Welcome to PrintableAlphabet.net, your go-to resource for all things connected to What Costs Can Be Capitalised For Intangible Assets In this detailed guide, we'll delve into the details of What Costs Can Be Capitalised For Intangible Assets, providing beneficial understandings, engaging tasks, and printable worksheets to boost your knowing experience.

Comprehending What Costs Can Be Capitalised For Intangible Assets

In this area, we'll discover the fundamental principles of What Costs Can Be Capitalised For Intangible Assets. Whether you're a teacher, moms and dad, or learner, acquiring a solid understanding of What Costs Can Be Capitalised For Intangible Assets is essential for successful language acquisition. Anticipate understandings, tips, and real-world applications to make What Costs Can Be Capitalised For Intangible Assets revived.

Capitalize Vs Expense GAAP Accounting Criteria

What Costs Can Be Capitalised For Intangible Assets

The cost of an internally generated intangible asset includes the directly attributable expenditure of preparing the asset for its intended use Expenditure on training activities identified inefficiencies and initial operating

Discover the relevance of understanding What Costs Can Be Capitalised For Intangible Assets in the context of language growth. We'll talk about just how proficiency in What Costs Can Be Capitalised For Intangible Assets lays the structure for improved analysis, composing, and general language abilities. Explore the more comprehensive effect of What Costs Can Be Capitalised For Intangible Assets on reliable interaction.

R D Costs How To Journalize And Record Expenses Thales Learning

R D Costs How To Journalize And Record Expenses Thales Learning

The cost of an internally generated intangible asset includes expenditure incurred from the date all the criteria for recognising the intangible asset are met including

Learning doesn't have to be boring. In this area, find a variety of appealing activities customized to What Costs Can Be Capitalised For Intangible Assets students of every ages. From interactive games to creative workouts, these activities are created to make What Costs Can Be Capitalised For Intangible Assets both fun and instructional.

Tangible Vs Intangible Assets Top 4 Differences with Infographics

Tangible Vs Intangible Assets Top 4 Differences with Infographics

Internal costs to capitalise or not to capitalise Costs with respect to payroll and overheads may be incurred by a business to develop an asset which will be used in future e g agile IT

Accessibility our particularly curated collection of printable worksheets focused on What Costs Can Be Capitalised For Intangible Assets These worksheets accommodate numerous skill levels, making certain a tailored knowing experience. Download and install, print, and take pleasure in hands-on activities that enhance What Costs Can Be Capitalised For Intangible Assets skills in a reliable and delightful way.

The Ultimate Guide To Project Management Resources

The Ultimate Guide To Project Management Resources

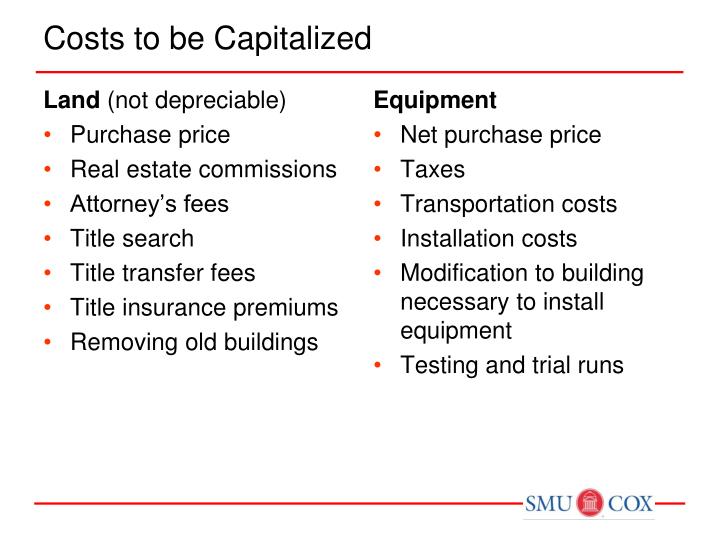

Intangible costs and certain types of labor can be capitalized in addition to fixed tangible assets A company must derive economic benefit from assets beyond the current year and use

Whether you're an educator trying to find efficient methods or a learner looking for self-guided methods, this area supplies practical ideas for understanding What Costs Can Be Capitalised For Intangible Assets. Gain from the experience and insights of teachers who specialize in What Costs Can Be Capitalised For Intangible Assets education and learning.

Get in touch with similar individuals who share an interest for What Costs Can Be Capitalised For Intangible Assets. Our community is a room for educators, parents, and learners to exchange concepts, seek advice, and commemorate successes in the journey of grasping the alphabet. Join the conversation and be a part of our growing neighborhood.

Here are the What Costs Can Be Capitalised For Intangible Assets

:max_bytes(150000):strip_icc()/Capitalizedcost_4-3-v2-b443f3a26548497a9ed4cf7f8aa20367.jpg)

https://kpmg.com › mt › en › home › insig…

The cost of an internally generated intangible asset includes the directly attributable expenditure of preparing the asset for its intended use Expenditure on training activities identified inefficiencies and initial operating

https://ifrscommunity.com › knowledge-base › ...

The cost of an internally generated intangible asset includes expenditure incurred from the date all the criteria for recognising the intangible asset are met including

The cost of an internally generated intangible asset includes the directly attributable expenditure of preparing the asset for its intended use Expenditure on training activities identified inefficiencies and initial operating

The cost of an internally generated intangible asset includes expenditure incurred from the date all the criteria for recognising the intangible asset are met including

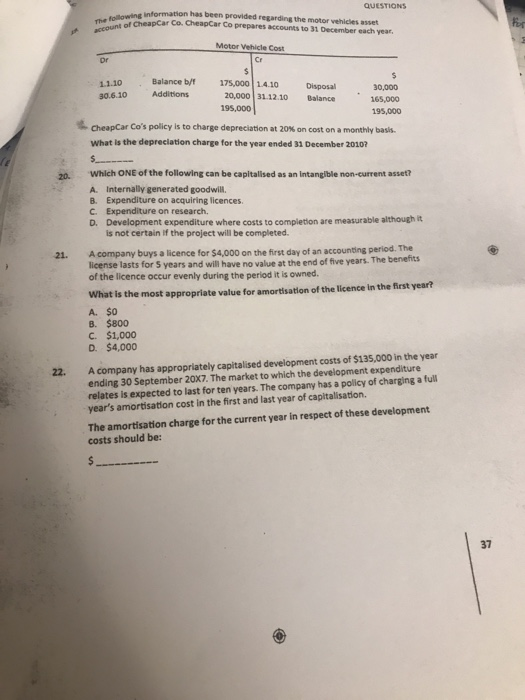

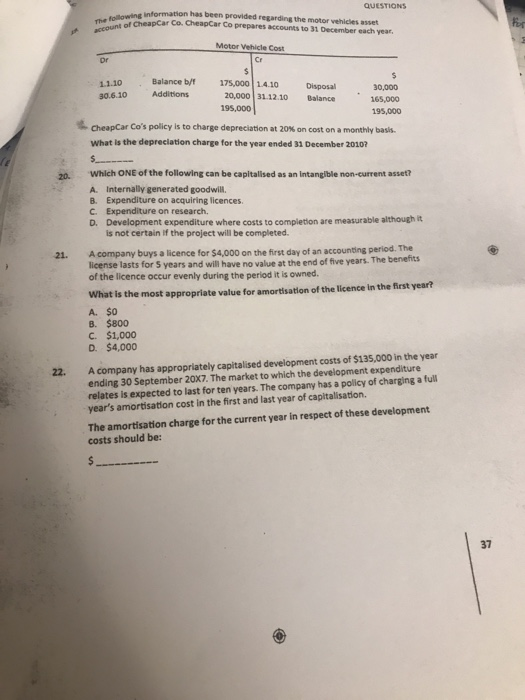

Solved QUESTIONS Information Has Been Provided Regarding The Chegg

Capitalizar Os Custos De Desenvolvimento De Software Ottima

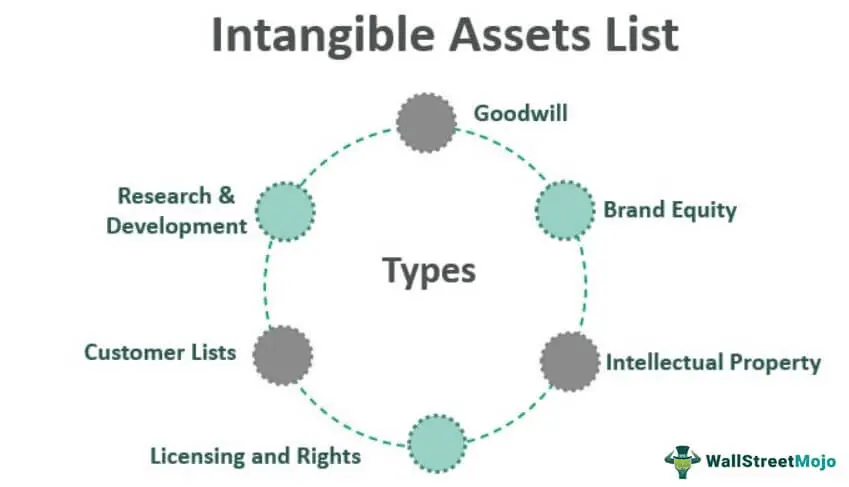

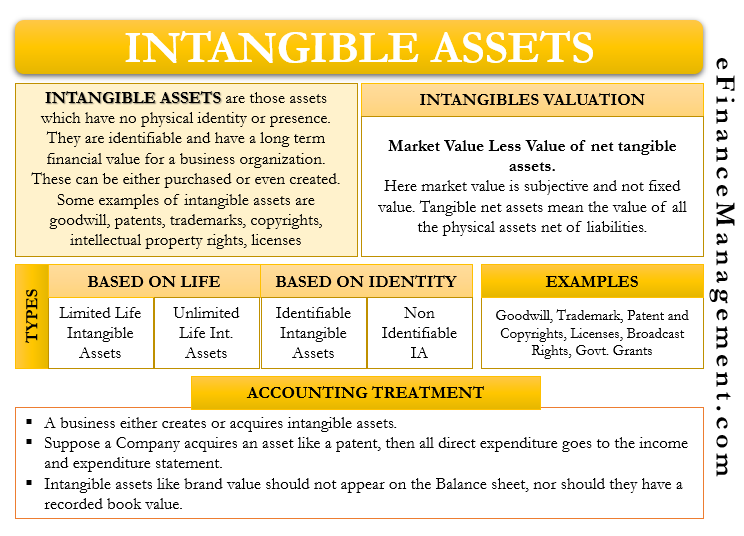

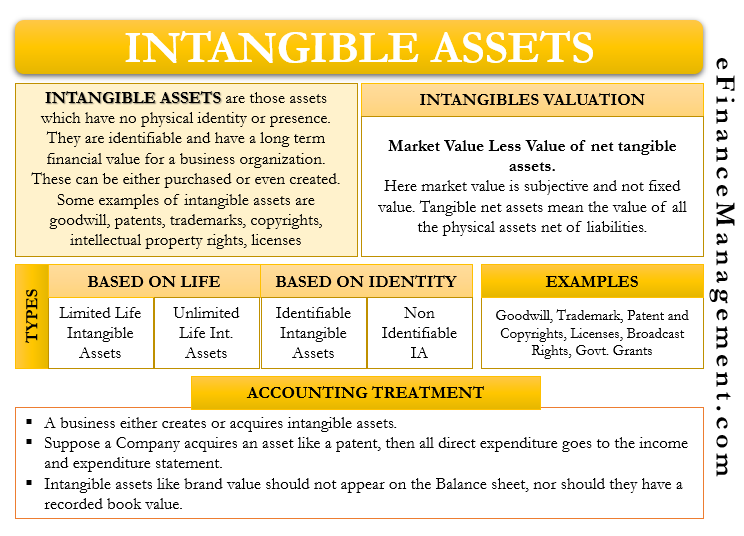

Intangible Assets Meaning Valuation Categories Example Accounting

How To Account For Intangible Assets Under IAS 38 CPDbox Making

Powers Of Attorney When To Capitalize

Are Intangible Assets Capitalized Or Expensed Universal CPA Review

Are Intangible Assets Capitalized Or Expensed Universal CPA Review

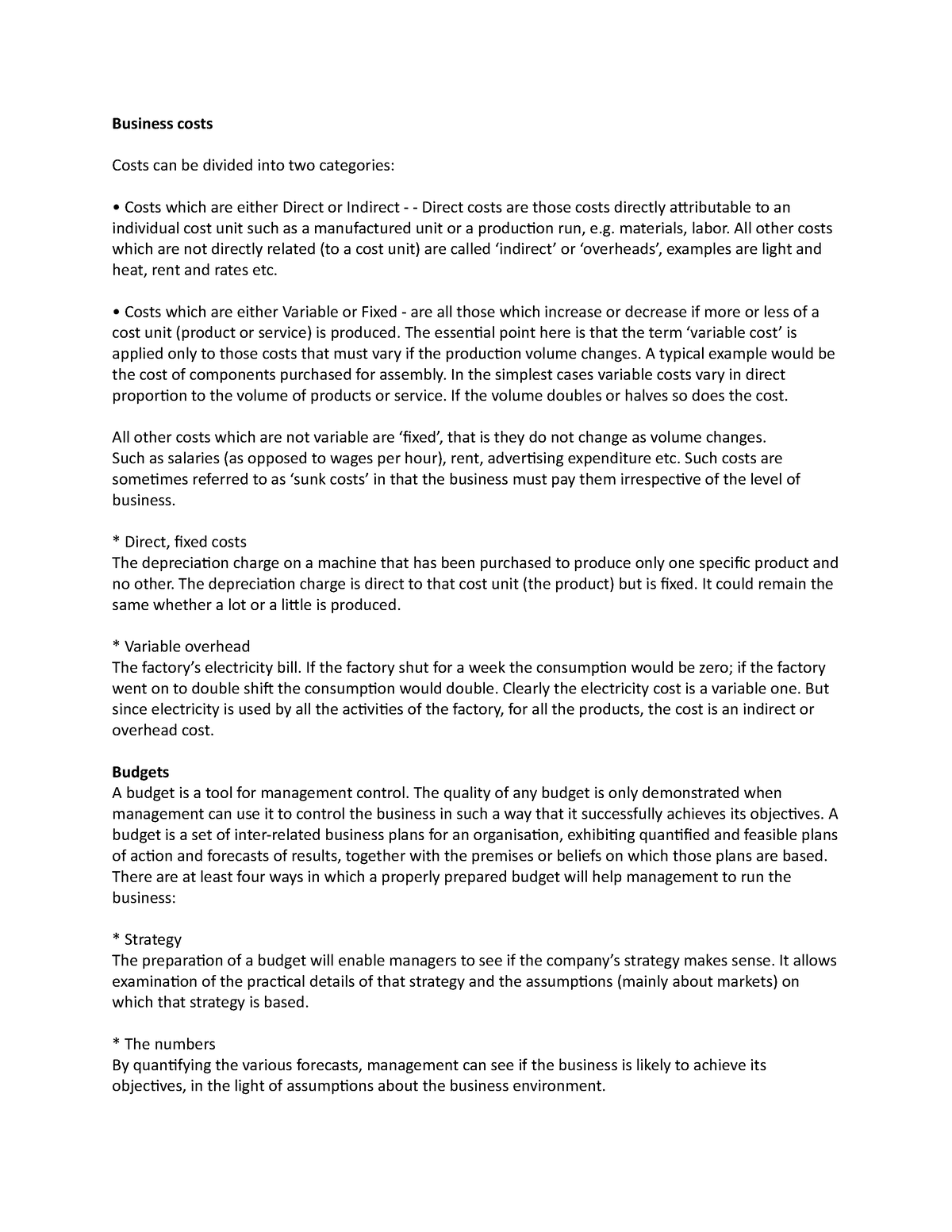

Export Finance Business Costs Costs Can Be Divided Into Two