Welcome to PrintableAlphabet.net, your go-to source for all things associated with What Does Disregarded For Tax Purposes Mean In this comprehensive guide, we'll delve into the details of What Does Disregarded For Tax Purposes Mean, offering useful understandings, involving activities, and printable worksheets to boost your knowing experience.

Recognizing What Does Disregarded For Tax Purposes Mean

In this section, we'll check out the essential ideas of What Does Disregarded For Tax Purposes Mean. Whether you're an educator, parent, or student, gaining a strong understanding of What Does Disregarded For Tax Purposes Mean is essential for successful language procurement. Anticipate insights, pointers, and real-world applications to make What Does Disregarded For Tax Purposes Mean revived.

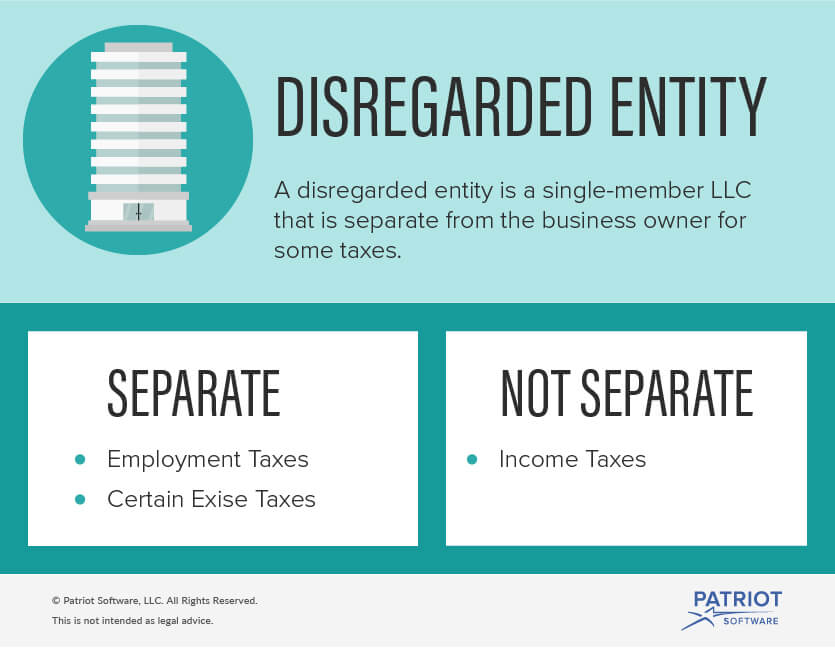

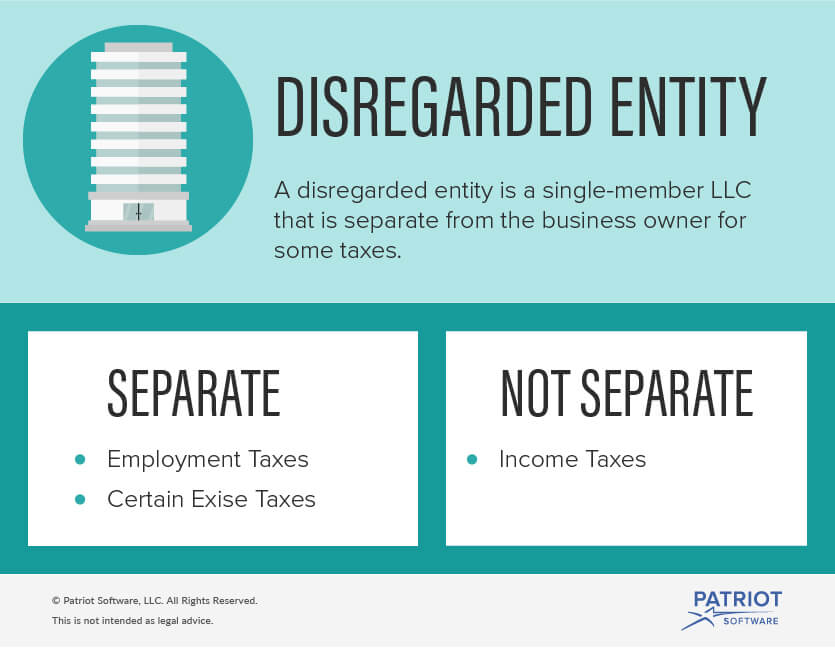

What Is A Disregarded Entity Pros And Cons For Tax Purposes

What Does Disregarded For Tax Purposes Mean

A disregarded entity is a business that elects not to be separate from its owner for tax purposes Learn about related tax and liability issues

Discover the relevance of mastering What Does Disregarded For Tax Purposes Mean in the context of language development. We'll talk about how efficiency in What Does Disregarded For Tax Purposes Mean lays the foundation for better reading, creating, and overall language abilities. Discover the more comprehensive effect of What Does Disregarded For Tax Purposes Mean on efficient interaction.

What Does The Disregarded Entity Means In Business

What Does The Disregarded Entity Means In Business

A disregarded entity is a business that s not separate from its owner for federal tax purposes the owner reports and pays the business portion of income and taxes on their tax

Discovering doesn't have to be plain. In this section, find a variety of interesting activities customized to What Does Disregarded For Tax Purposes Mean learners of every ages. From interactive video games to innovative workouts, these tasks are created to make What Does Disregarded For Tax Purposes Mean both enjoyable and educational.

Why Is A Single Member LLC Sometimes Called A Disregarded Entity What

Why Is A Single Member LLC Sometimes Called A Disregarded Entity What

A disregarded entity DE is one that is separate or distinct from the business owner but for federal tax purposes that entity is disregarded as a separate entity from the business owner by the Internal Revenue Service

Access our specially curated collection of printable worksheets concentrated on What Does Disregarded For Tax Purposes Mean These worksheets deal with various skill levels, making sure a personalized knowing experience. Download and install, print, and enjoy hands-on tasks that enhance What Does Disregarded For Tax Purposes Mean abilities in an effective and enjoyable method.

What Does Medical History Disregarded Mean

What Does Medical History Disregarded Mean

A disregarded entity is a legal entity that s ignored for income tax purposes It s a separate entity from its owner unlike a sole proprietorship

Whether you're an instructor trying to find efficient approaches or a learner seeking self-guided strategies, this section offers functional suggestions for grasping What Does Disregarded For Tax Purposes Mean. Gain from the experience and understandings of teachers who focus on What Does Disregarded For Tax Purposes Mean education.

Connect with like-minded people who share an enthusiasm for What Does Disregarded For Tax Purposes Mean. Our neighborhood is an area for educators, moms and dads, and students to exchange concepts, seek advice, and celebrate successes in the journey of mastering the alphabet. Sign up with the discussion and belong of our expanding area.

Get More What Does Disregarded For Tax Purposes Mean

https://www.thebalancemoney.com/disr…

A disregarded entity is a business that elects not to be separate from its owner for tax purposes Learn about related tax and liability issues

https://fitsmallbusiness.com/what-is-disregarded-entity

A disregarded entity is a business that s not separate from its owner for federal tax purposes the owner reports and pays the business portion of income and taxes on their tax

A disregarded entity is a business that elects not to be separate from its owner for tax purposes Learn about related tax and liability issues

A disregarded entity is a business that s not separate from its owner for federal tax purposes the owner reports and pays the business portion of income and taxes on their tax

What Is A Disregarded Entity LLC Pros Cons SimplifyLLC

What Is A Disregarded Entity Pros And Cons For Tax Purposes

What Is A Disregarded Entity Pros And Cons For Tax Purposes

What You Need To Know About Single LLC Taxes And A Disregarded Entity

Structuring A Business What Is A Disregarded Entity Camino Financial

What Is A Disregarded Entity Single member LLC

What Is A Disregarded Entity Single member LLC

Business Tax Id Form So Adding A Disregarded Entity What Is An