Welcome to PrintableAlphabet.net, your best source for all things associated with Minimum Age For Income Tax Return In this detailed overview, we'll delve into the ins and outs of Minimum Age For Income Tax Return, offering beneficial insights, engaging tasks, and printable worksheets to boost your knowing experience.

Understanding Minimum Age For Income Tax Return

In this section, we'll explore the essential concepts of Minimum Age For Income Tax Return. Whether you're an educator, parent, or learner, acquiring a solid understanding of Minimum Age For Income Tax Return is essential for successful language purchase. Expect understandings, pointers, and real-world applications to make Minimum Age For Income Tax Return revived.

Zero Tax On Salary Income INR 20 Lakhs Legal Way Here

Minimum Age For Income Tax Return

Generally you need to file if Your gross income is over the filing requirement You have over 400 in net earnings from self employment side jobs or

Discover the significance of mastering Minimum Age For Income Tax Return in the context of language advancement. We'll discuss exactly how efficiency in Minimum Age For Income Tax Return lays the foundation for enhanced analysis, composing, and total language abilities. Check out the wider influence of Minimum Age For Income Tax Return on efficient communication.

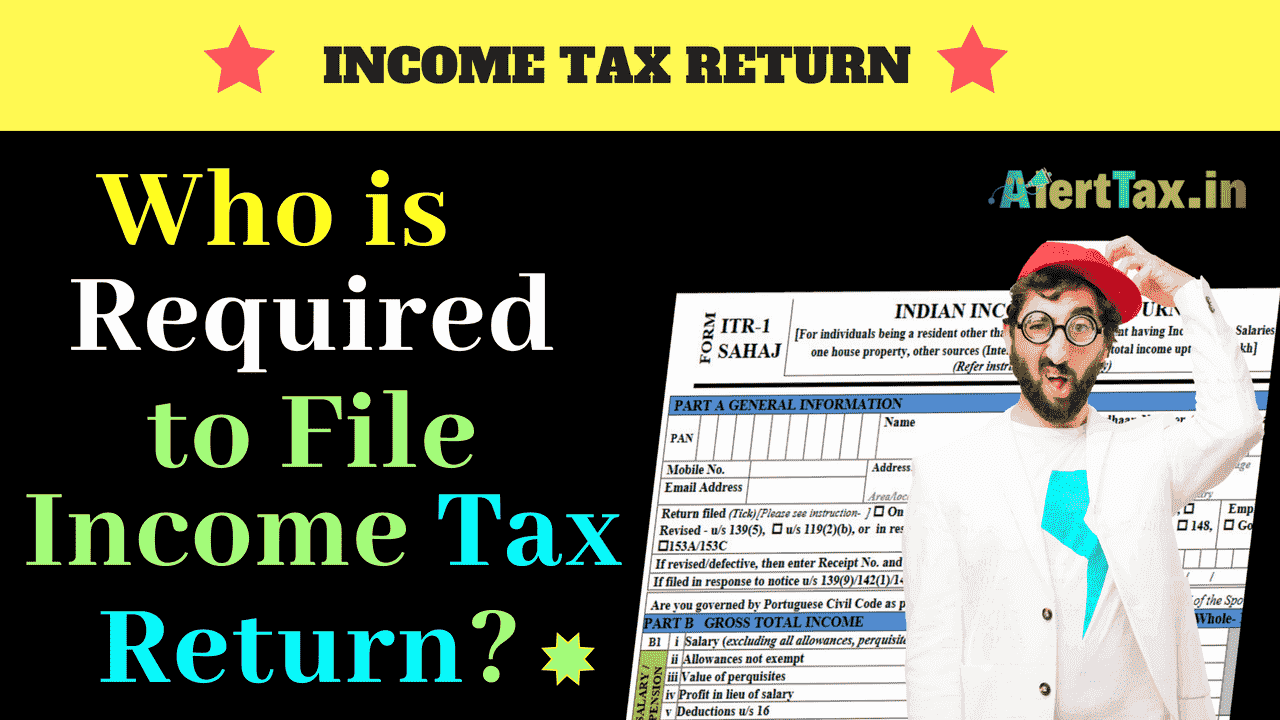

How To File For Income Tax Online Auto Calculate For You

How To File For Income Tax Online Auto Calculate For You

You probably have to file a tax return in 2024 if your gross income in 2023 was at least 13 850 as a single filer 27 700 if married filing jointly or 20 800 if head

Discovering does not have to be plain. In this area, find a range of engaging activities customized to Minimum Age For Income Tax Return students of any ages. From interactive games to imaginative exercises, these activities are developed to make Minimum Age For Income Tax Return both enjoyable and academic.

Latest ITR Forms Archives Certicom

Latest ITR Forms Archives Certicom

Generally most U S citizens and permanent residents who work in the United States need to file a tax return if they make more than a certain amount for the

Gain access to our particularly curated collection of printable worksheets focused on Minimum Age For Income Tax Return These worksheets accommodate numerous ability levels, ensuring a tailored learning experience. Download, print, and take pleasure in hands-on tasks that reinforce Minimum Age For Income Tax Return abilities in a reliable and enjoyable way.

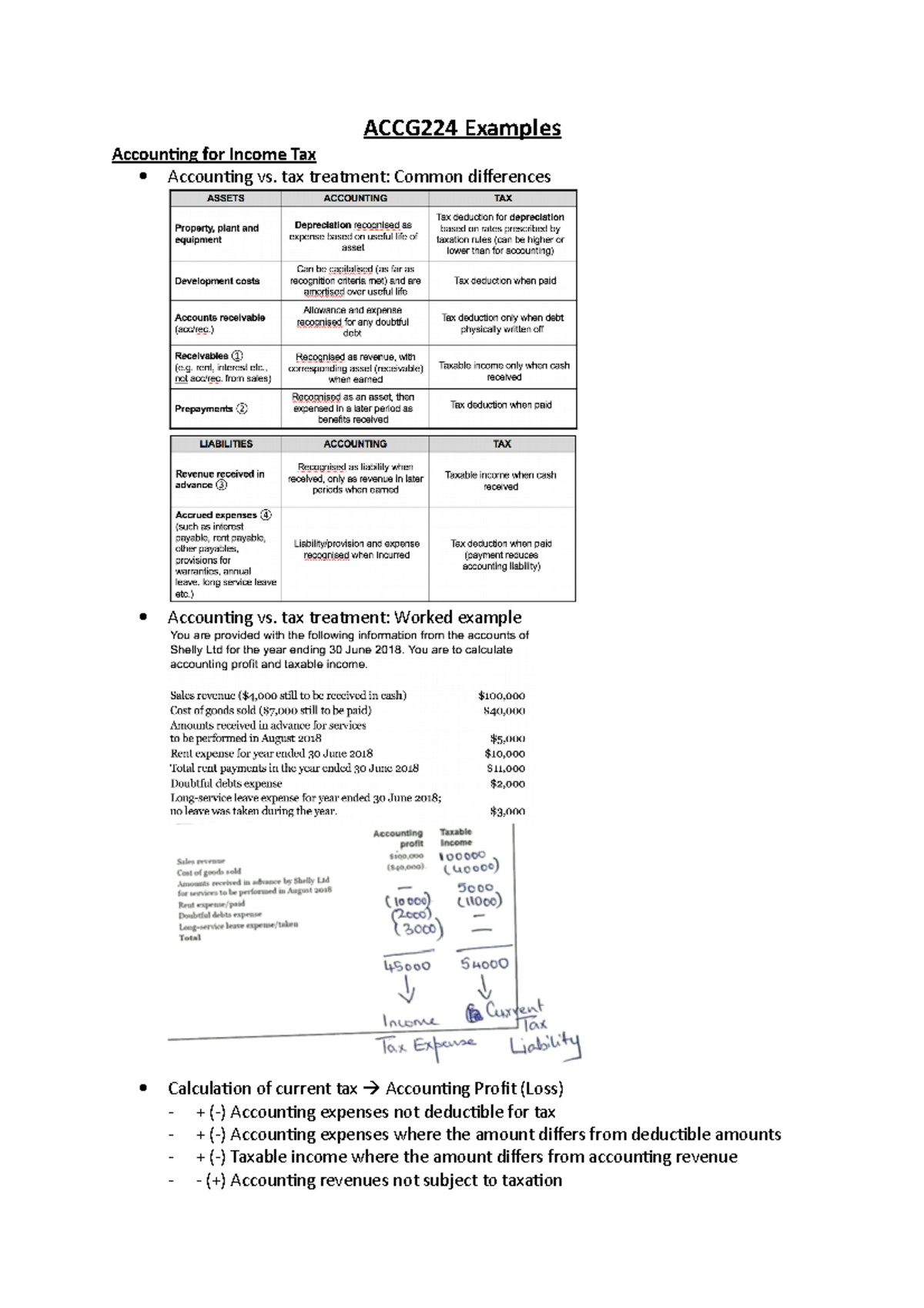

ACCG224 Examples ACCG224 Examples Accounting For Income Tax

ACCG224 Examples ACCG224 Examples Accounting For Income Tax

Want to know what the minimum income is to file taxes Learn about the IRS filing requirements based on your age income and filing status here

Whether you're an instructor seeking efficient techniques or a student looking for self-guided approaches, this section uses practical suggestions for grasping Minimum Age For Income Tax Return. Take advantage of the experience and insights of instructors who specialize in Minimum Age For Income Tax Return education.

Get in touch with like-minded individuals who share a passion for Minimum Age For Income Tax Return. Our community is a space for teachers, moms and dads, and learners to exchange ideas, consult, and commemorate successes in the trip of understanding the alphabet. Sign up with the conversation and be a part of our growing area.

Download More Minimum Age For Income Tax Return

https://www.irs.gov/individuals/check-if-you-need-to-file-a-tax-return

Generally you need to file if Your gross income is over the filing requirement You have over 400 in net earnings from self employment side jobs or

https://www.nerdwallet.com/article/taxes/do-i-need...

You probably have to file a tax return in 2024 if your gross income in 2023 was at least 13 850 as a single filer 27 700 if married filing jointly or 20 800 if head

Generally you need to file if Your gross income is over the filing requirement You have over 400 in net earnings from self employment side jobs or

You probably have to file a tax return in 2024 if your gross income in 2023 was at least 13 850 as a single filer 27 700 if married filing jointly or 20 800 if head

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

Here s When IRS Will Start Accepting Tax Returns In 2023 Al

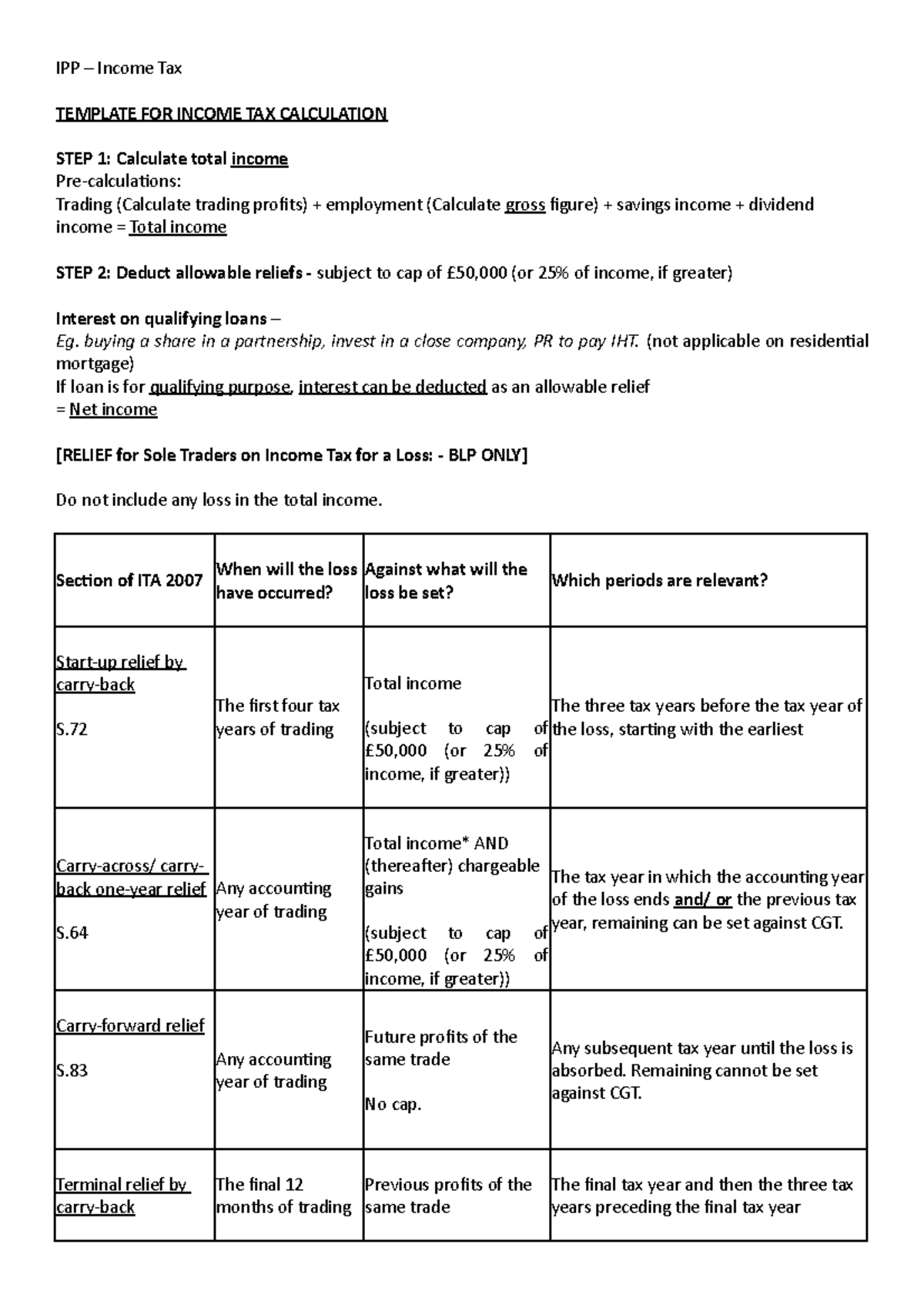

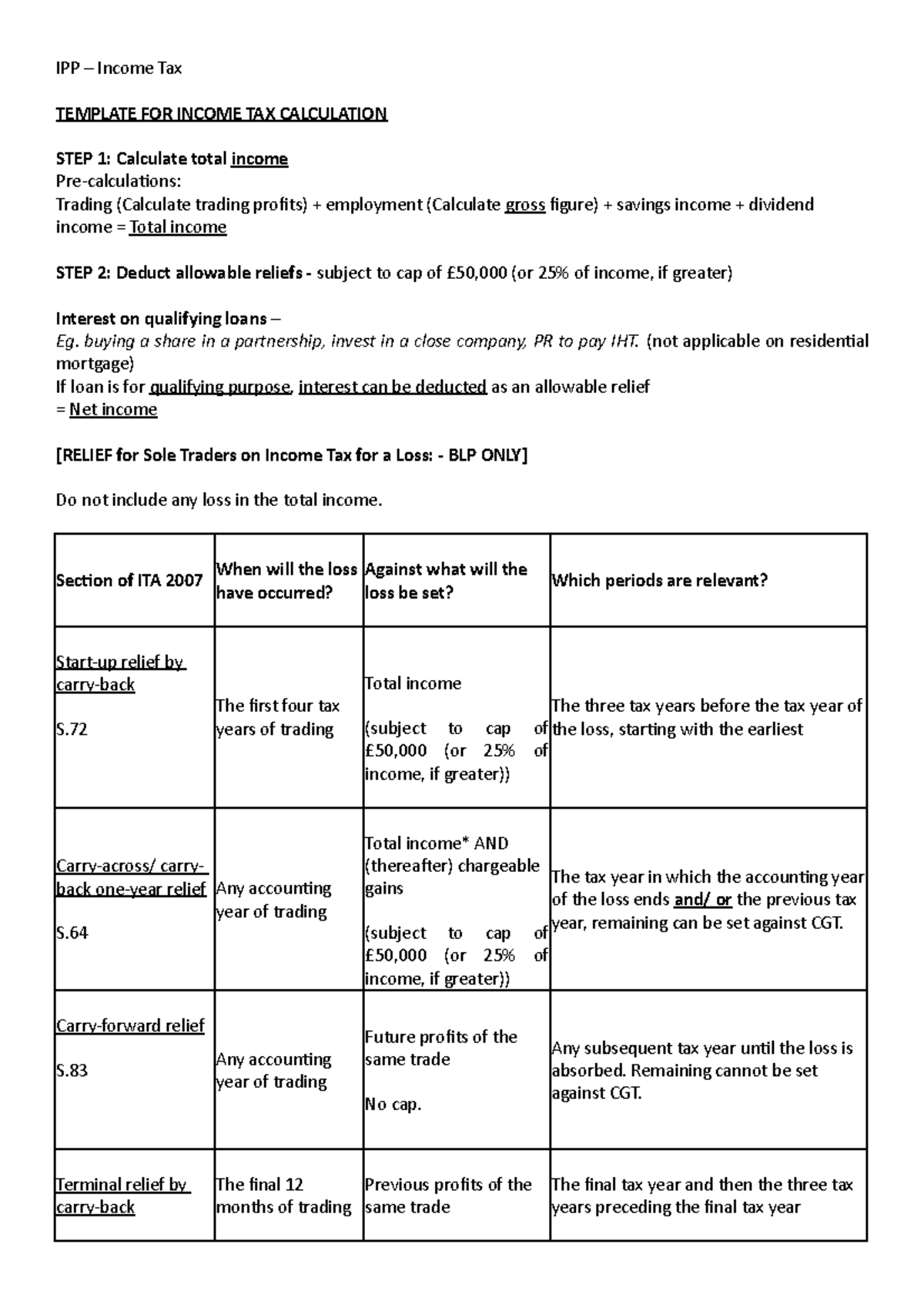

Income Tax Procedure For IPP TEMPLATE FOR INCOME TAX CALCULATION STEP

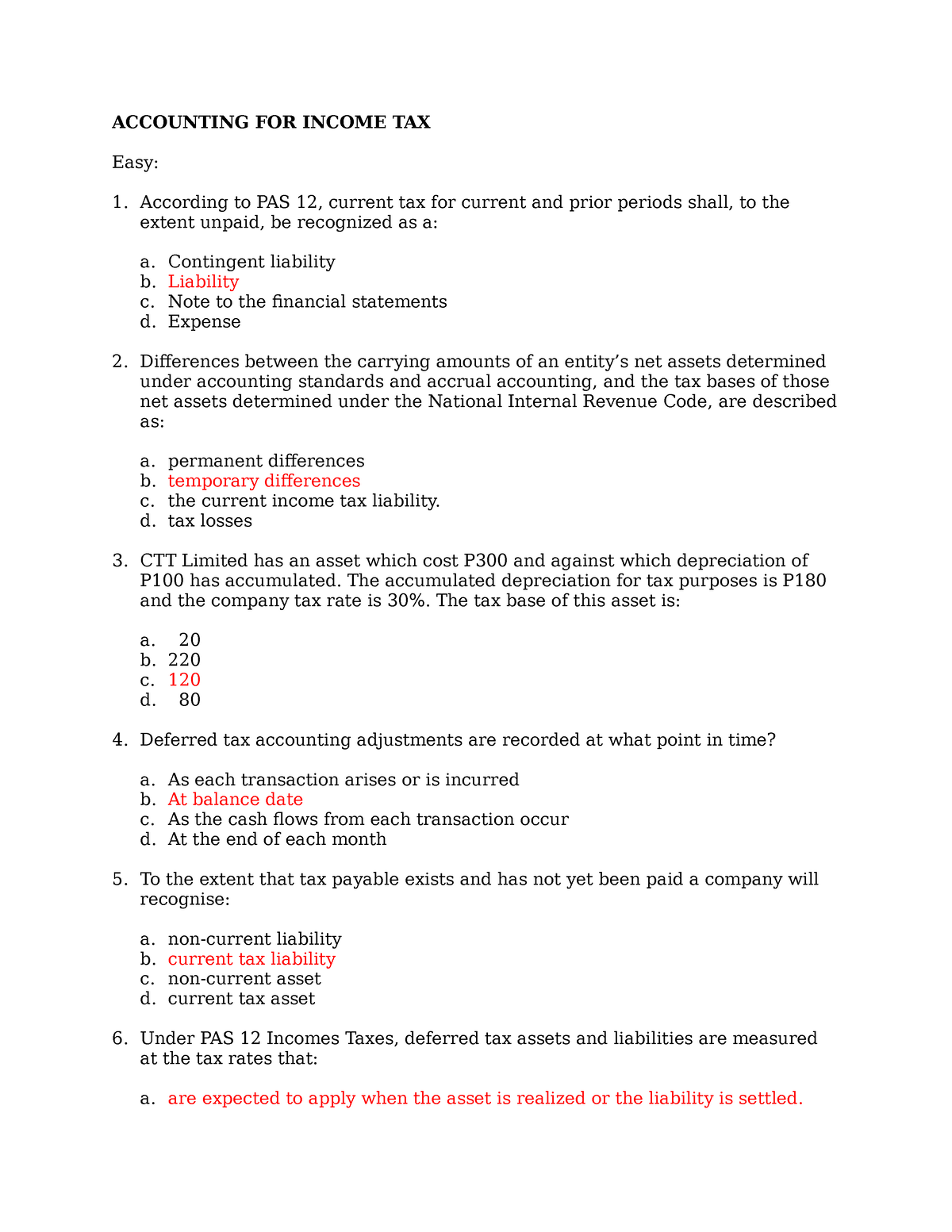

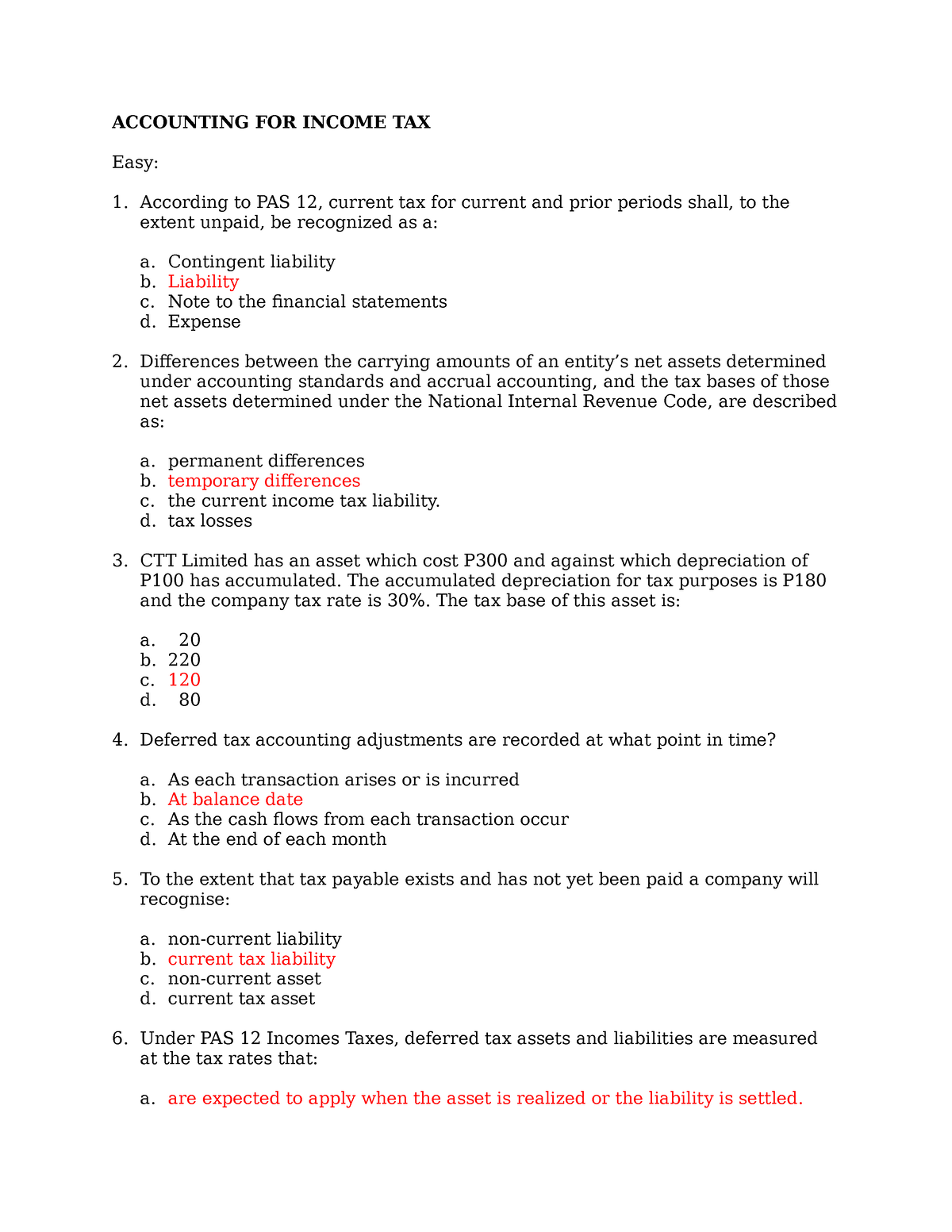

Accounting For Income Tax ACCOUNTING FOR INCOME TAX Easy According

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

Salary Income Tax Return Service At Best Price In Mumbai

Salary Income Tax Return Service At Best Price In Mumbai

Income Tax Return Filing Last Date Revised ITR Deadline For Taxpayers