Welcome to PrintableAlphabet.net, your best source for all things related to What Do Write Offs Mean In this detailed guide, we'll delve into the intricacies of What Do Write Offs Mean, providing useful understandings, engaging tasks, and printable worksheets to enhance your discovering experience.

Comprehending What Do Write Offs Mean

In this area, we'll explore the essential concepts of What Do Write Offs Mean. Whether you're an instructor, moms and dad, or learner, acquiring a solid understanding of What Do Write Offs Mean is vital for effective language purchase. Anticipate insights, ideas, and real-world applications to make What Do Write Offs Mean revived.

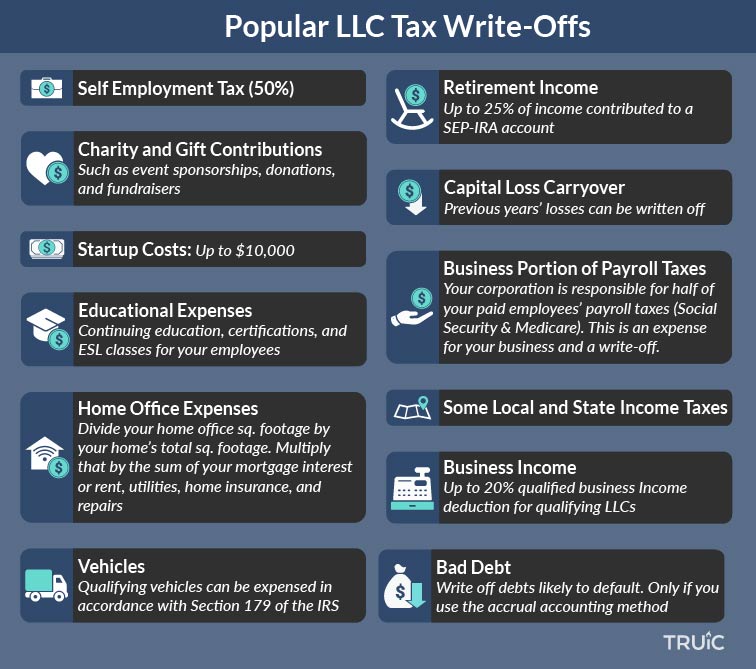

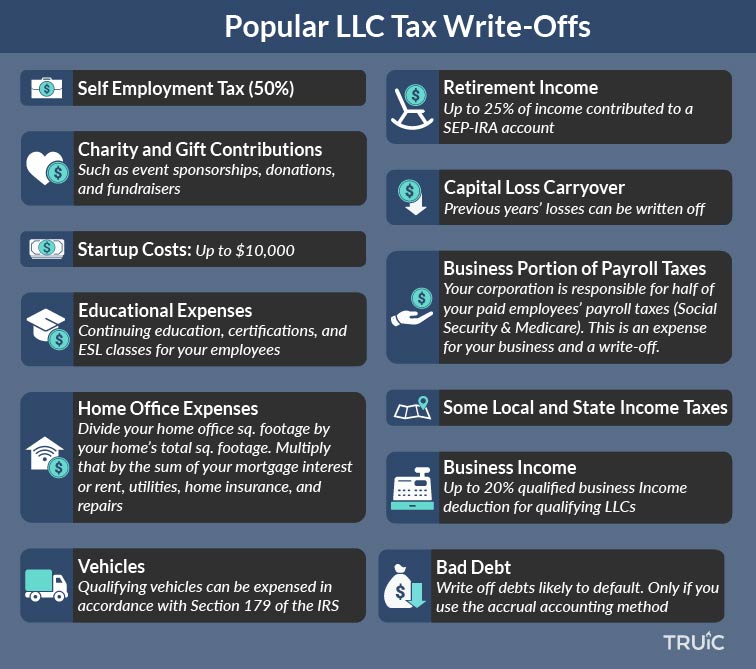

Tax Write offs For LLCs Maximize Deductions TRUiC

What Do Write Offs Mean

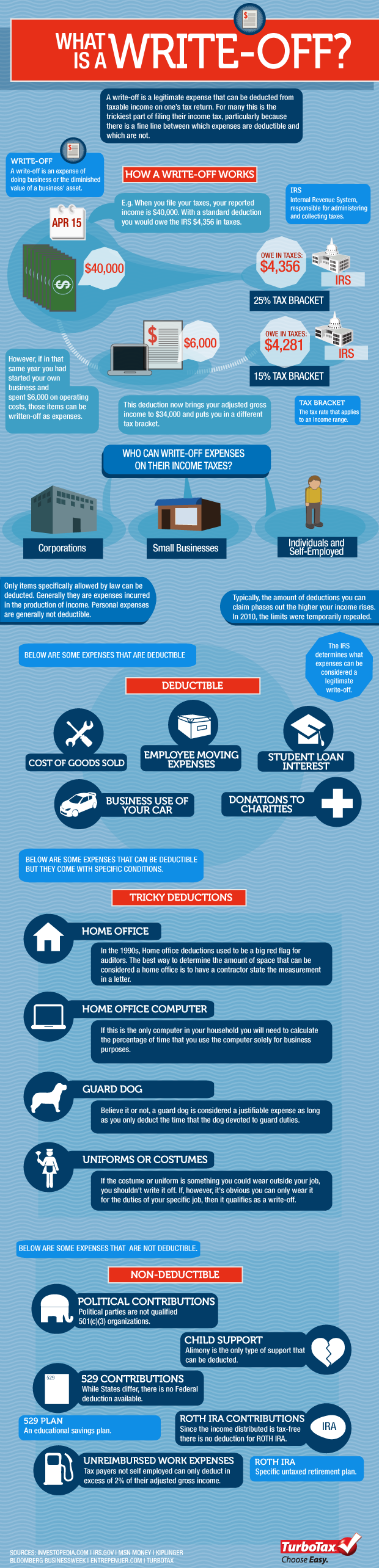

A tax write off is a business expense that can be claimed as a tax deduction on a federal income tax return lowering the amount the business will be assessed for taxes Tax write offs are deducted from total revenue to determine total taxable income for a small business

Discover the importance of mastering What Do Write Offs Mean in the context of language development. We'll review how proficiency in What Do Write Offs Mean lays the foundation for better reading, writing, and total language skills. Discover the broader effect of What Do Write Offs Mean on reliable communication.

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

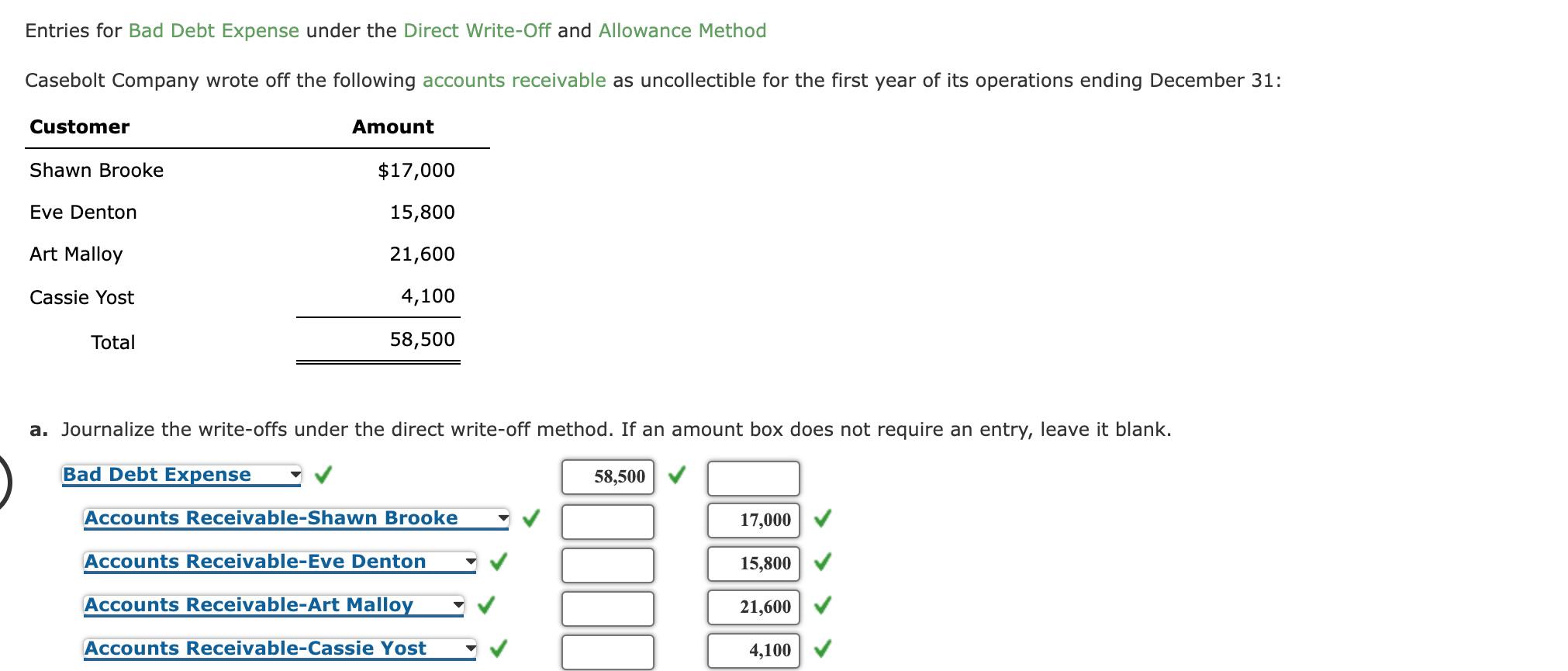

A write off is a business accounting expense that is reported for unreceived payments or losses from assets Here s how and when write offs are commonly done

Discovering does not have to be plain. In this area, locate a range of interesting activities tailored to What Do Write Offs Mean learners of all ages. From interactive games to innovative workouts, these activities are developed to make What Do Write Offs Mean both fun and academic.

How Do You Write Off Fuel On Your Taxes Leia Aqui Is It Better To

How Do You Write Off Fuel On Your Taxes Leia Aqui Is It Better To

The write Off is a tax deductible operating expense Expenses are everything that is purchased as part of running a business for profit The cost of these items is deducted from your income to reduce your total taxable income According to the IRS examples of Write Off include vehicle costs and rent or

Accessibility our specially curated collection of printable worksheets focused on What Do Write Offs Mean These worksheets deal with various ability levels, ensuring a customized discovering experience. Download, print, and enjoy hands-on tasks that reinforce What Do Write Offs Mean skills in an effective and delightful way.

The Deductions You Can Claim Hra Tax Vrogue

The Deductions You Can Claim Hra Tax Vrogue

What are tax write offs in a nutshell In a nutshell a tax write off is a legitimate expense that lowers your taxable income on your tax return A tax write off is commonly referred to as a tax deduction

Whether you're a teacher seeking effective techniques or a learner looking for self-guided approaches, this area offers sensible tips for understanding What Do Write Offs Mean. Take advantage of the experience and insights of teachers who concentrate on What Do Write Offs Mean education.

Get in touch with like-minded individuals who share an enthusiasm for What Do Write Offs Mean. Our community is a space for educators, parents, and students to exchange concepts, consult, and celebrate successes in the journey of mastering the alphabet. Join the discussion and be a part of our expanding neighborhood.

Download More What Do Write Offs Mean

:max_bytes(150000):strip_icc()/write-off-4186686-FINAL-2-7eaa5af39eec457e898ccf77a0f6a4b9.png)

https://www.freshbooks.com/hub/accounting/write-offs

A tax write off is a business expense that can be claimed as a tax deduction on a federal income tax return lowering the amount the business will be assessed for taxes Tax write offs are deducted from total revenue to determine total taxable income for a small business

https://smartasset.com/taxes/what-is-a-write-off

A write off is a business accounting expense that is reported for unreceived payments or losses from assets Here s how and when write offs are commonly done

A tax write off is a business expense that can be claimed as a tax deduction on a federal income tax return lowering the amount the business will be assessed for taxes Tax write offs are deducted from total revenue to determine total taxable income for a small business

A write off is a business accounting expense that is reported for unreceived payments or losses from assets Here s how and when write offs are commonly done

Solved B Journalize The Write offs Under The Allowance Chegg

A Day In The Life Of A Midwife Socialist Party

Trade Off Definition In Economics DEFINITION KLW

7 Insanely Awesome Write Offs That Solopreneurs Need To Know

Tax Deductions Write Offs To Save You Money Financial Gym

Tax Write Offs For Self Employed Hairstylists ShearShare The 1

Tax Write Offs For Self Employed Hairstylists ShearShare The 1

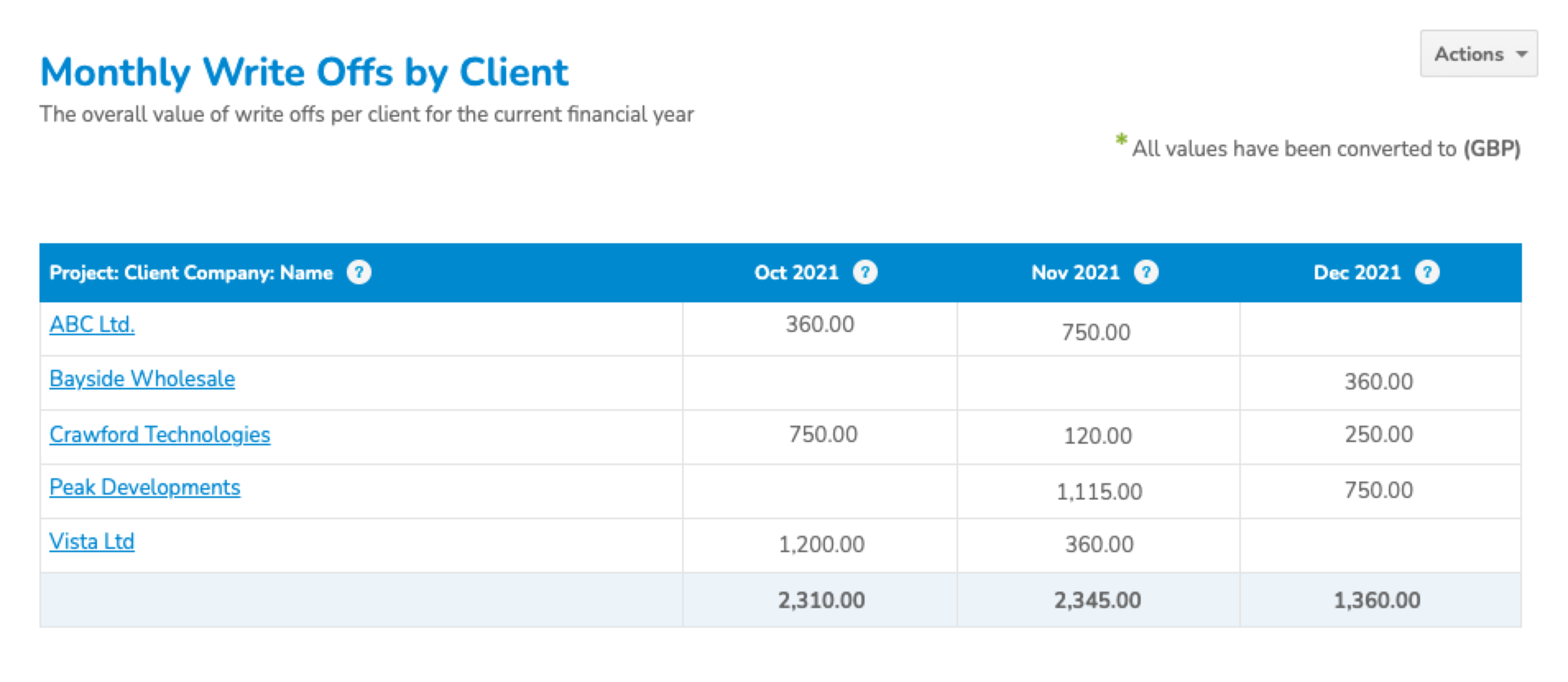

Reporting On Write Offs Learning Center