Welcome to PrintableAlphabet.net, your best resource for all things related to Expected Shortfall Definition In this comprehensive guide, we'll explore the complexities of Expected Shortfall Definition, supplying useful understandings, engaging tasks, and printable worksheets to improve your knowing experience.

Comprehending Expected Shortfall Definition

In this area, we'll explore the fundamental ideas of Expected Shortfall Definition. Whether you're a teacher, parent, or student, acquiring a solid understanding of Expected Shortfall Definition is essential for effective language procurement. Anticipate insights, pointers, and real-world applications to make Expected Shortfall Definition revived.

Expected Shortfall Definition Capital

Expected Shortfall Definition

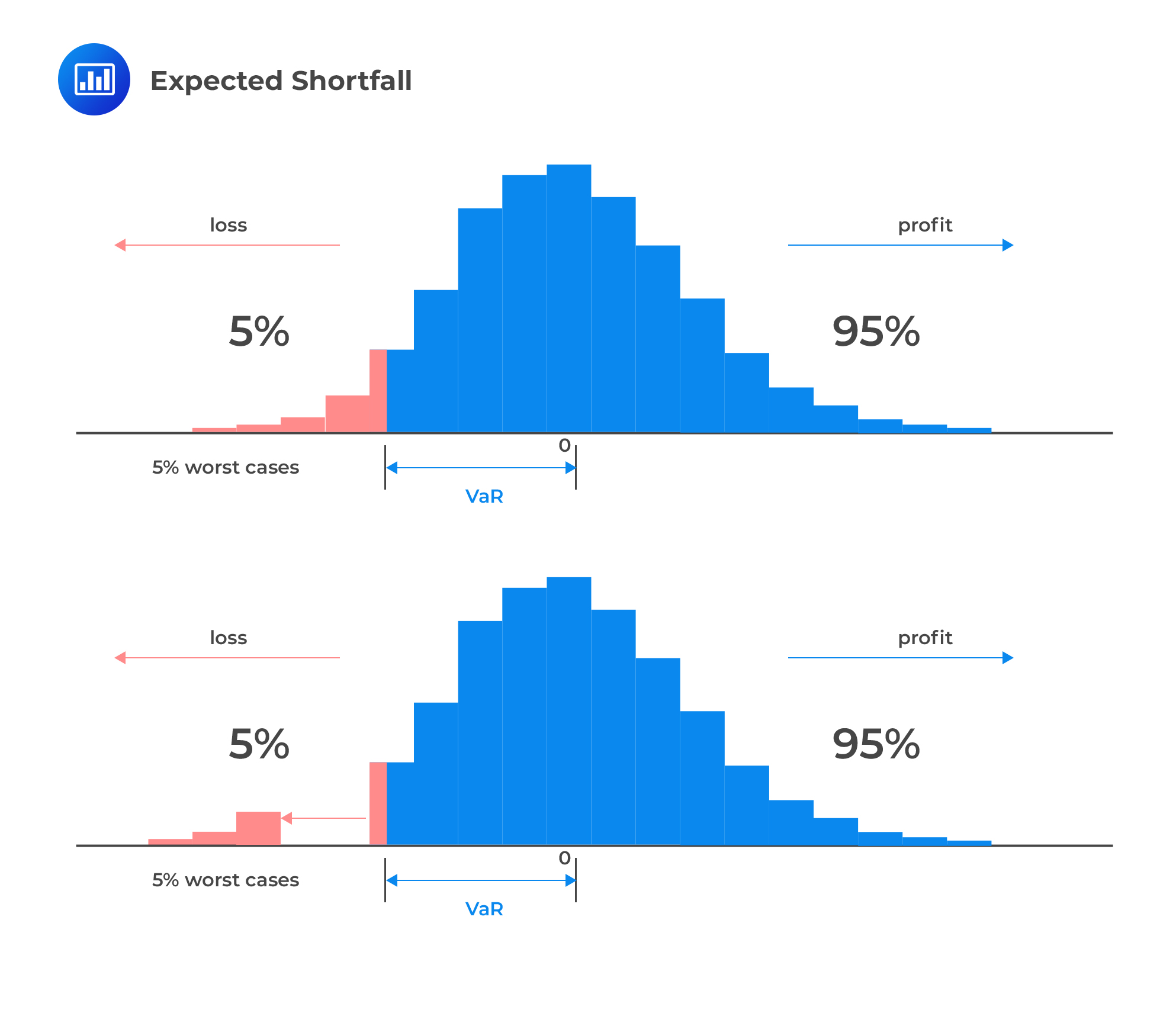

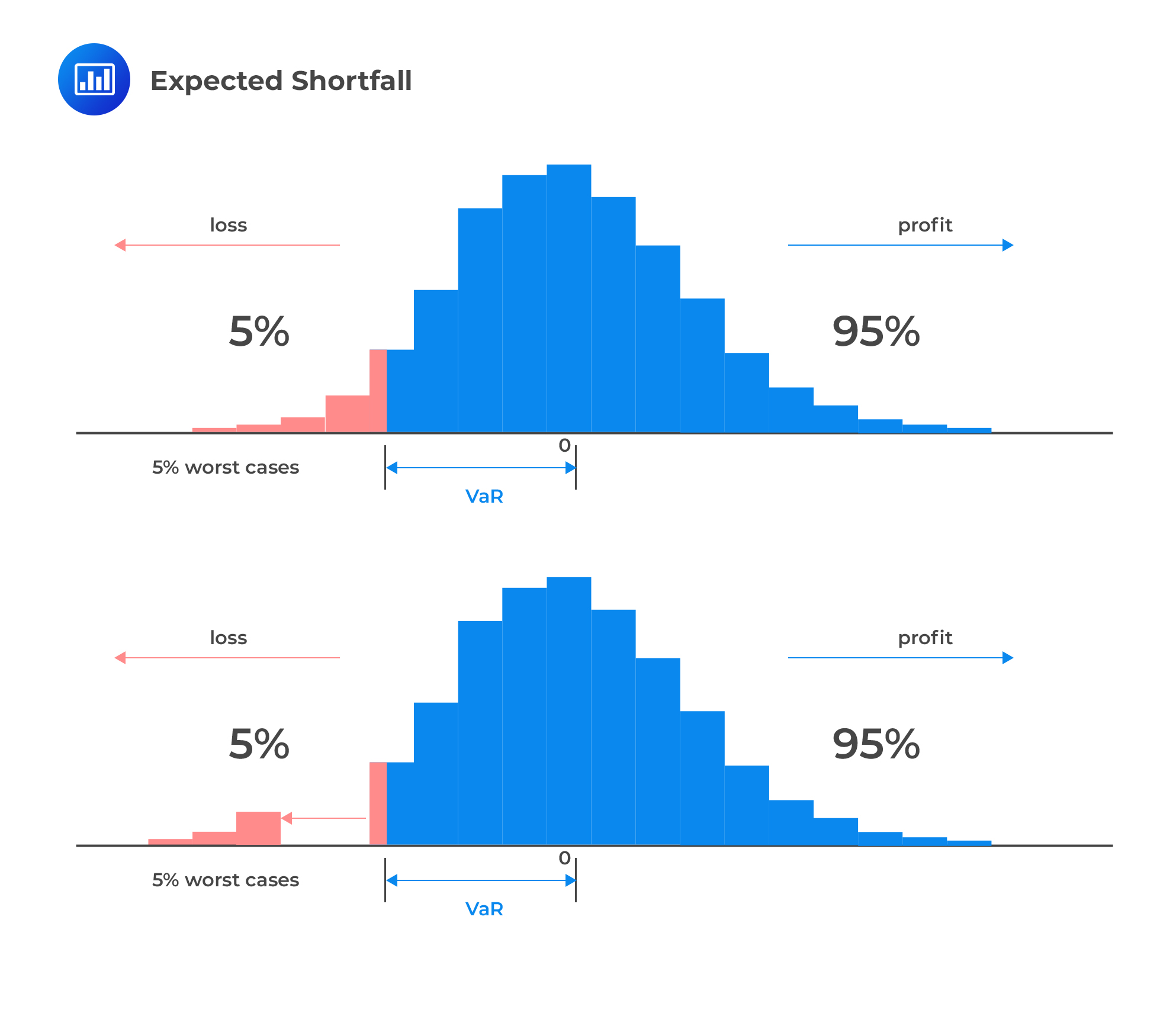

Expected Shortfall ES also known as Conditional Value at Risk CVaR is a risk measure used to assess the level of risk possessed by an investment or portfolio given that the loss exceeds the VaR It is used in different financial organizations such as banks mutual funds insurance companies hedge funds pension

Discover the relevance of mastering Expected Shortfall Definition in the context of language growth. We'll go over exactly how effectiveness in Expected Shortfall Definition lays the foundation for better reading, creating, and overall language abilities. Explore the wider effect of Expected Shortfall Definition on reliable communication.

Expected Shortfall CFA FRM And Actuarial Exams Study Notes

Expected Shortfall CFA FRM And Actuarial Exams Study Notes

Expected Shortfall is a risk measure that indicates the average value of a possible loss in an investment that exceeds a given confidence level It is also usually referred to as conditional value at risk CVaR and can be considered an improvement over traditional VaR when it comes to measuring risk

Learning does not need to be boring. In this section, discover a range of interesting activities customized to Expected Shortfall Definition students of all ages. From interactive games to imaginative workouts, these activities are developed to make Expected Shortfall Definition both enjoyable and academic.

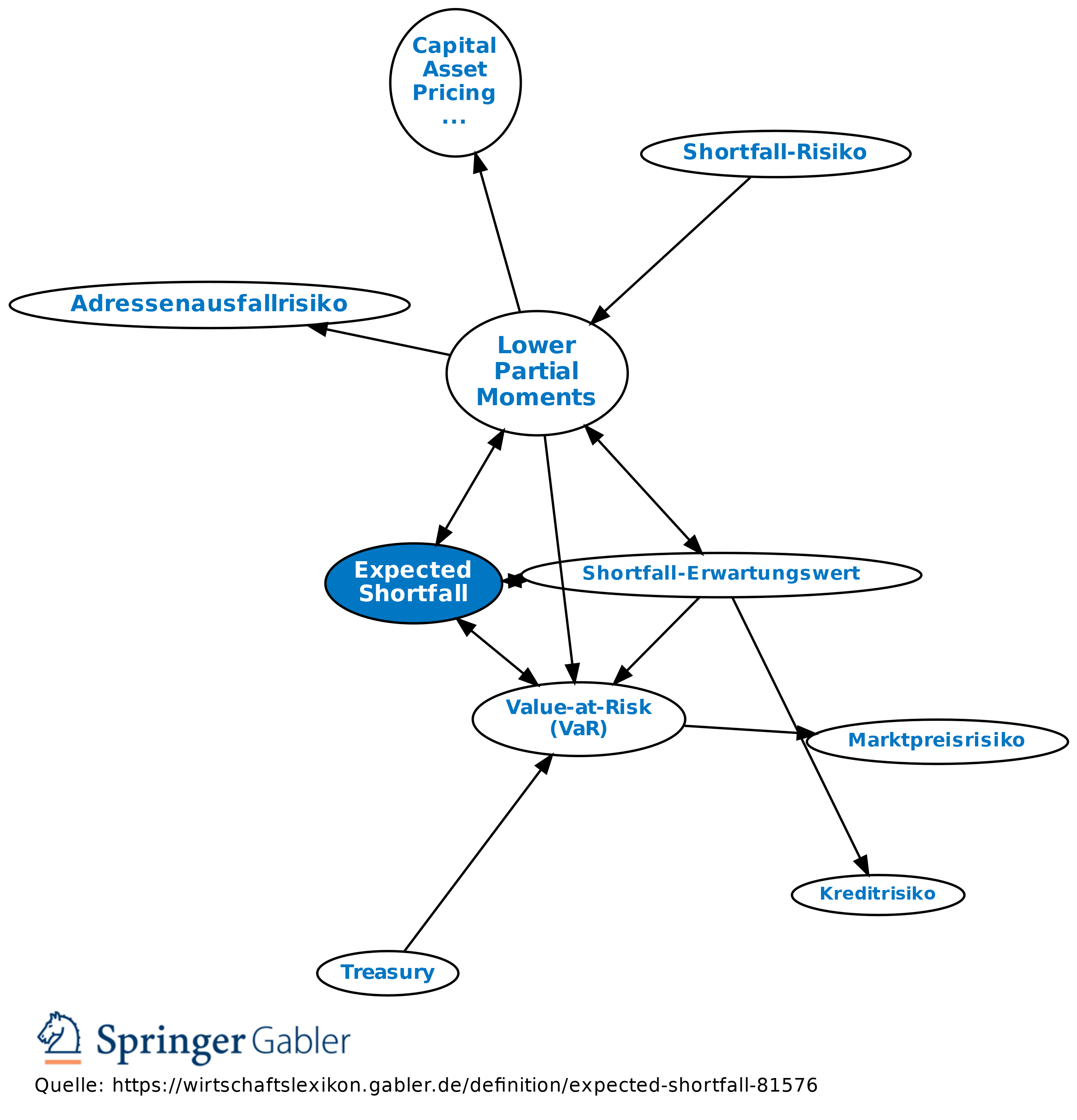

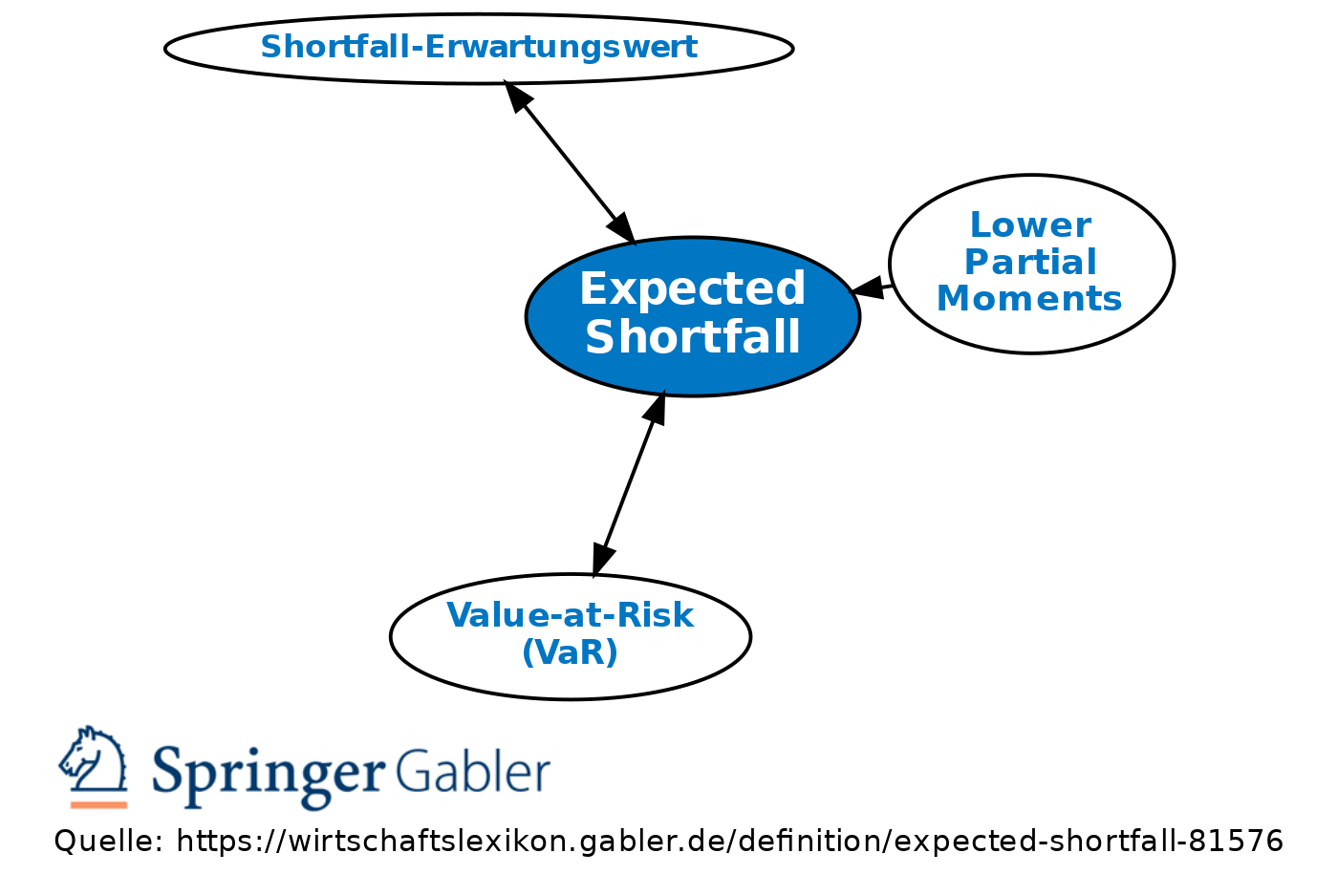

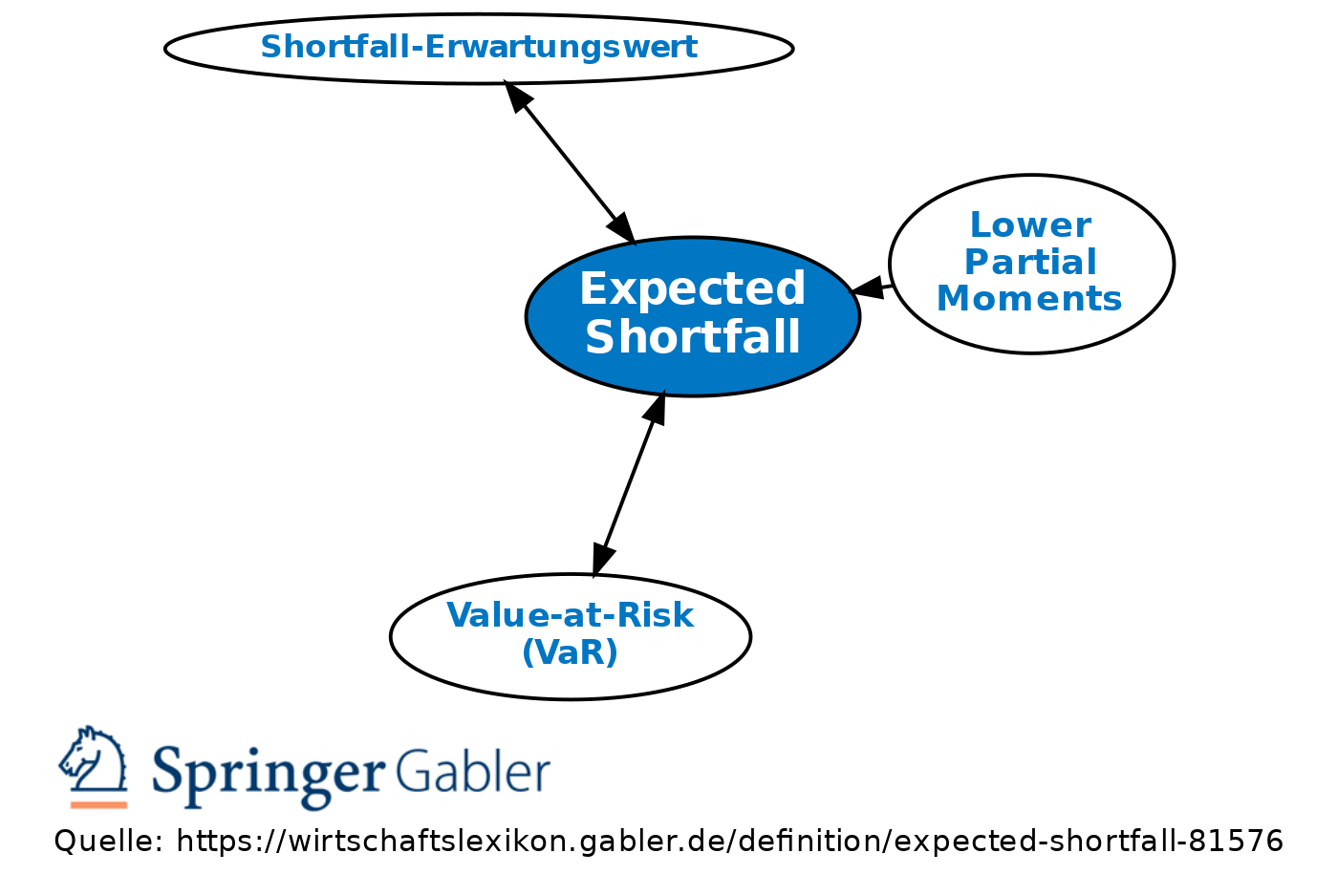

Expected Shortfall Definition Gabler Banklexikon

Expected Shortfall Definition Gabler Banklexikon

Conditional Value at Risk CVaR also known as the expected shortfall is a risk assessment measure that quantifies the amount of tail risk an investment portfolio

Accessibility our specially curated collection of printable worksheets concentrated on Expected Shortfall Definition These worksheets deal with different ability levels, ensuring a personalized knowing experience. Download and install, print, and delight in hands-on tasks that enhance Expected Shortfall Definition skills in a reliable and delightful method.

Shortfall SHORTFALL Meaning YouTube

Shortfall SHORTFALL Meaning YouTube

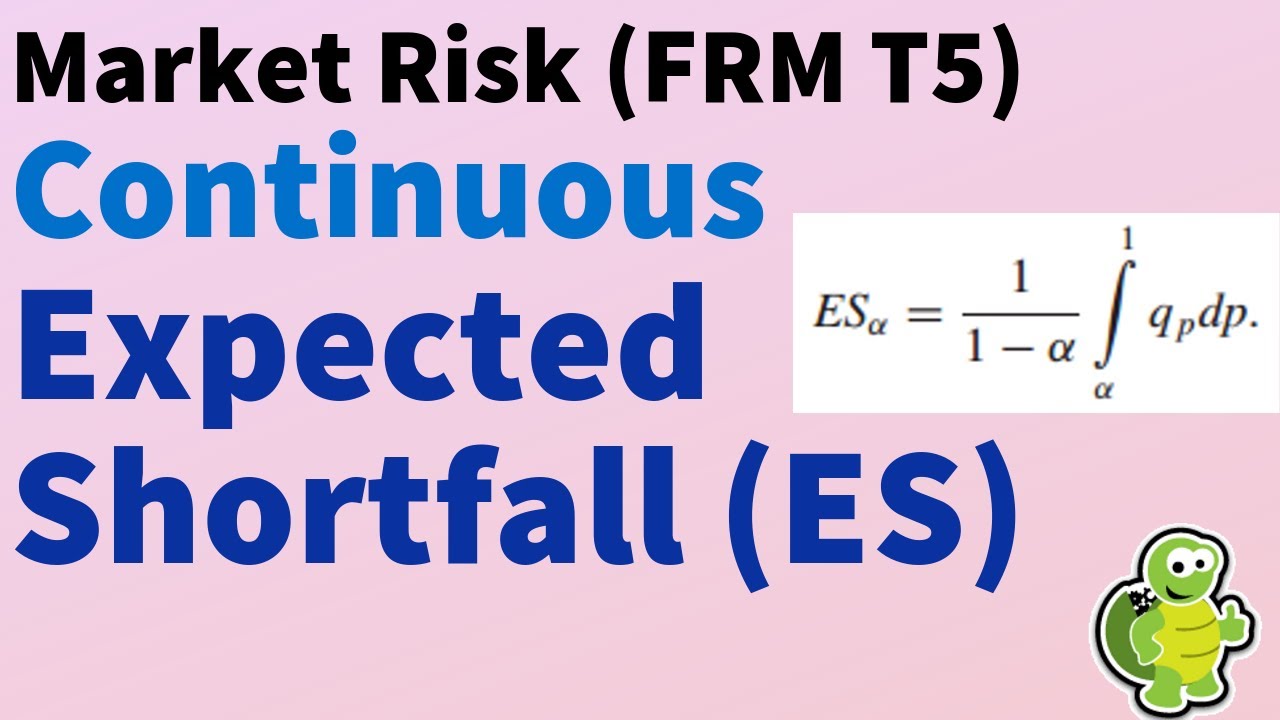

Expected shortfall is a risk measure sensitive to the shape of the tail of the distribution of returns on a portfolio unlike the more commonly used value at risk VAR Expected shortfall is calculated by averaging all of the returns in the distribution that are worse than the VAR of the portfolio at a given level of confidence

Whether you're an instructor looking for effective approaches or a student looking for self-guided approaches, this area supplies useful tips for grasping Expected Shortfall Definition. Benefit from the experience and understandings of instructors who specialize in Expected Shortfall Definition education.

Get in touch with similar individuals that share an interest for Expected Shortfall Definition. Our area is a room for teachers, parents, and learners to exchange ideas, inquire, and commemorate successes in the trip of understanding the alphabet. Sign up with the discussion and be a part of our growing neighborhood.

Get More Expected Shortfall Definition

/budget-cf9b7217e2bd4bdb8744ce9495fd4dd0.jpg)

https://www.wallstreetmojo.com/expected-shortfall

Expected Shortfall ES also known as Conditional Value at Risk CVaR is a risk measure used to assess the level of risk possessed by an investment or portfolio given that the loss exceeds the VaR It is used in different financial organizations such as banks mutual funds insurance companies hedge funds pension

https://www.qmr.ai/what-is-expected-shortfall-cvar

Expected Shortfall is a risk measure that indicates the average value of a possible loss in an investment that exceeds a given confidence level It is also usually referred to as conditional value at risk CVaR and can be considered an improvement over traditional VaR when it comes to measuring risk

Expected Shortfall ES also known as Conditional Value at Risk CVaR is a risk measure used to assess the level of risk possessed by an investment or portfolio given that the loss exceeds the VaR It is used in different financial organizations such as banks mutual funds insurance companies hedge funds pension

Expected Shortfall is a risk measure that indicates the average value of a possible loss in an investment that exceeds a given confidence level It is also usually referred to as conditional value at risk CVaR and can be considered an improvement over traditional VaR when it comes to measuring risk

Expected Shortfall ppt

Recall That The Expected Shortfall Is Defined As Chegg

/budget-cf9b7217e2bd4bdb8744ce9495fd4dd0.jpg)

Shortfall Definition

Shortfall Meaning YouTube

Expected Shortfall Approximating Continuous With Code ES Continous

Expected CampbellDemba

Expected CampbellDemba

Medicaid Shortfall Definition Should Change When Tallying DSH