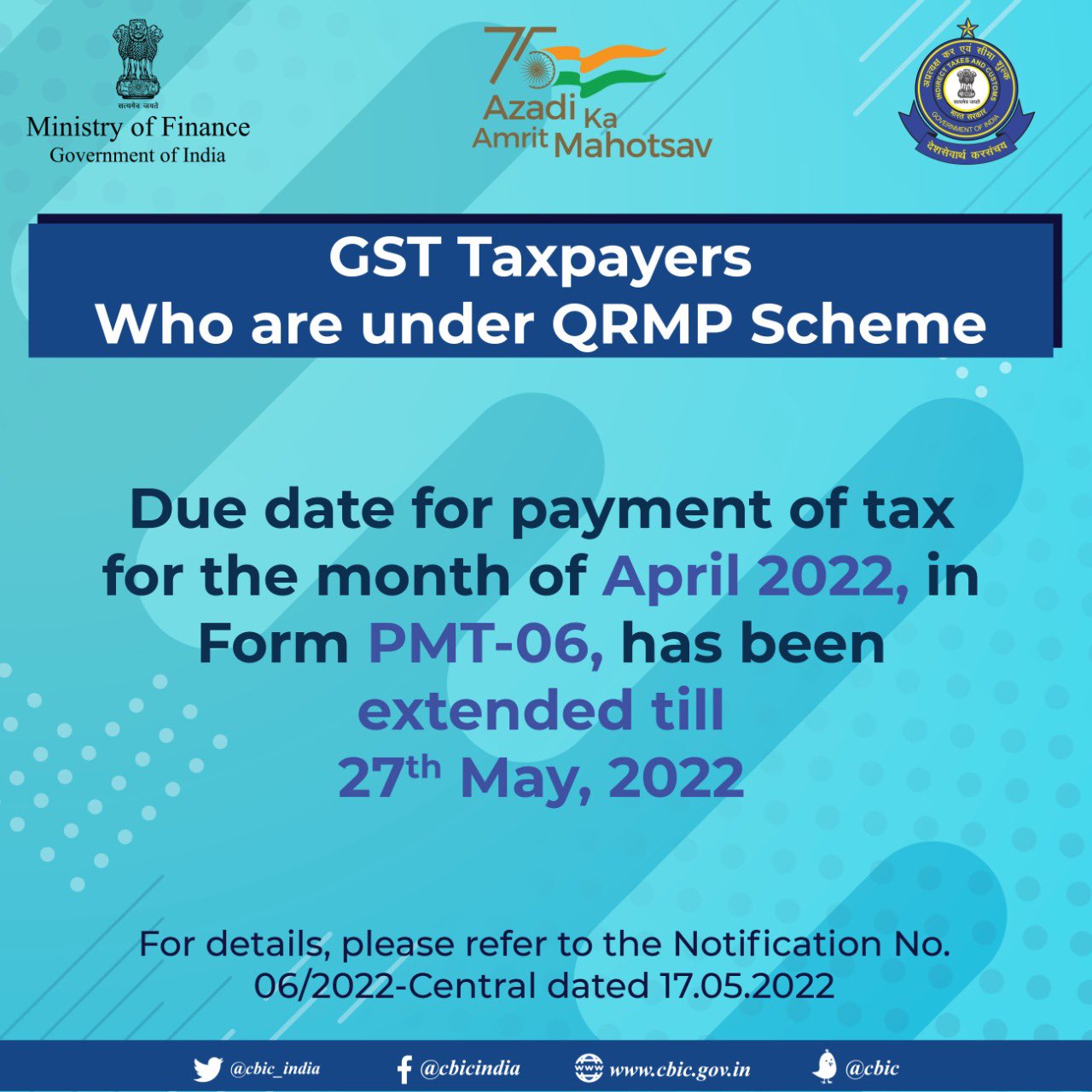

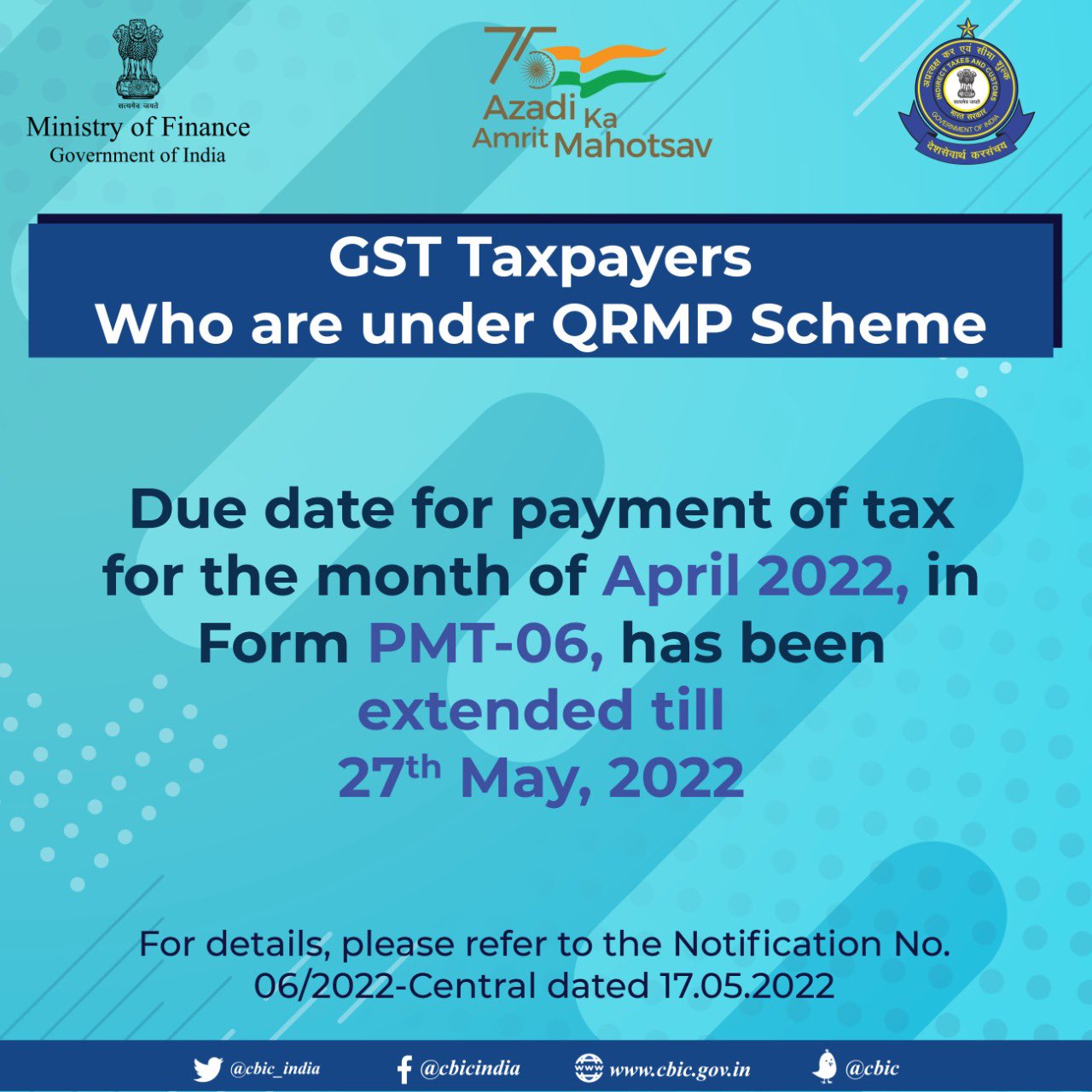

CBIC On Twitter Attention GST Taxpayers Who Are Under QRMP Scheme

GST Return Due Date For FY 2023 24

Due Date For Furnishing Form GST PMT 06 For April 2022 Extended Till

Due Date For Furnishing Form GST PMT 06 For April 2022 Extended Till

Big Update For GSTR9 Due Date Of Qrmp Payment Interest On Qrmp