Welcome to PrintableAlphabet.net, your go-to source for all things connected to What Is Depreciated Replacement Cost Method Of Valuation In this thorough overview, we'll look into the intricacies of What Is Depreciated Replacement Cost Method Of Valuation, offering useful insights, engaging tasks, and printable worksheets to boost your knowing experience.

Comprehending What Is Depreciated Replacement Cost Method Of Valuation

In this area, we'll explore the fundamental concepts of What Is Depreciated Replacement Cost Method Of Valuation. Whether you're a teacher, moms and dad, or student, obtaining a solid understanding of What Is Depreciated Replacement Cost Method Of Valuation is important for successful language acquisition. Expect understandings, ideas, and real-world applications to make What Is Depreciated Replacement Cost Method Of Valuation come to life.

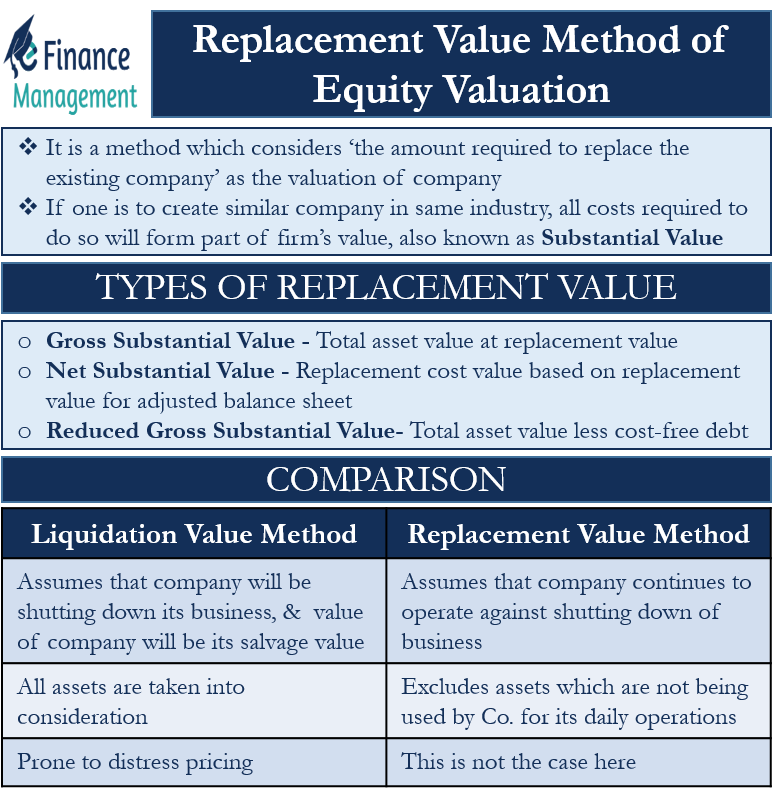

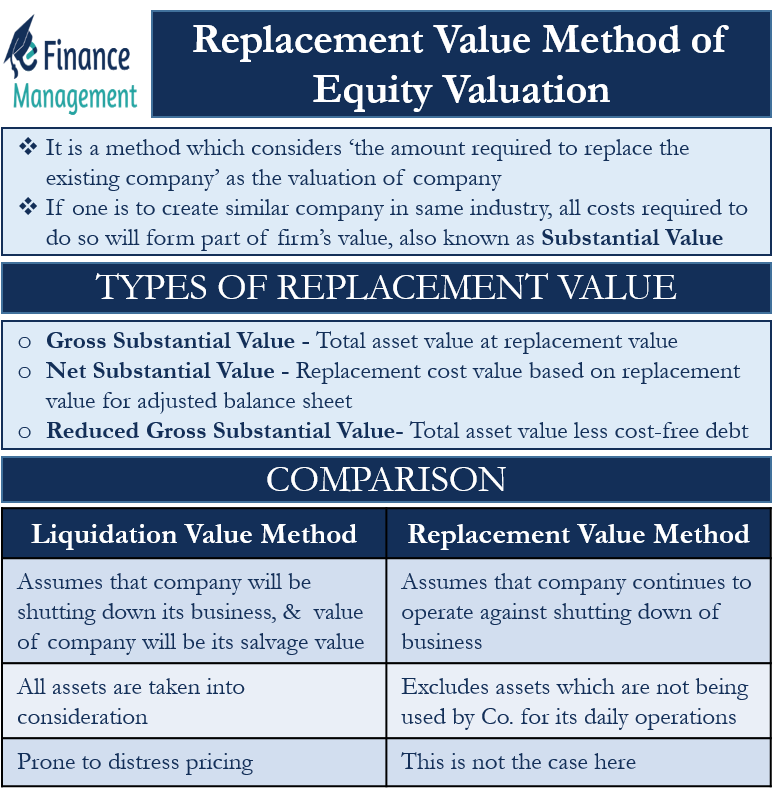

Replacement Value Method Of Equity Valuation Formula Calculation

What Is Depreciated Replacement Cost Method Of Valuation

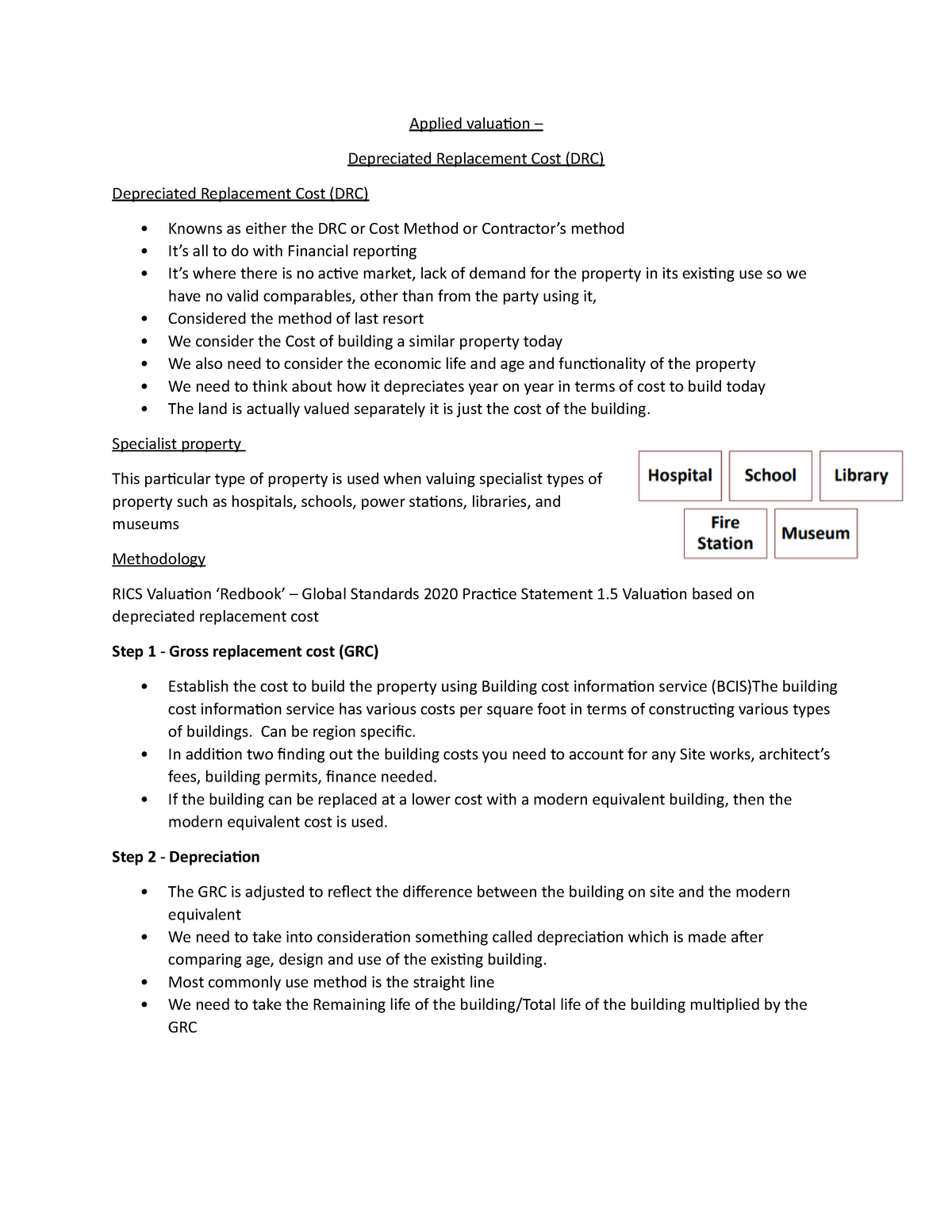

Depreciated replacement cost method of valuation for financial reporting RICS guidance note 1st edition November 2018 Published by the Royal Institution of Chartered

Discover the value of understanding What Is Depreciated Replacement Cost Method Of Valuation in the context of language development. We'll talk about how proficiency in What Is Depreciated Replacement Cost Method Of Valuation lays the structure for better analysis, writing, and general language abilities. Check out the wider effect of What Is Depreciated Replacement Cost Method Of Valuation on efficient interaction.

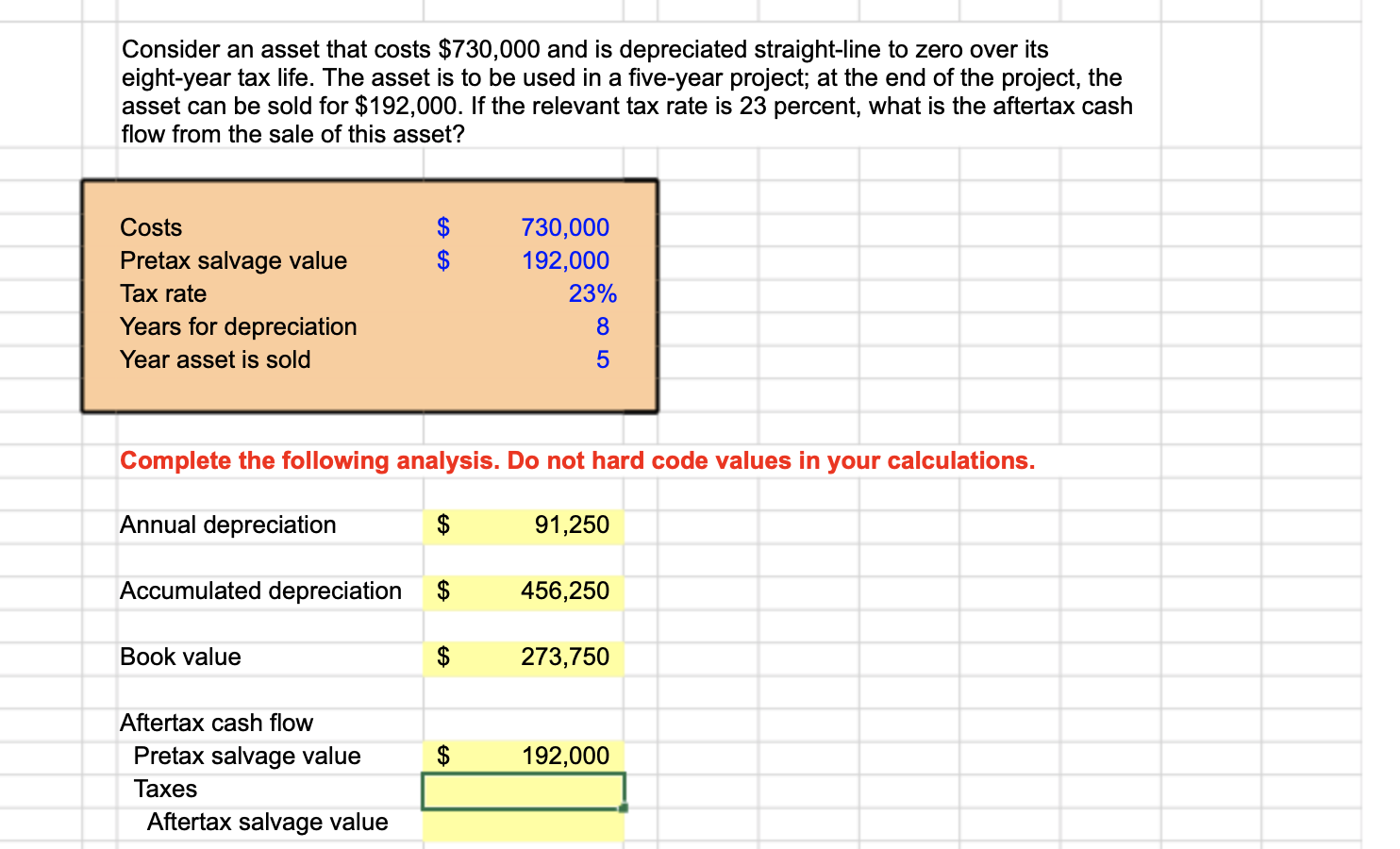

Consider An Asset That Costs 715 000 And Is Depreciated Straight line

Consider An Asset That Costs 715 000 And Is Depreciated Straight line

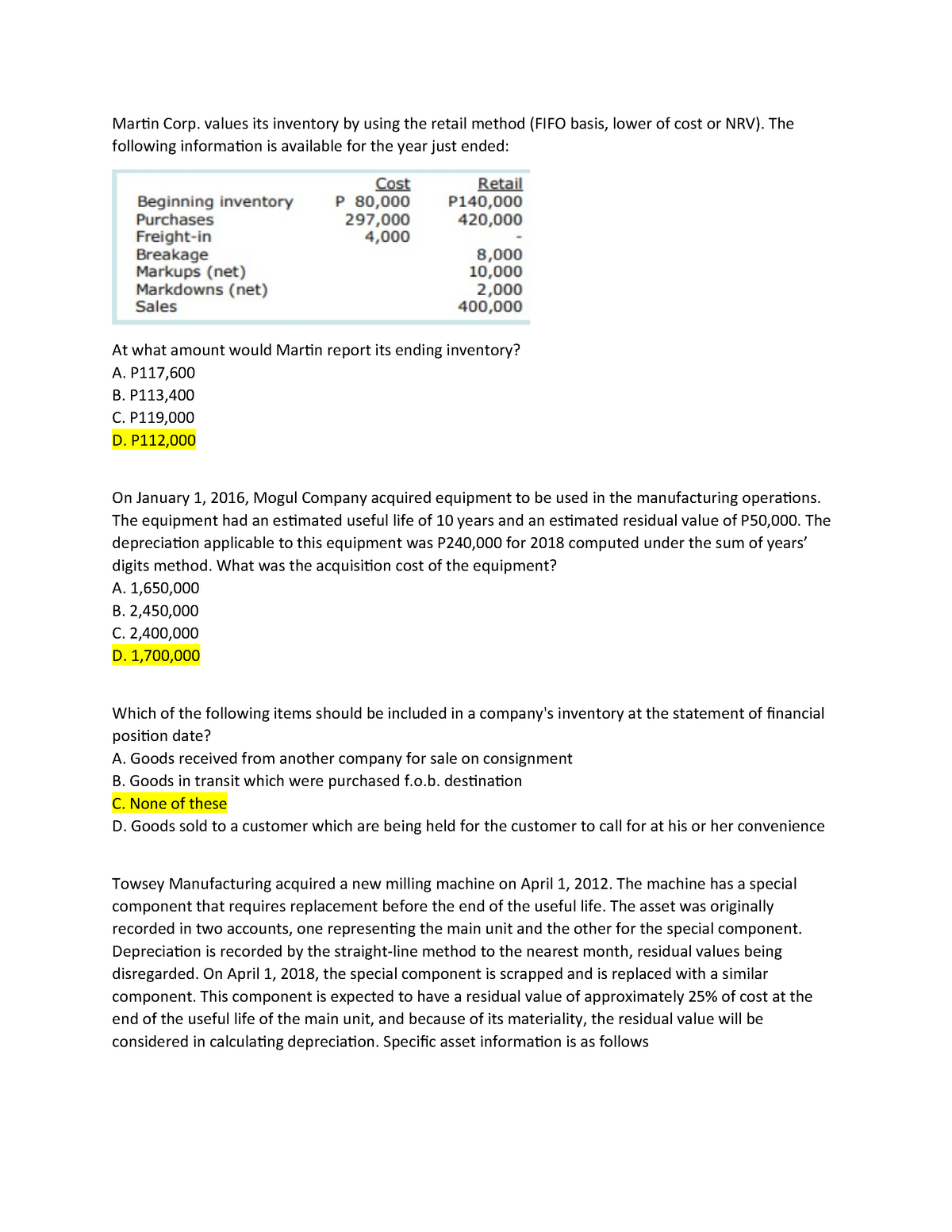

Depreciated Replacement Cost 120 000 120 000 60 48 000 We have to deduct 60 from the market price as the current truck is already depreciated for 60 The

Understanding doesn't have to be boring. In this area, find a range of interesting activities customized to What Is Depreciated Replacement Cost Method Of Valuation learners of any ages. From interactive games to innovative exercises, these activities are created to make What Is Depreciated Replacement Cost Method Of Valuation both enjoyable and instructional.

How To Calculate Notional Depreciation Haiper

How To Calculate Notional Depreciation Haiper

2035 July 27 2020 Depreciated Replacement Cost The depreciated replacement cost of an asset is the current replacement cost of the asset less accumulated depreciation

Accessibility our specifically curated collection of printable worksheets concentrated on What Is Depreciated Replacement Cost Method Of Valuation These worksheets cater to various ability degrees, ensuring a customized discovering experience. Download and install, print, and take pleasure in hands-on tasks that reinforce What Is Depreciated Replacement Cost Method Of Valuation abilities in a reliable and pleasurable means.

Get Answer Transcribed Image Text Consider An Asset That Costs

Get Answer Transcribed Image Text Consider An Asset That Costs

Depreciated Replacement Cost DRC is a method of valuing an asset typically a building or equipment which takes into account the asset s depreciation

Whether you're an instructor searching for efficient strategies or a learner seeking self-guided methods, this area supplies sensible pointers for mastering What Is Depreciated Replacement Cost Method Of Valuation. Benefit from the experience and insights of teachers who specialize in What Is Depreciated Replacement Cost Method Of Valuation education.

Get in touch with similar people that share a passion for What Is Depreciated Replacement Cost Method Of Valuation. Our area is an area for teachers, parents, and learners to exchange ideas, seek advice, and celebrate successes in the trip of understanding the alphabet. Join the discussion and be a part of our expanding community.

Get More What Is Depreciated Replacement Cost Method Of Valuation

:max_bytes(150000):strip_icc()/Term-Definitions_depreciation-6a519480f170442fba6cf542a1a3e023.jpg)

https://www.rics.org/content/dam/ricsglobal/...

Depreciated replacement cost method of valuation for financial reporting RICS guidance note 1st edition November 2018 Published by the Royal Institution of Chartered

https://accountinguide.com/depreciated-replacement-cost

Depreciated Replacement Cost 120 000 120 000 60 48 000 We have to deduct 60 from the market price as the current truck is already depreciated for 60 The

Depreciated replacement cost method of valuation for financial reporting RICS guidance note 1st edition November 2018 Published by the Royal Institution of Chartered

Depreciated Replacement Cost 120 000 120 000 60 48 000 We have to deduct 60 from the market price as the current truck is already depreciated for 60 The

Depreciation And Depletion Depreciation And Depletion Learning

Journal Entry For Depreciation Example Quiz More

Solved Depreciation For Tax Purposes An Item May Be Chegg

Replacement Cost How To Calculate The Replacement Cost Of A Firm

Solved A Machine Costing 214 000 With A Four year Life And An

Solved Revision Of Depreciation Equipment With A Cost Of Chegg

Solved Revision Of Depreciation Equipment With A Cost Of Chegg

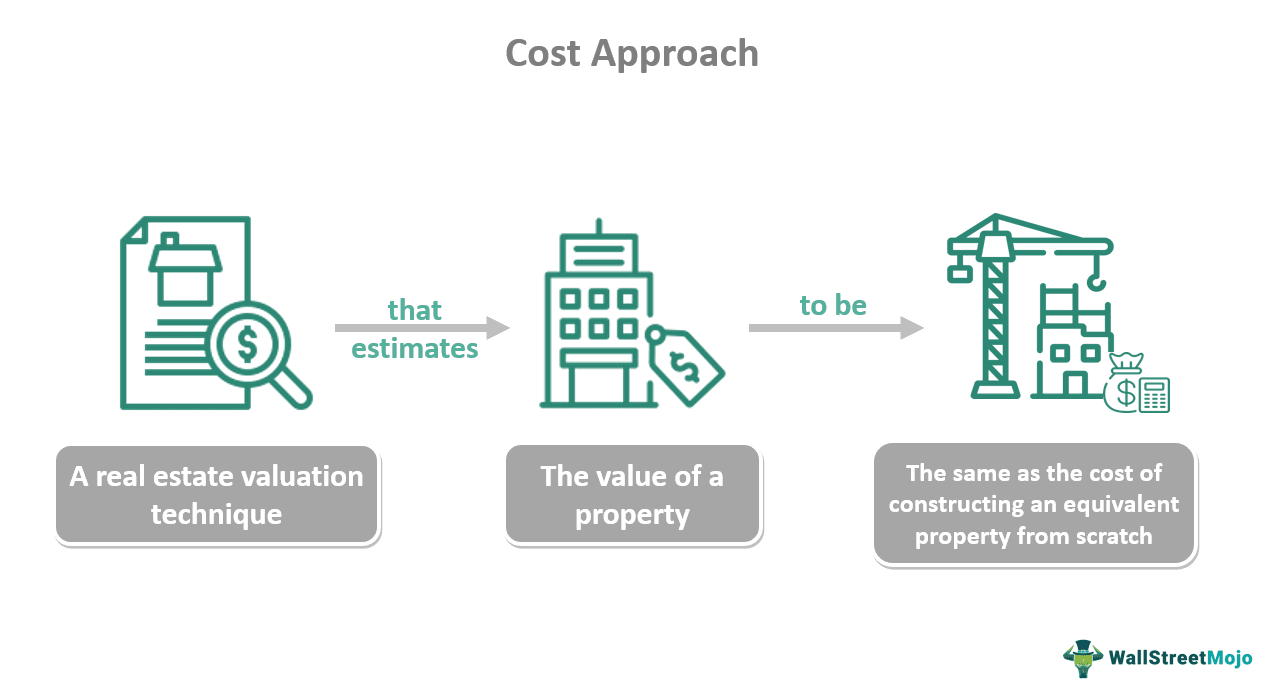

Cost Approach What Is It Appraisal Formula