Welcome to PrintableAlphabet.net, your best source for all points connected to What Is Considered Office Equipment For Taxes In this comprehensive overview, we'll look into the complexities of What Is Considered Office Equipment For Taxes, supplying beneficial understandings, engaging tasks, and printable worksheets to boost your understanding experience.

Recognizing What Is Considered Office Equipment For Taxes

In this section, we'll discover the essential ideas of What Is Considered Office Equipment For Taxes. Whether you're a teacher, parent, or learner, getting a strong understanding of What Is Considered Office Equipment For Taxes is essential for successful language procurement. Anticipate understandings, suggestions, and real-world applications to make What Is Considered Office Equipment For Taxes come to life.

Meet Our Team Total Office Office Supplies Business Solutions

What Is Considered Office Equipment For Taxes

As far as the IRS is concerned office supplies are the tangible items you use and regularly replenish to conduct business in your office including pens paper and printer toner

Discover the value of understanding What Is Considered Office Equipment For Taxes in the context of language advancement. We'll talk about exactly how proficiency in What Is Considered Office Equipment For Taxes lays the structure for better reading, composing, and general language abilities. Explore the broader impact of What Is Considered Office Equipment For Taxes on efficient communication.

What Is Considered Office Equipment Bexlondon

What Is Considered Office Equipment Bexlondon

You can deduct office supplies or equipment on your business tax return if you are able to show that they are ordinary and necessary business expenses not personal

Understanding doesn't need to be dull. In this section, discover a range of interesting activities tailored to What Is Considered Office Equipment For Taxes students of all ages. From interactive video games to innovative exercises, these tasks are designed to make What Is Considered Office Equipment For Taxes both fun and instructional.

Are Businesses Responsible For PAT Testing Of Office Equipment For Home

Are Businesses Responsible For PAT Testing Of Office Equipment For Home

Is a calculator considered office supplies or office equipment Let s take a look at all three business expense categories and how to classify them properly

Access our specially curated collection of printable worksheets focused on What Is Considered Office Equipment For Taxes These worksheets cater to various ability degrees, making sure a customized knowing experience. Download, print, and appreciate hands-on tasks that enhance What Is Considered Office Equipment For Taxes skills in an efficient and enjoyable way.

A Guide To Buying Business Equipment Custom Printing Deals

A Guide To Buying Business Equipment Custom Printing Deals

This article is a general overview not tax or legal advice Get help from a tax professional for depreciating equipment or reporting capital gains taxes Learn about business

Whether you're a teacher trying to find reliable methods or a learner looking for self-guided methods, this area offers sensible pointers for understanding What Is Considered Office Equipment For Taxes. Benefit from the experience and insights of teachers who specialize in What Is Considered Office Equipment For Taxes education and learning.

Get in touch with like-minded individuals that share a passion for What Is Considered Office Equipment For Taxes. Our neighborhood is a room for educators, parents, and students to exchange concepts, seek advice, and celebrate successes in the journey of understanding the alphabet. Join the conversation and belong of our growing neighborhood.

Get More What Is Considered Office Equipment For Taxes

https://www.quill.com/blog/office-expenses-vs-supplies

As far as the IRS is concerned office supplies are the tangible items you use and regularly replenish to conduct business in your office including pens paper and printer toner

https://www.thebalancemoney.com/office-expenses-supplies-taxes-398957

You can deduct office supplies or equipment on your business tax return if you are able to show that they are ordinary and necessary business expenses not personal

As far as the IRS is concerned office supplies are the tangible items you use and regularly replenish to conduct business in your office including pens paper and printer toner

You can deduct office supplies or equipment on your business tax return if you are able to show that they are ordinary and necessary business expenses not personal

Should You Buy Or Lease Office Equipment The Pros And Cons

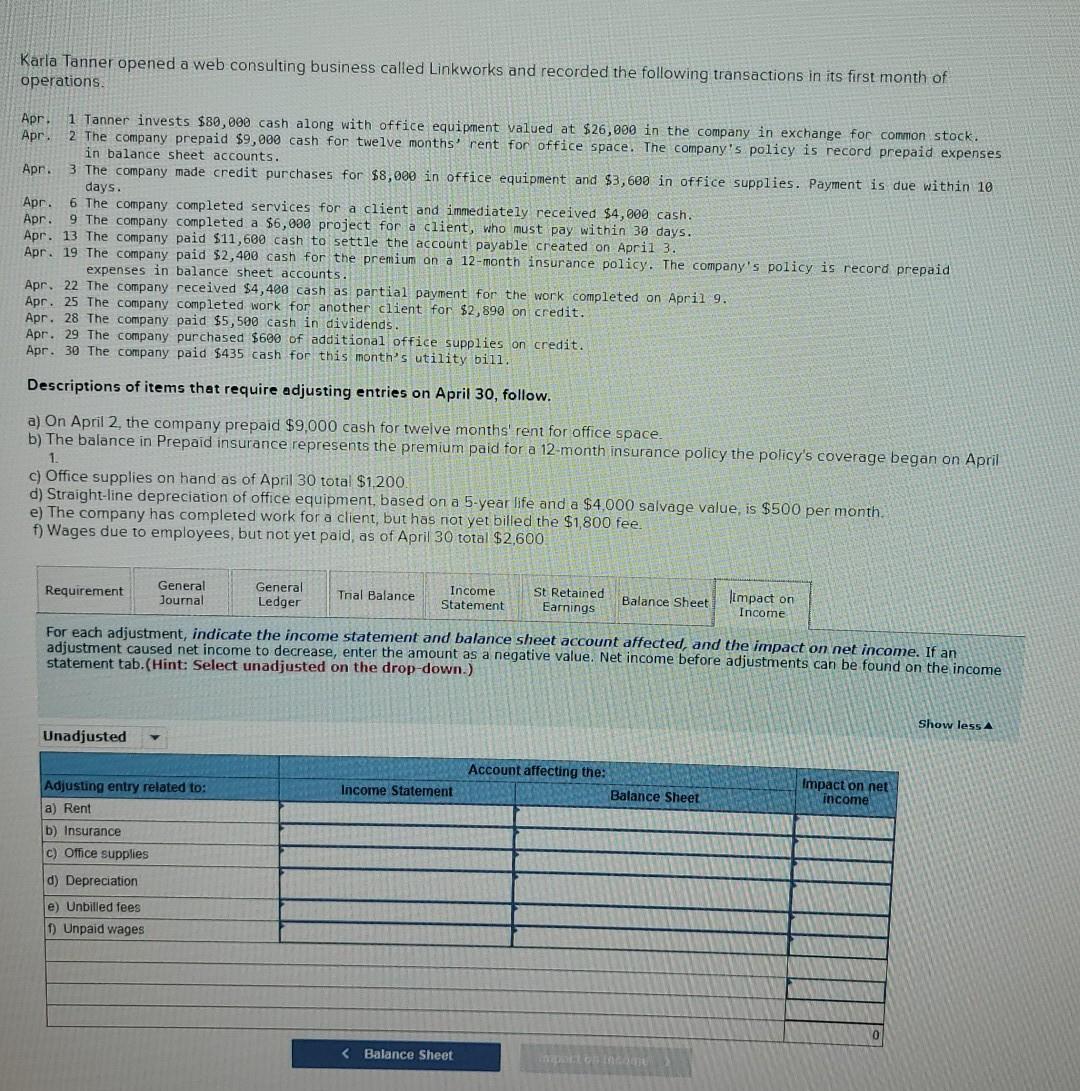

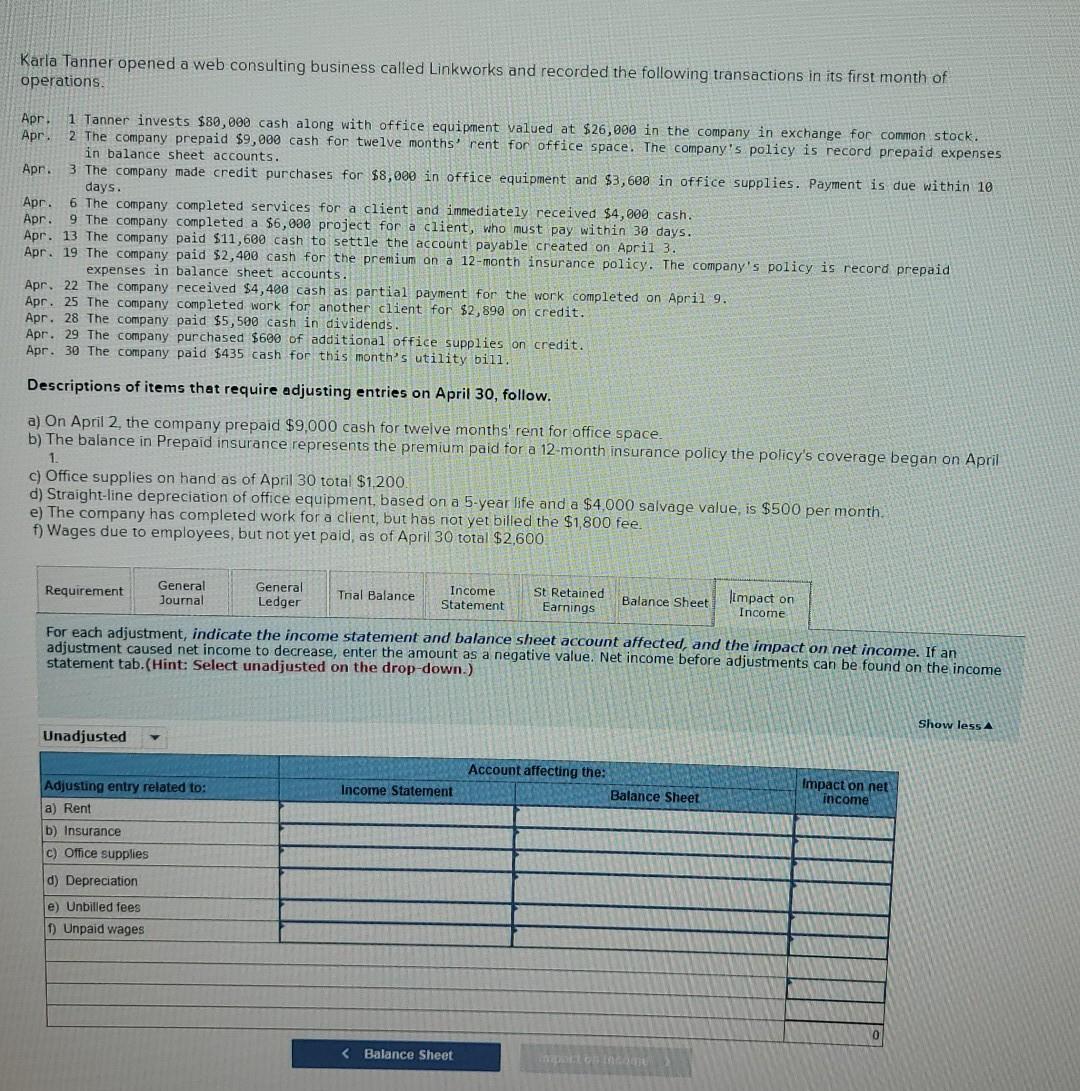

Solved Apr 1 Tanner Invests 80 000 Cash Along With Office Chegg

Assets In Accounting Identification Types And Learning Free Nude Porn

Selecting The Right Office Equipment For Your Law Firm Bizcopier

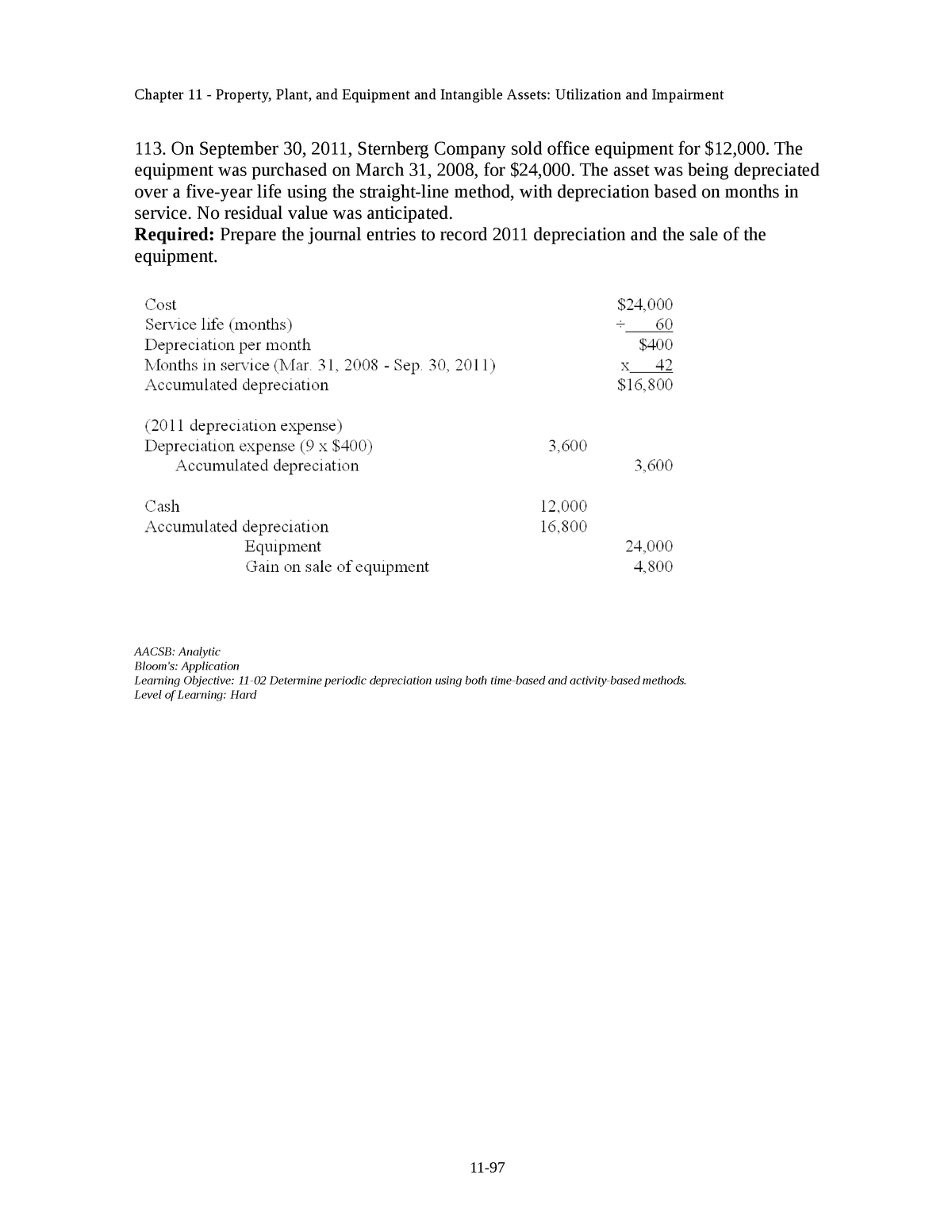

Intangible Assets 5 Notes On September 30 2011 Sternberg Company

What Is A Good VantageScore Credello

What Is A Good VantageScore Credello

Office Equipment A Perfect Resource For Better Working By Office