Welcome to PrintableAlphabet.net, your go-to resource for all points associated with What Does Standard Deduction Mean In Business In this comprehensive overview, we'll delve into the intricacies of What Does Standard Deduction Mean In Business, supplying important understandings, involving tasks, and printable worksheets to boost your discovering experience.

Comprehending What Does Standard Deduction Mean In Business

In this section, we'll explore the basic principles of What Does Standard Deduction Mean In Business. Whether you're a teacher, parent, or learner, getting a strong understanding of What Does Standard Deduction Mean In Business is essential for effective language procurement. Anticipate insights, ideas, and real-world applications to make What Does Standard Deduction Mean In Business revived.

Deductions Under Chapter VIA

What Does Standard Deduction Mean In Business

A deduction allows a taxpayer to reduce their total taxable income You can either itemize deductions or take a large single deduction known as the standard deduction

Discover the significance of grasping What Does Standard Deduction Mean In Business in the context of language development. We'll review exactly how efficiency in What Does Standard Deduction Mean In Business lays the foundation for improved analysis, composing, and general language skills. Explore the wider effect of What Does Standard Deduction Mean In Business on reliable communication.

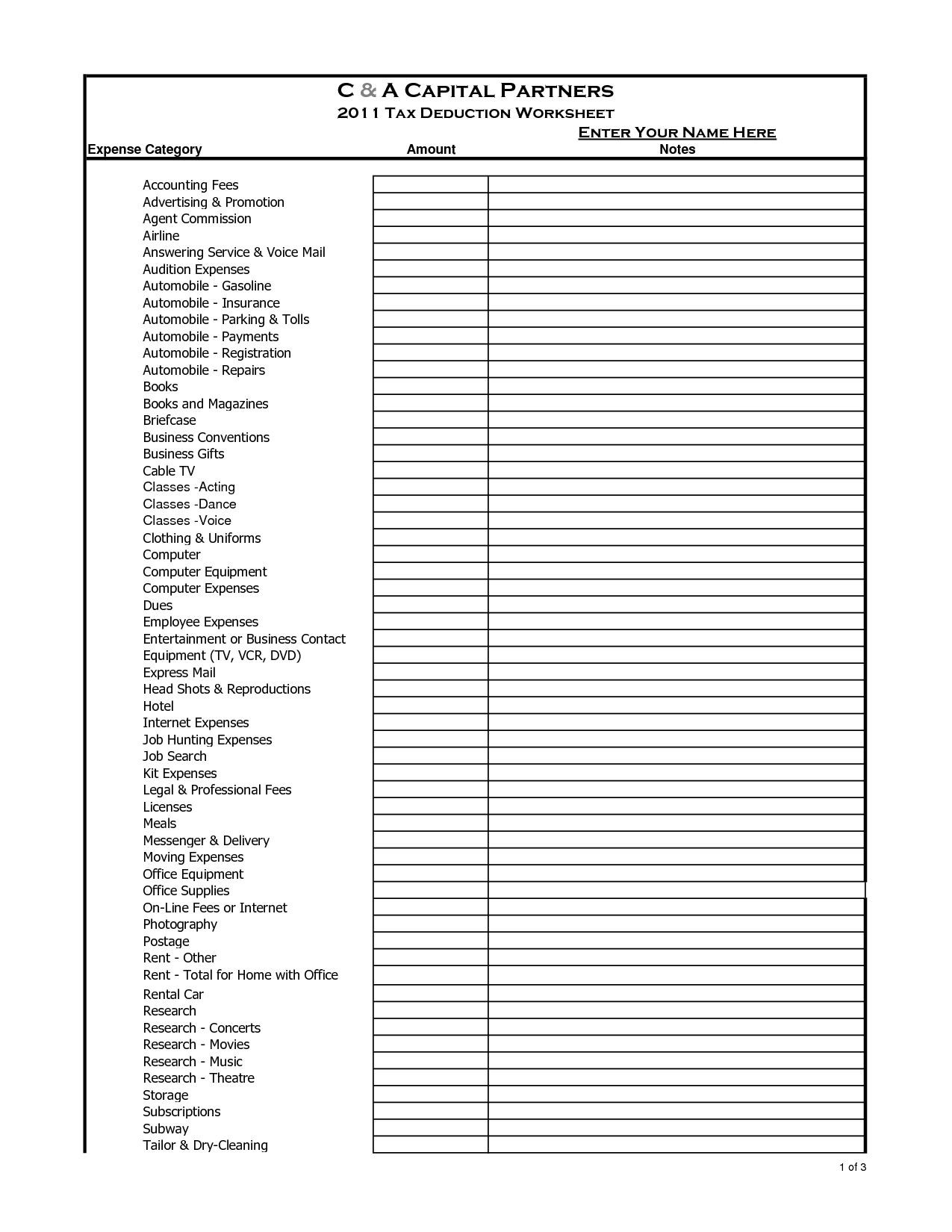

13 Car Expenses Worksheet Worksheeto

13 Car Expenses Worksheet Worksheeto

The standard deduction is a fixed number that taxpayers can deduct from their taxable income and they have a choice each year between taking that standard deduction or taking the sum of all of their eligible deductions called itemizing

Discovering doesn't have to be boring. In this section, locate a selection of appealing tasks tailored to What Does Standard Deduction Mean In Business students of all ages. From interactive video games to creative workouts, these activities are developed to make What Does Standard Deduction Mean In Business both fun and academic.

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

The Standard Deduction lets you reduce your taxable income by a fixed amount making tax filing simpler since you don t need to itemize deductions Each year the Standard Deduction amount typically goes up to

Access our specifically curated collection of printable worksheets concentrated on What Does Standard Deduction Mean In Business These worksheets deal with numerous ability levels, ensuring a customized discovering experience. Download, print, and delight in hands-on tasks that reinforce What Does Standard Deduction Mean In Business abilities in a reliable and pleasurable means.

Itemized Vs Standard Tax Deductions Pros And Cons 2023

Itemized Vs Standard Tax Deductions Pros And Cons 2023

The standard deduction is a flat amount that reduces your taxable income and potentially your tax bill The amount set by the IRS could vary by tax year and filing

Whether you're an instructor seeking effective strategies or a learner looking for self-guided approaches, this section uses practical tips for understanding What Does Standard Deduction Mean In Business. Benefit from the experience and understandings of teachers who concentrate on What Does Standard Deduction Mean In Business education.

Get in touch with like-minded individuals that share an interest for What Does Standard Deduction Mean In Business. Our area is a room for teachers, parents, and learners to trade concepts, inquire, and celebrate successes in the trip of understanding the alphabet. Join the conversation and be a part of our expanding community.

Get More What Does Standard Deduction Mean In Business

https://www.investopedia.com › terms …

A deduction allows a taxpayer to reduce their total taxable income You can either itemize deductions or take a large single deduction known as the standard deduction

https://www.bench.co › blog › tax-tips › s…

The standard deduction is a fixed number that taxpayers can deduct from their taxable income and they have a choice each year between taking that standard deduction or taking the sum of all of their eligible deductions called itemizing

A deduction allows a taxpayer to reduce their total taxable income You can either itemize deductions or take a large single deduction known as the standard deduction

The standard deduction is a fixed number that taxpayers can deduct from their taxable income and they have a choice each year between taking that standard deduction or taking the sum of all of their eligible deductions called itemizing

What Is The Standard Deduction And How Does It Work Borshoff Consulting

What Does Tax Deductible Mean And How Do Deductions Work

Standard Deduction In Income Tax 2023 Examples InstaFiling

What Does The Super Deduction Mean For My Business Omer Compan

Disk U e Zvuk Schedule 1 Kuhinja Rezidencija Ekspertiza

The Standard Deduction What You Need To Know Thesharpener

The Standard Deduction What You Need To Know Thesharpener

What Is Mean And Standard Deviation In Image Processing Icsid