Welcome to PrintableAlphabet.net, your best resource for all things related to What Is Considered Office Supplies For Taxes In this thorough guide, we'll explore the details of What Is Considered Office Supplies For Taxes, giving important understandings, involving tasks, and printable worksheets to improve your discovering experience.

Recognizing What Is Considered Office Supplies For Taxes

In this section, we'll check out the fundamental principles of What Is Considered Office Supplies For Taxes. Whether you're a teacher, moms and dad, or learner, acquiring a strong understanding of What Is Considered Office Supplies For Taxes is vital for successful language procurement. Expect understandings, ideas, and real-world applications to make What Is Considered Office Supplies For Taxes come to life.

Ultimate Direct Sales Office Supply Bundle Modern Direct Seller

What Is Considered Office Supplies For Taxes

When you file your taxes your office supplies are deducted from your profit This means if you earn 35 000 but spend 4 000 on office supplies your profit will be 31 000 for tax

Discover the relevance of understanding What Is Considered Office Supplies For Taxes in the context of language advancement. We'll review exactly how effectiveness in What Is Considered Office Supplies For Taxes lays the foundation for better reading, creating, and total language abilities. Discover the broader influence of What Is Considered Office Supplies For Taxes on efficient interaction.

17 Ways To Organize Office Supplies For An Efficient Workspace Be

17 Ways To Organize Office Supplies For An Efficient Workspace Be

There are three major kinds of office expense categories to consider general office expenses office supplies and large office equipment such as furniture All need to be dealt with properly

Learning doesn't have to be plain. In this section, find a range of interesting activities tailored to What Is Considered Office Supplies For Taxes learners of all ages. From interactive games to innovative workouts, these activities are developed to make What Is Considered Office Supplies For Taxes both enjoyable and academic.

Essential Office Supplies For A New Business Techicy

Essential Office Supplies For A New Business Techicy

However higher priced office expenses e g computers smartphones are considered assets and can be depreciated Office supplies are items that aid in the short term operation of your

Access our specifically curated collection of printable worksheets focused on What Is Considered Office Supplies For Taxes These worksheets satisfy numerous skill levels, guaranteeing a customized knowing experience. Download and install, print, and enjoy hands-on activities that strengthen What Is Considered Office Supplies For Taxes abilities in an effective and pleasurable method.

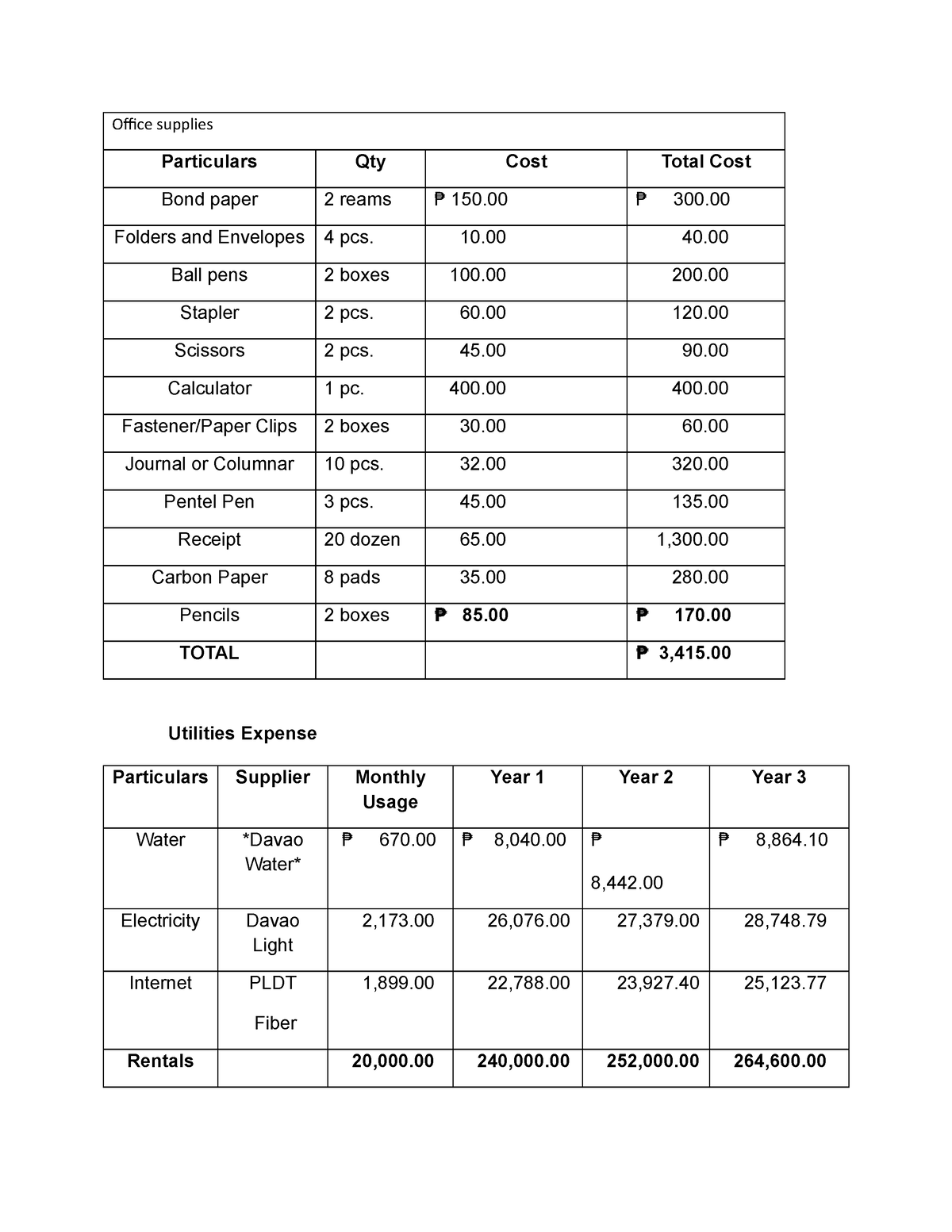

Office Supplies Lecture Notes 1 Office Supplies Particulars Qty

Office Supplies Lecture Notes 1 Office Supplies Particulars Qty

Business supply purchases are deducted in your business tax return in the Expenses or Deductions section What Is Business Equipment Business equipment is tangible property used in a business

Whether you're an educator searching for reliable methods or a student seeking self-guided approaches, this section provides useful pointers for understanding What Is Considered Office Supplies For Taxes. Benefit from the experience and insights of instructors who focus on What Is Considered Office Supplies For Taxes education.

Connect with like-minded people that share a passion for What Is Considered Office Supplies For Taxes. Our community is a space for teachers, parents, and students to trade concepts, inquire, and celebrate successes in the trip of mastering the alphabet. Sign up with the conversation and be a part of our growing neighborhood.

Here are the What Is Considered Office Supplies For Taxes

https://smallbusiness.chron.com

When you file your taxes your office supplies are deducted from your profit This means if you earn 35 000 but spend 4 000 on office supplies your profit will be 31 000 for tax

https://smallbusiness.chron.com › difference-between...

There are three major kinds of office expense categories to consider general office expenses office supplies and large office equipment such as furniture All need to be dealt with properly

When you file your taxes your office supplies are deducted from your profit This means if you earn 35 000 but spend 4 000 on office supplies your profit will be 31 000 for tax

There are three major kinds of office expense categories to consider general office expenses office supplies and large office equipment such as furniture All need to be dealt with properly

5 Essential Packaging Supplies For Taxes Archiving The Packaging

Office Supplies Office Supplies For Work And Study 3694593 Vector Art

Office Supplies Expense The Bottom Line Group

10 Best Office Supplies For Productivity Safeguard By Innovative

5 Best Places To Buy Cheap Office Supplies Online In 2023

Best Descriptive Office Stationery Items List For Offices

Best Descriptive Office Stationery Items List For Offices

SUPPLY AND DELIVERY OF OFFICE SUPPLIES FOR THE FILING OF THE DOCUMENTS