Welcome to PrintableAlphabet.net, your best resource for all points related to What Is The Treatment Of Bad Debts In this detailed overview, we'll explore the ins and outs of What Is The Treatment Of Bad Debts, offering beneficial understandings, engaging tasks, and printable worksheets to boost your discovering experience.

Recognizing What Is The Treatment Of Bad Debts

In this area, we'll check out the essential concepts of What Is The Treatment Of Bad Debts. Whether you're an educator, parent, or student, obtaining a solid understanding of What Is The Treatment Of Bad Debts is crucial for successful language procurement. Anticipate insights, tips, and real-world applications to make What Is The Treatment Of Bad Debts come to life.

The Facts About Bad Debt Deductions Cruz And Co

What Is The Treatment Of Bad Debts

Bad debt can be managed by using either the direct write off method or the allowance method The allowance method is more widely accepted under GAAP

Discover the relevance of grasping What Is The Treatment Of Bad Debts in the context of language advancement. We'll go over how proficiency in What Is The Treatment Of Bad Debts lays the structure for enhanced analysis, composing, and general language abilities. Explore the wider influence of What Is The Treatment Of Bad Debts on efficient interaction.

Bad Debts Recovered Journal Entry CArunway

Bad Debts Recovered Journal Entry CArunway

Bad debts are the account receivables that have been clearly identified as uncollectible in the present or future time The account receivables are credited by the amount of bad debt The debtors who have become bad debts are

Learning does not have to be boring. In this section, locate a range of appealing activities tailored to What Is The Treatment Of Bad Debts learners of all ages. From interactive video games to imaginative workouts, these activities are designed to make What Is The Treatment Of Bad Debts both enjoyable and academic.

Treatment Of Provision For Doubtful Debts In Cash Flow Statement

Treatment Of Provision For Doubtful Debts In Cash Flow Statement

Bad debts is the amount of credit sales which can not be recovered or become irrecoverable are called bad debts It is considered as the business loss of the company and

Gain access to our particularly curated collection of printable worksheets concentrated on What Is The Treatment Of Bad Debts These worksheets cater to numerous ability degrees, ensuring a customized discovering experience. Download, print, and appreciate hands-on activities that enhance What Is The Treatment Of Bad Debts abilities in an efficient and enjoyable means.

The Difference Between Bad Debt And doubtful Debt

The Difference Between Bad Debt And doubtful Debt

The process of strategically estimating bad debt that needs to be written off in the future is called bad debt provision There are several ways to make the estimates called provisions some of which are legally required

Whether you're an educator seeking reliable strategies or a learner seeking self-guided techniques, this section supplies functional suggestions for understanding What Is The Treatment Of Bad Debts. Benefit from the experience and insights of instructors that specialize in What Is The Treatment Of Bad Debts education.

Get in touch with like-minded individuals who share an enthusiasm for What Is The Treatment Of Bad Debts. Our neighborhood is a room for teachers, moms and dads, and learners to exchange ideas, inquire, and celebrate successes in the trip of mastering the alphabet. Join the conversation and be a part of our growing area.

Download More What Is The Treatment Of Bad Debts

https://www.investopedia.com › terms …

Bad debt can be managed by using either the direct write off method or the allowance method The allowance method is more widely accepted under GAAP

https://www.wikiaccounting.com › accou…

Bad debts are the account receivables that have been clearly identified as uncollectible in the present or future time The account receivables are credited by the amount of bad debt The debtors who have become bad debts are

Bad debt can be managed by using either the direct write off method or the allowance method The allowance method is more widely accepted under GAAP

Bad debts are the account receivables that have been clearly identified as uncollectible in the present or future time The account receivables are credited by the amount of bad debt The debtors who have become bad debts are

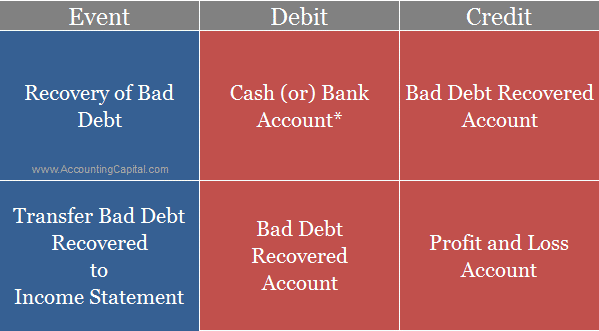

Journal Entry For Bad Debts And Bad Debts Recovered GeeksforGeeks

Bad Debts Recovered Journal Entry

How To Calculate Bad Debt Expense Get Business Strategy

Treatment Of Bad Debts Provision For Doubtful Debts Accounting

Bad Debts How They Happen And What To Do About Them

Journal Entry Bad Debt And Provision For Bad Debt

Journal Entry Bad Debt And Provision For Bad Debt

Glory Bad Debts Recovered In Trial Balance Need Of Cash Flow Statement