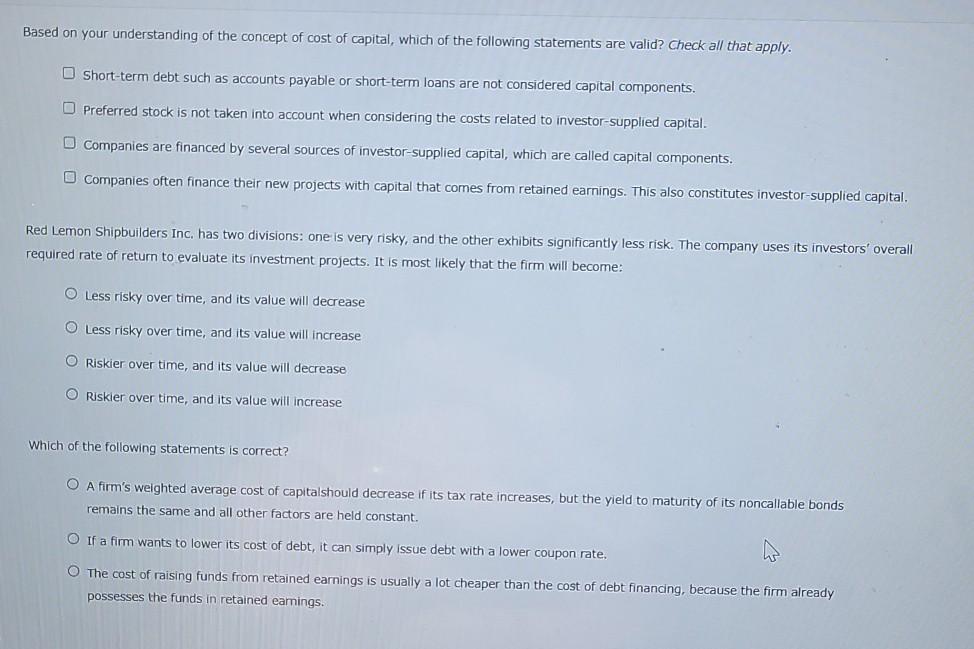

Welcome to PrintableAlphabet.net, your best source for all things related to What Assets Are Considered Capital Gains In this detailed guide, we'll look into the details of What Assets Are Considered Capital Gains, offering useful understandings, involving tasks, and printable worksheets to improve your learning experience.

Comprehending What Assets Are Considered Capital Gains

In this area, we'll discover the essential principles of What Assets Are Considered Capital Gains. Whether you're an instructor, moms and dad, or learner, obtaining a strong understanding of What Assets Are Considered Capital Gains is crucial for successful language acquisition. Anticipate understandings, ideas, and real-world applications to make What Assets Are Considered Capital Gains come to life.

Short Term Capital Gains Tax EQUITYMULTIPLE

What Assets Are Considered Capital Gains

A capital gains tax is a tax imposed on the sale of an asset The long term capital gains tax rates for the 2025 tax year are 0 15 or 20 of the profit depending on the income of the filer

Discover the value of mastering What Assets Are Considered Capital Gains in the context of language development. We'll go over how proficiency in What Assets Are Considered Capital Gains lays the foundation for better reading, creating, and total language skills. Discover the broader impact of What Assets Are Considered Capital Gains on effective interaction.

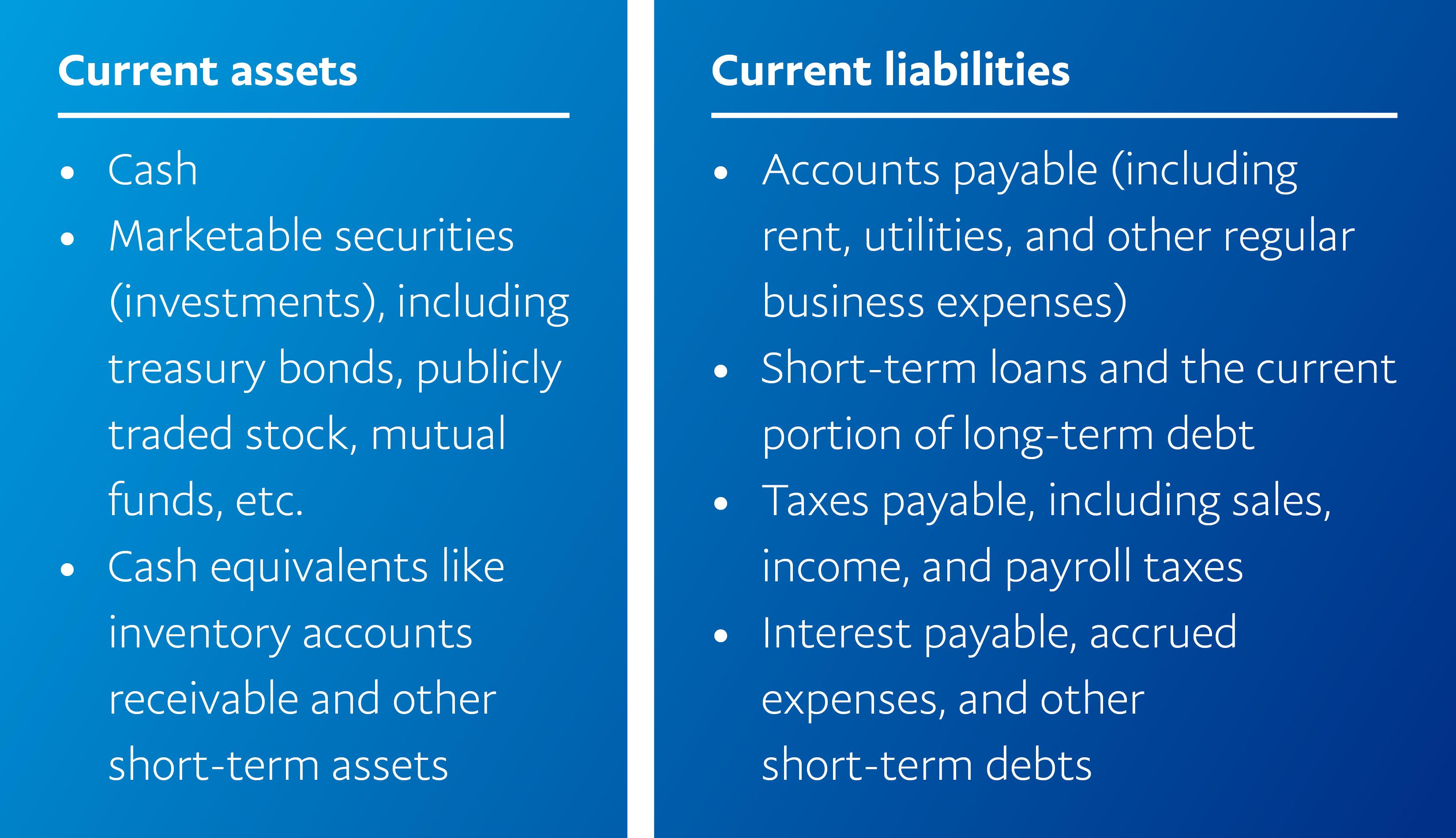

Capital De Giro NWC Economia E Negocios

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Capital De Giro NWC Economia E Negocios

Capital gains refer to the profit that comes from selling an asset or an investment for more than the price at which it was originally purchased These gains though initially exciting due to the associated profit bear significant tax

Discovering does not have to be plain. In this area, discover a variety of interesting activities customized to What Assets Are Considered Capital Gains students of all ages. From interactive games to imaginative exercises, these tasks are made to make What Assets Are Considered Capital Gains both fun and academic.

Assets In Accounting Identification Types And Learning Free Nude Porn

Assets In Accounting Identification Types And Learning Free Nude Porn

Your taxable capital gain is generally equal to the value that you receive when you sell or exchange a capital asset minus your basis in the asset Your basis is generally what you

Gain access to our specially curated collection of printable worksheets focused on What Assets Are Considered Capital Gains These worksheets deal with different ability levels, making sure a tailored learning experience. Download and install, print, and appreciate hands-on tasks that reinforce What Assets Are Considered Capital Gains abilities in an effective and enjoyable way.

What Assets Are Not Considered Part Of An Estate E Law

What Assets Are Not Considered Part Of An Estate E Law

You have a capital gain if you sell the asset for more than your adjusted basis You have a capital loss if you sell the asset for less than your adjusted basis Losses from the

Whether you're an instructor searching for effective methods or a learner looking for self-guided methods, this section offers useful pointers for grasping What Assets Are Considered Capital Gains. Gain from the experience and insights of teachers that specialize in What Assets Are Considered Capital Gains education and learning.

Connect with similar individuals who share an enthusiasm for What Assets Are Considered Capital Gains. Our area is a room for educators, parents, and students to trade ideas, seek advice, and commemorate successes in the trip of mastering the alphabet. Join the conversation and be a part of our growing area.

Download What Assets Are Considered Capital Gains

https://www.investopedia.com/terms/c/…

A capital gains tax is a tax imposed on the sale of an asset The long term capital gains tax rates for the 2025 tax year are 0 15 or 20 of the profit depending on the income of the filer

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg?w=186)

https://www.financestrategists.com/.../ca…

Capital gains refer to the profit that comes from selling an asset or an investment for more than the price at which it was originally purchased These gains though initially exciting due to the associated profit bear significant tax

A capital gains tax is a tax imposed on the sale of an asset The long term capital gains tax rates for the 2025 tax year are 0 15 or 20 of the profit depending on the income of the filer

Capital gains refer to the profit that comes from selling an asset or an investment for more than the price at which it was originally purchased These gains though initially exciting due to the associated profit bear significant tax

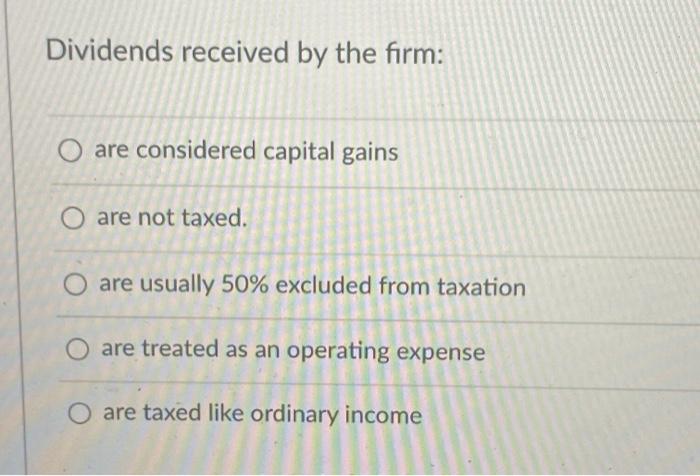

Solved Dividends Received By The Firm O Are Considered Chegg

What Is Asset Meaning Definition Examples Of Assets

How To Disclose Capital Gains In Income Tax Return

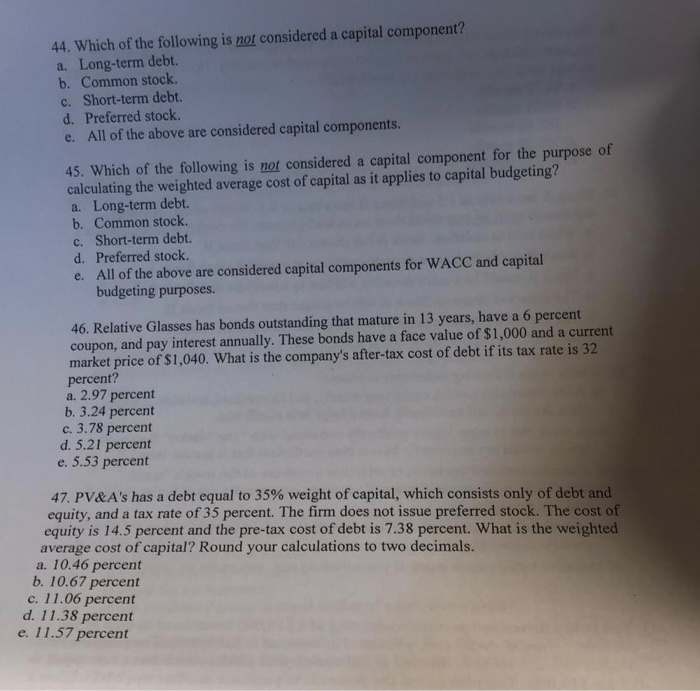

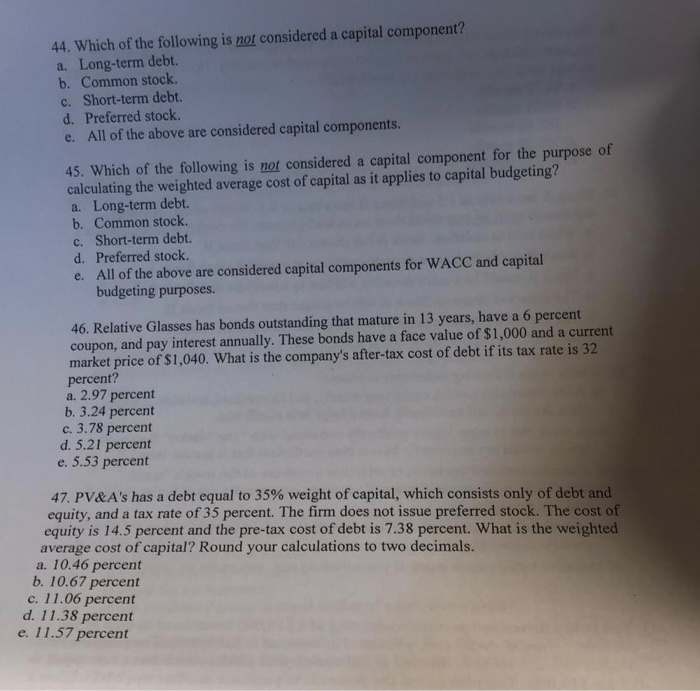

Solved 44 Which Of The Following Is Not Considered A Chegg

List Of Assets Liabilities And Equity With Examples Financial Falconet

Liabilities How To Classify Track And Calculate Liabilities

Liabilities How To Classify Track And Calculate Liabilities

2021 Short Term Capital Gains Tax Rate Cryptocurrency Mining Taxes