Welcome to PrintableAlphabet.net, your go-to source for all things related to What Is The Entry Of Bad Debts Written Off In this extensive overview, we'll explore the complexities of What Is The Entry Of Bad Debts Written Off, offering useful understandings, engaging tasks, and printable worksheets to boost your learning experience.

Recognizing What Is The Entry Of Bad Debts Written Off

In this area, we'll discover the basic ideas of What Is The Entry Of Bad Debts Written Off. Whether you're a teacher, moms and dad, or student, gaining a solid understanding of What Is The Entry Of Bad Debts Written Off is critical for effective language acquisition. Expect insights, pointers, and real-world applications to make What Is The Entry Of Bad Debts Written Off come to life.

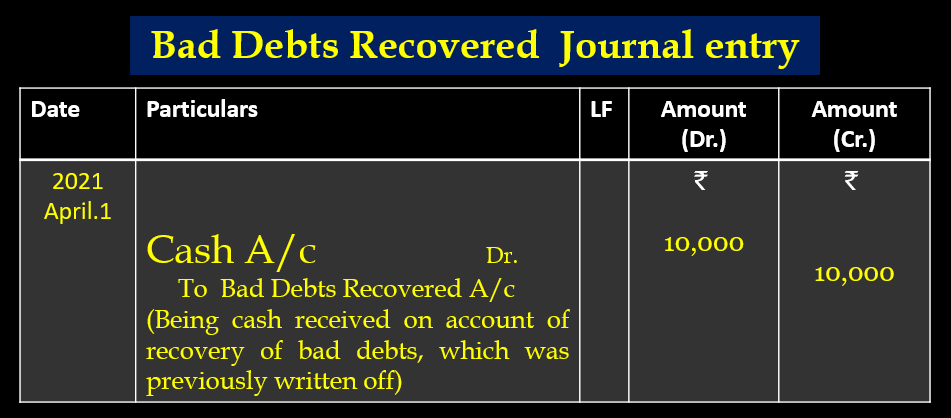

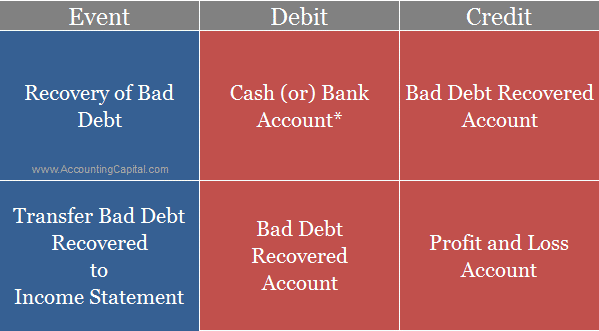

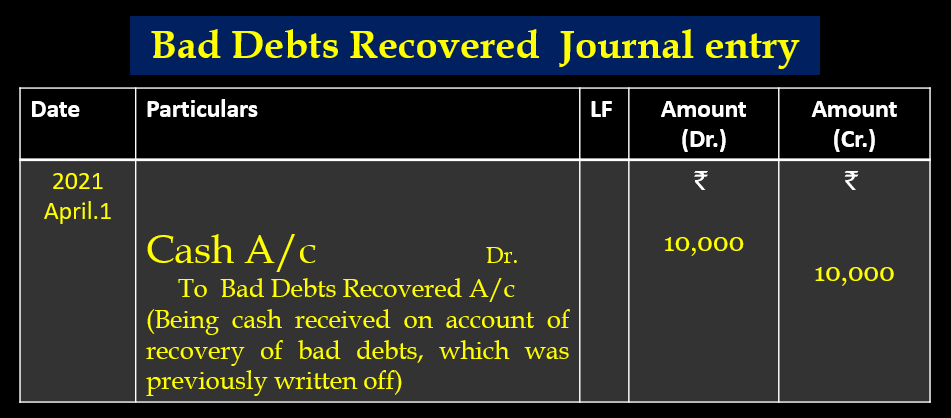

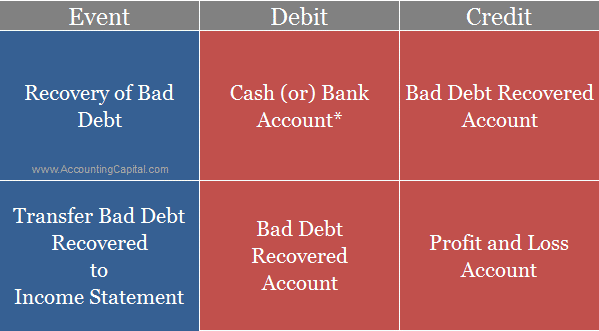

Bad Debts Recovered Journal Entry Important 2022

What Is The Entry Of Bad Debts Written Off

The bad debt written off is an expense for the business and a charge is made to the income statement through the bad debt expense account Credit The amount owed by the customer 200 would have been sitting as a debit on accounts receivable The credit above reduces the amount down to zero

Discover the importance of mastering What Is The Entry Of Bad Debts Written Off in the context of language development. We'll review just how effectiveness in What Is The Entry Of Bad Debts Written Off lays the foundation for improved reading, writing, and total language skills. Explore the more comprehensive effect of What Is The Entry Of Bad Debts Written Off on reliable interaction.

Bad Debts Recovered Journal Entry CArunway

Bad Debts Recovered Journal Entry CArunway

A bad debt can be written off using either the direct write off method or the provision method The method chosen can vary the timing of expense recognition

Discovering doesn't have to be boring. In this area, find a variety of interesting tasks customized to What Is The Entry Of Bad Debts Written Off learners of all ages. From interactive video games to creative exercises, these activities are designed to make What Is The Entry Of Bad Debts Written Off both enjoyable and educational.

Bad Debts Written Off Journal Entry

Bad Debts Written Off Journal Entry

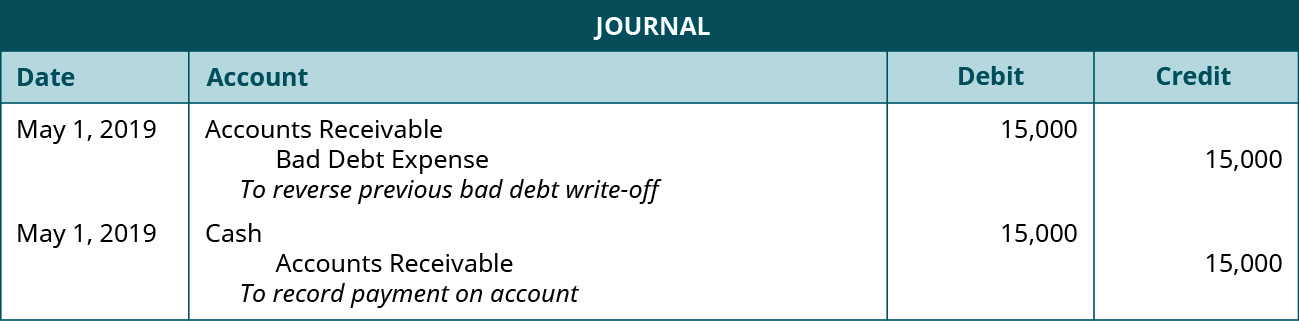

Accounting and journal entry for bad debt expense involves two accounts Bad Debts Account Debtor s Account Name When you write off bad debt you simply acknowledge that you have suffered a loss It differs from a bad debt expense which anticipates future losses

Access our specifically curated collection of printable worksheets focused on What Is The Entry Of Bad Debts Written Off These worksheets deal with different skill levels, making sure a customized understanding experience. Download and install, print, and delight in hands-on tasks that strengthen What Is The Entry Of Bad Debts Written Off abilities in an effective and delightful method.

Difference Between Bad Debts And Doubtful Debts with Journal Entries

Difference Between Bad Debts And Doubtful Debts with Journal Entries

Under the direct write off method the company records the journal entry for bad debt expense by debiting bad debt expense and crediting accounts receivable For example company XYZ Ltd decides to write off one of its customers Mr Z as uncollectible with a balance of USD 350

Whether you're a teacher seeking efficient techniques or a student looking for self-guided approaches, this area uses useful tips for understanding What Is The Entry Of Bad Debts Written Off. Benefit from the experience and insights of educators who specialize in What Is The Entry Of Bad Debts Written Off education and learning.

Get in touch with like-minded people who share an enthusiasm for What Is The Entry Of Bad Debts Written Off. Our neighborhood is a room for educators, moms and dads, and students to exchange concepts, seek advice, and celebrate successes in the journey of understanding the alphabet. Join the conversation and belong of our expanding area.

Here are the What Is The Entry Of Bad Debts Written Off

https://www.double-entry-bookkeeping.com/accounts...

The bad debt written off is an expense for the business and a charge is made to the income statement through the bad debt expense account Credit The amount owed by the customer 200 would have been sitting as a debit on accounts receivable The credit above reduces the amount down to zero

https://www.accountingtools.com/articles/how-to...

A bad debt can be written off using either the direct write off method or the provision method The method chosen can vary the timing of expense recognition

The bad debt written off is an expense for the business and a charge is made to the income statement through the bad debt expense account Credit The amount owed by the customer 200 would have been sitting as a debit on accounts receivable The credit above reduces the amount down to zero

A bad debt can be written off using either the direct write off method or the provision method The method chosen can vary the timing of expense recognition

How To Calculate Bad Debt Expense Get Business Strategy

Journal Entry For Bad Debts And Bad Debts Recovered GeeksforGeeks

Bad Debts Recovered Journal Entry

From The Following Details Find Out The Amount To Be Debited To Profit

Bad Debts Written Off Journal Entry

Glory Bad Debts Recovered In Trial Balance Need Of Cash Flow Statement

Glory Bad Debts Recovered In Trial Balance Need Of Cash Flow Statement

What Is The Provision For Doubtful Debts And Bad Debts