Welcome to PrintableAlphabet.net, your go-to source for all things associated with What Is Replacement Method Of Depreciation In this comprehensive overview, we'll delve into the intricacies of What Is Replacement Method Of Depreciation, providing important insights, involving tasks, and printable worksheets to enhance your learning experience.

Comprehending What Is Replacement Method Of Depreciation

In this section, we'll check out the basic concepts of What Is Replacement Method Of Depreciation. Whether you're a teacher, moms and dad, or student, getting a solid understanding of What Is Replacement Method Of Depreciation is vital for effective language purchase. Anticipate insights, pointers, and real-world applications to make What Is Replacement Method Of Depreciation come to life.

How To Calculate Depreciation Calculator Haiper

What Is Replacement Method Of Depreciation

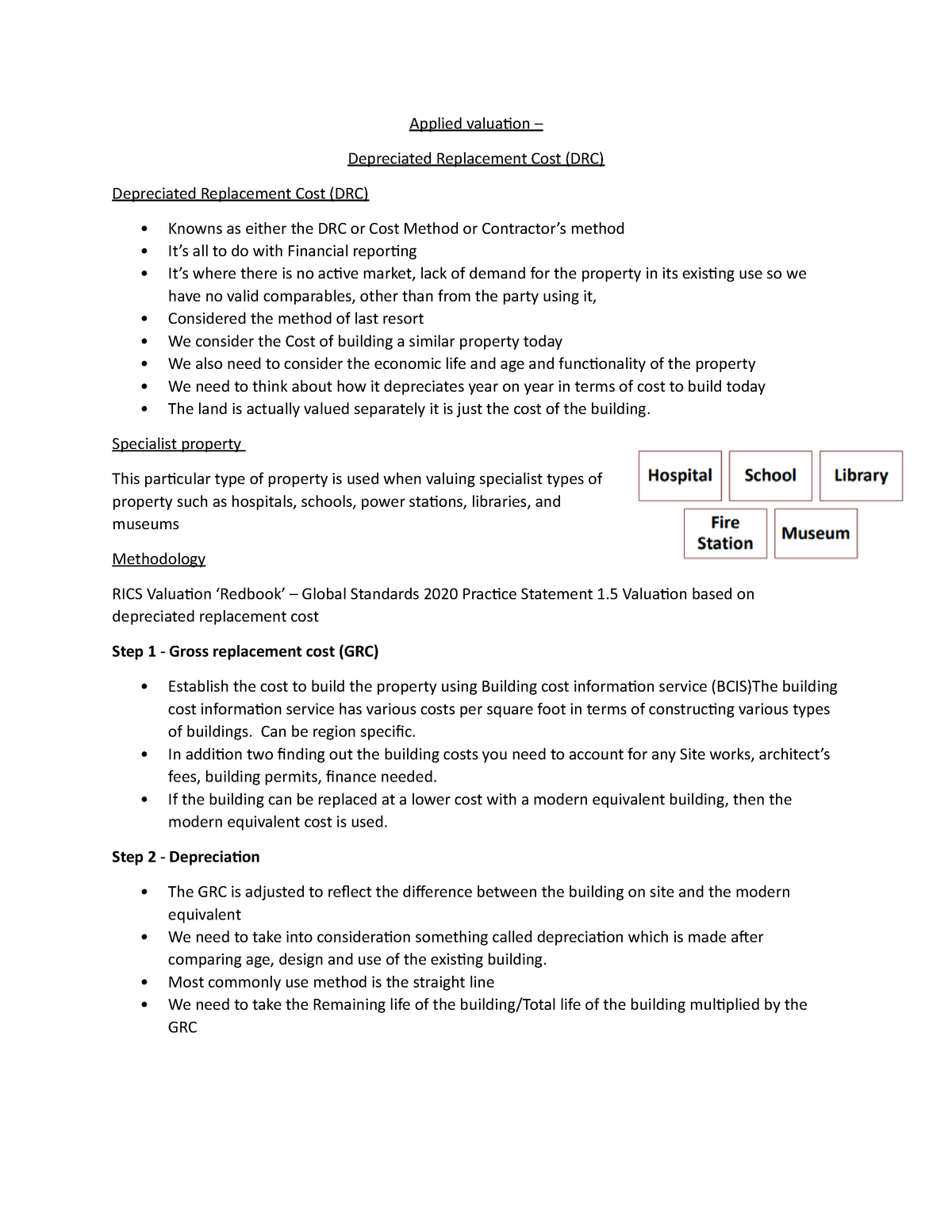

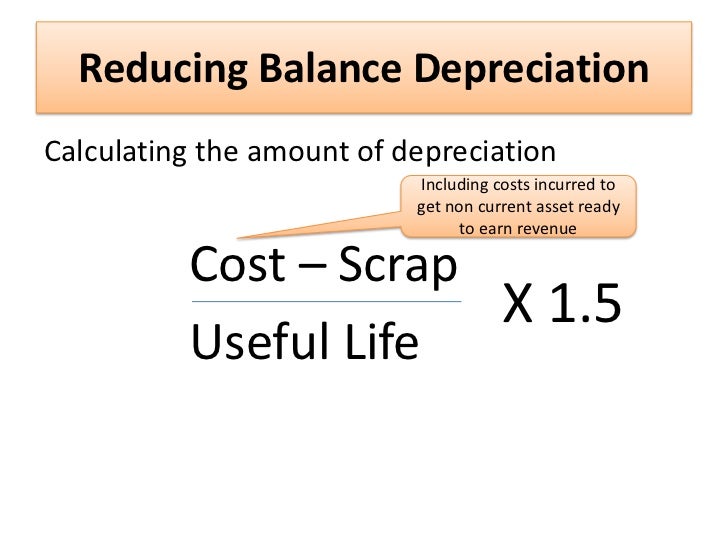

Key Takeaways The replacement cost is an amount that a company pays to replace an essential asset that is priced at the same or equal value The cost to replace an asset can change

Discover the importance of mastering What Is Replacement Method Of Depreciation in the context of language development. We'll review just how efficiency in What Is Replacement Method Of Depreciation lays the foundation for improved analysis, writing, and total language abilities. Check out the wider influence of What Is Replacement Method Of Depreciation on effective interaction.

Hecht Group How To Read A Depreciation Schedule

Hecht Group How To Read A Depreciation Schedule

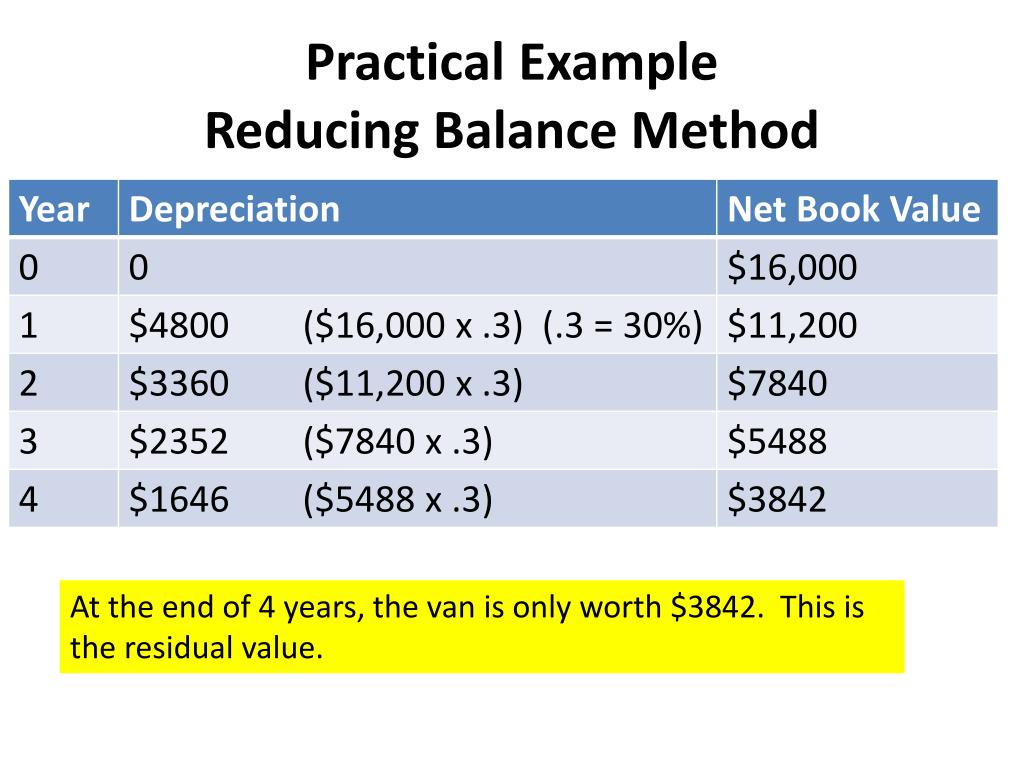

Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset Depreciation can be calculated using the straight line method or the

Understanding doesn't have to be dull. In this area, find a variety of appealing tasks customized to What Is Replacement Method Of Depreciation learners of all ages. From interactive video games to imaginative workouts, these tasks are created to make What Is Replacement Method Of Depreciation both fun and academic.

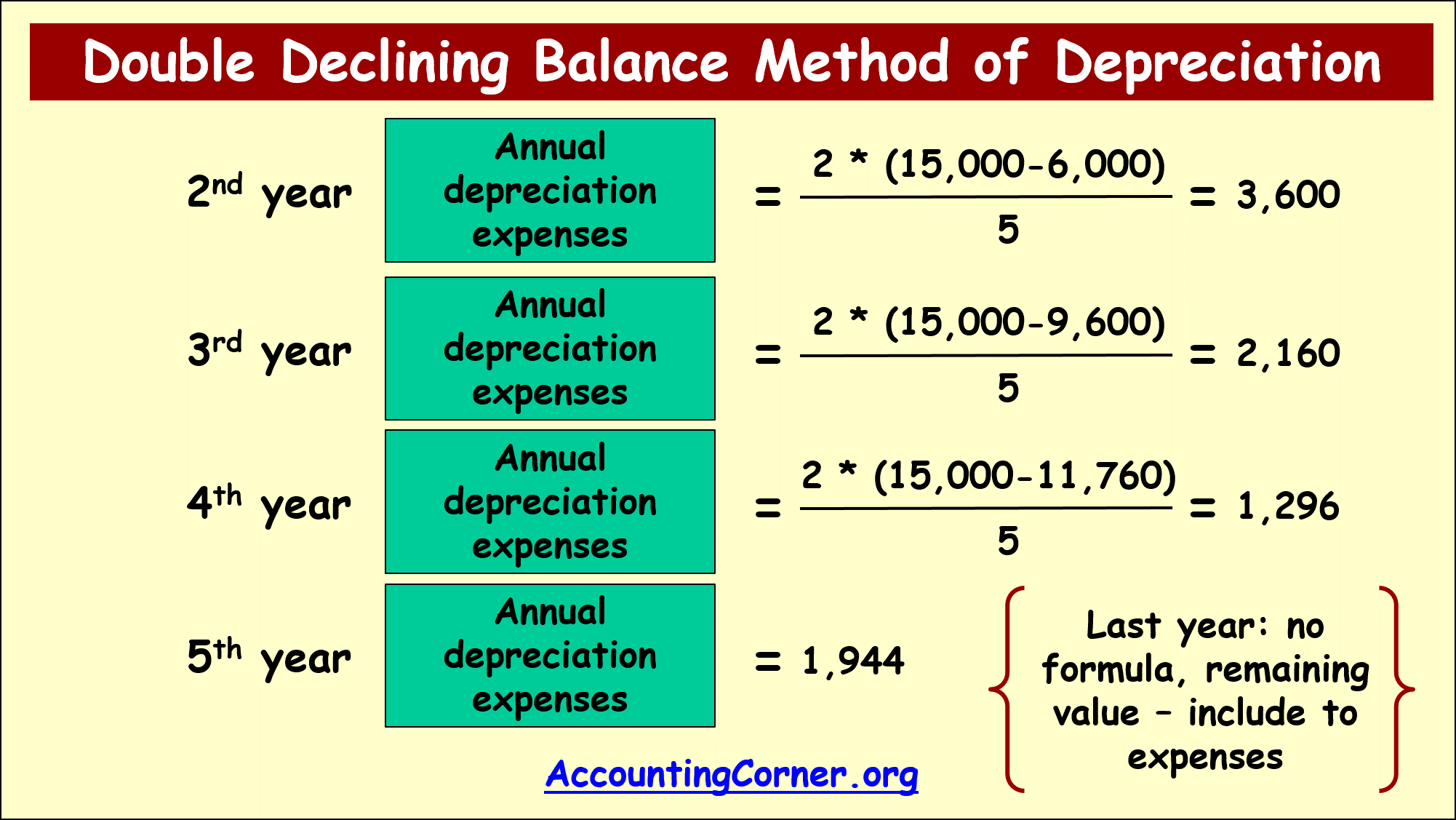

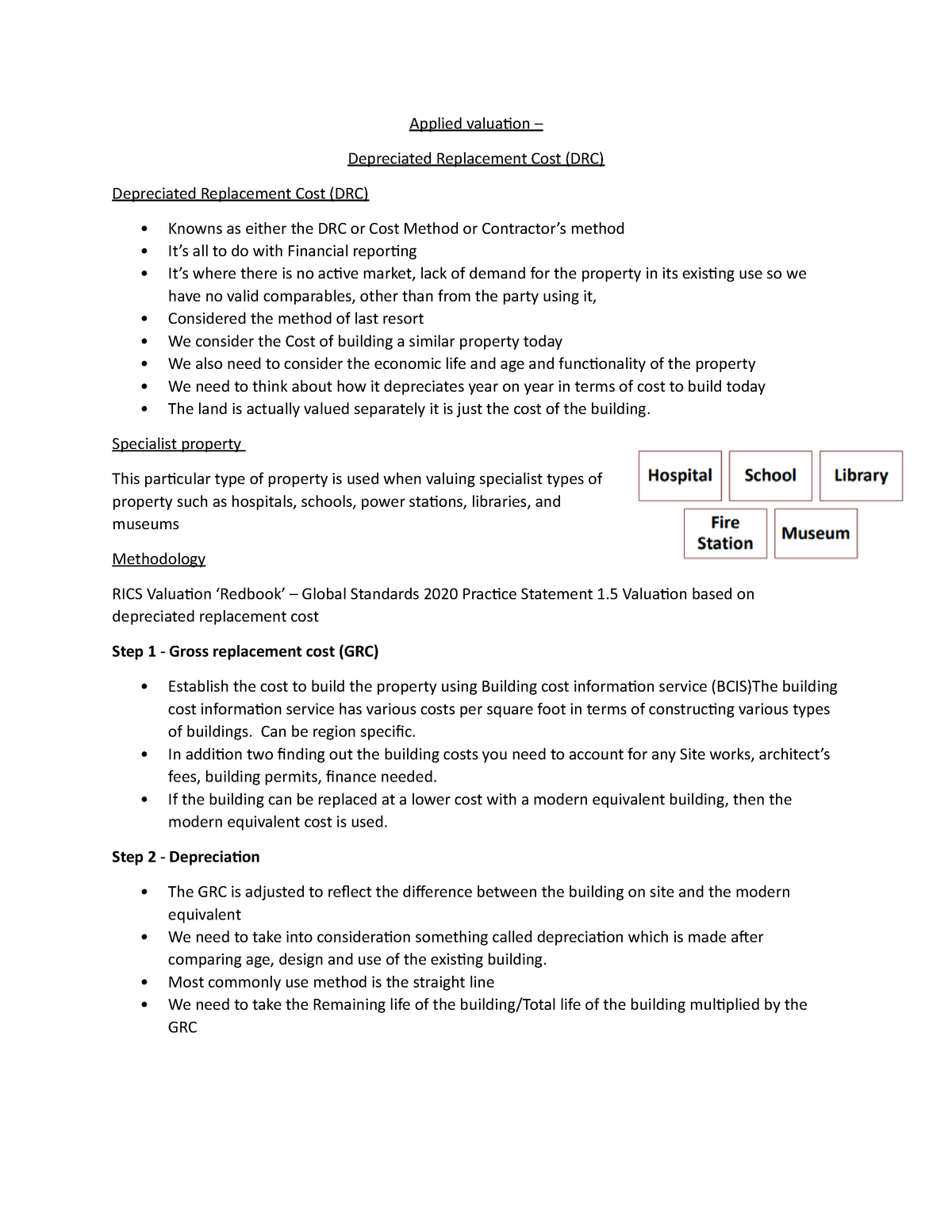

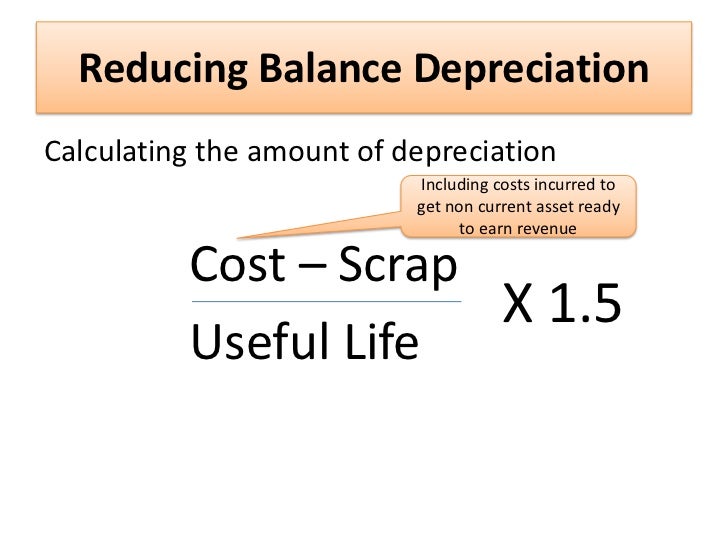

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

The depreciated replacement cost of an asset is the current replacement cost of the asset less accumulated depreciation computed on the basis of such a cost to account for the future economic benefits of the asset

Access our specifically curated collection of printable worksheets focused on What Is Replacement Method Of Depreciation These worksheets deal with various skill degrees, making certain a tailored discovering experience. Download and install, print, and delight in hands-on activities that reinforce What Is Replacement Method Of Depreciation abilities in a reliable and enjoyable way.

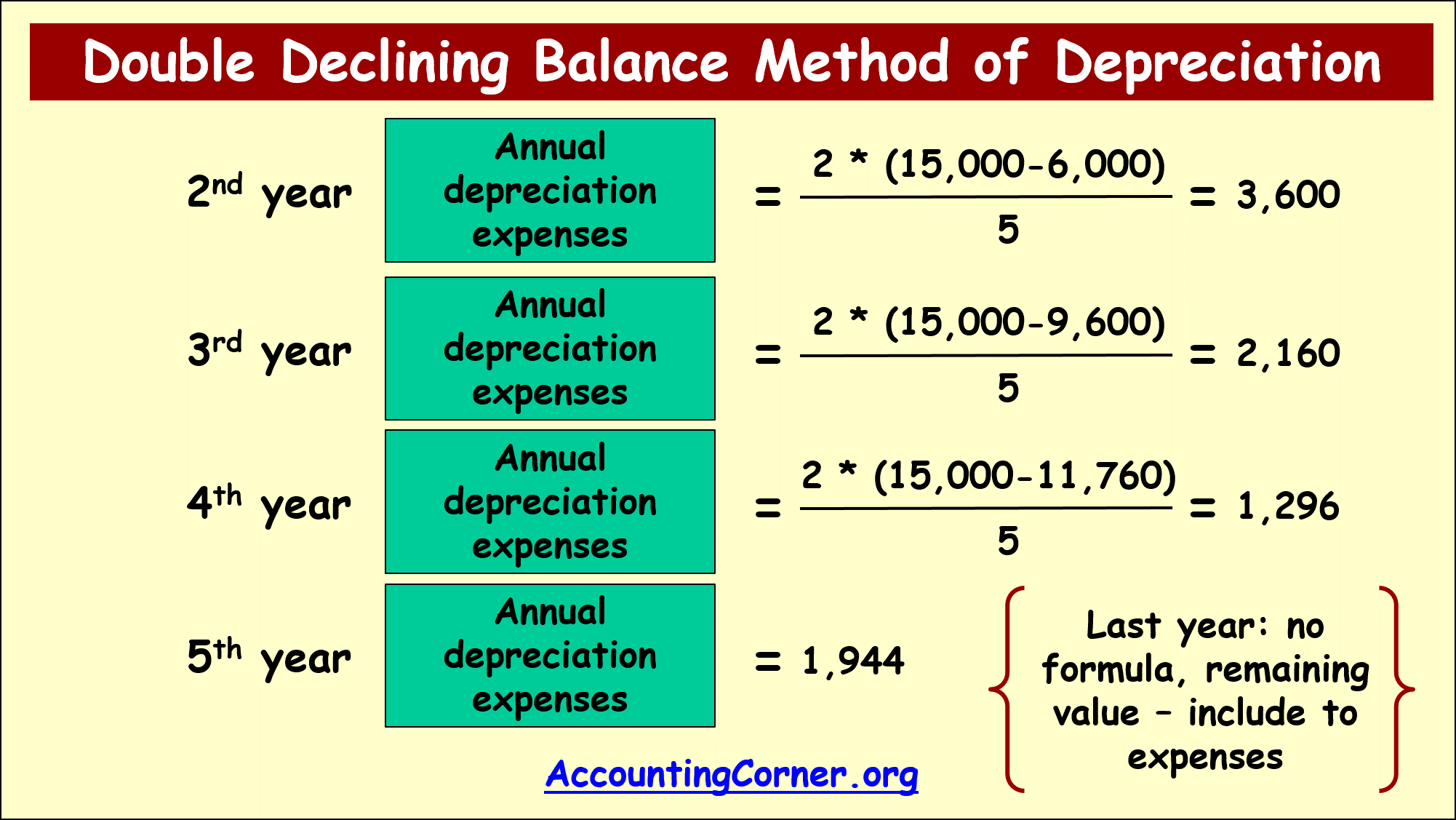

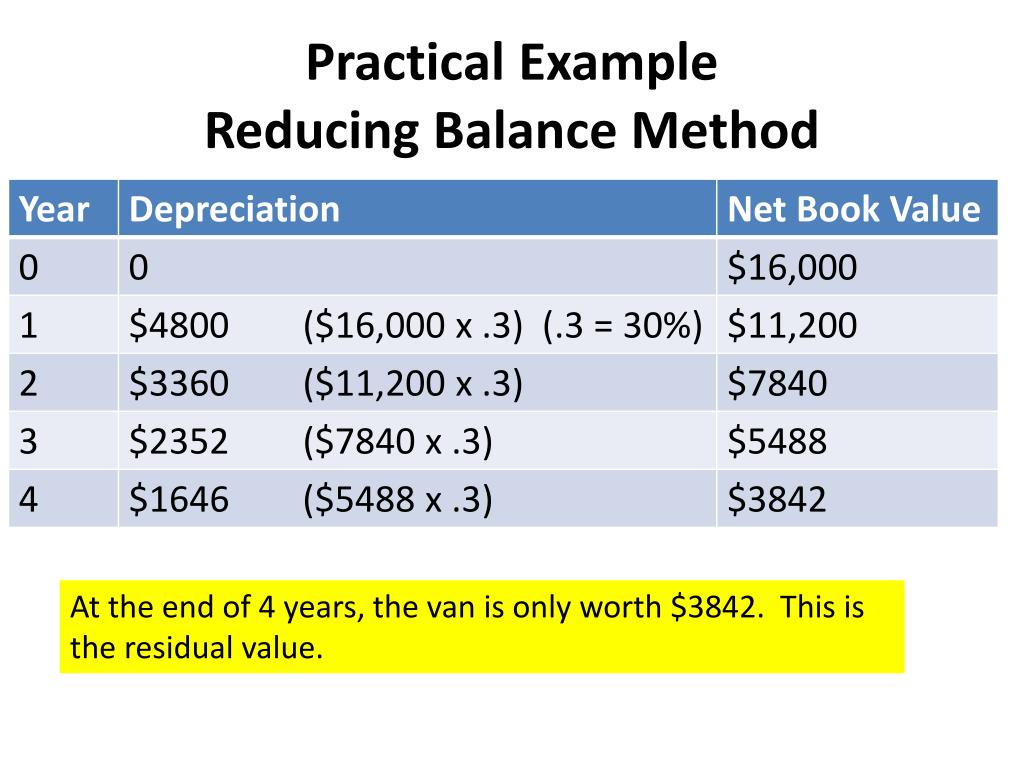

Depreciation Methods Our Top 4 Picks 2021 InvestingPR

Depreciation Methods Our Top 4 Picks 2021 InvestingPR

Methods of Depreciation The four depreciation methods include straight line declining balance sum of the years digits and units of production Straight Line Depreciation The

Whether you're a teacher looking for reliable methods or a student seeking self-guided methods, this area uses functional suggestions for understanding What Is Replacement Method Of Depreciation. Gain from the experience and insights of instructors that concentrate on What Is Replacement Method Of Depreciation education.

Get in touch with like-minded individuals that share a passion for What Is Replacement Method Of Depreciation. Our area is a room for teachers, parents, and learners to exchange ideas, seek advice, and commemorate successes in the journey of understanding the alphabet. Sign up with the discussion and belong of our growing neighborhood.

Download More What Is Replacement Method Of Depreciation

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

:max_bytes(150000):strip_icc()/Term-Definitions_depreciation-6a519480f170442fba6cf542a1a3e023.jpg)

https://www.investopedia.com/terms/r/replacementcost.asp

Key Takeaways The replacement cost is an amount that a company pays to replace an essential asset that is priced at the same or equal value The cost to replace an asset can change

https://www.investopedia.com/articles/06/depreciation.asp

Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset Depreciation can be calculated using the straight line method or the

Key Takeaways The replacement cost is an amount that a company pays to replace an essential asset that is priced at the same or equal value The cost to replace an asset can change

Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset Depreciation can be calculated using the straight line method or the

Part A Depreciated Replacement Cost DRC Applied Valuation

:max_bytes(150000):strip_icc()/Term-Definitions_depreciation-6a519480f170442fba6cf542a1a3e023.jpg)

Depreciation Definition And Types With Calculation Examples

How To Calculate Depreciation Diminishing Balance Method Haiper

How To Calculate Depreciation By Reducing Balance Method Haiper

What Is Straight Line Depreciation Method PMP Exam YouTube

How To Calculate Depreciation Using Reducing Balance Method Haiper

How To Calculate Depreciation Using Reducing Balance Method Haiper

How To Choose Between Straight line Depreciation And Accelerated